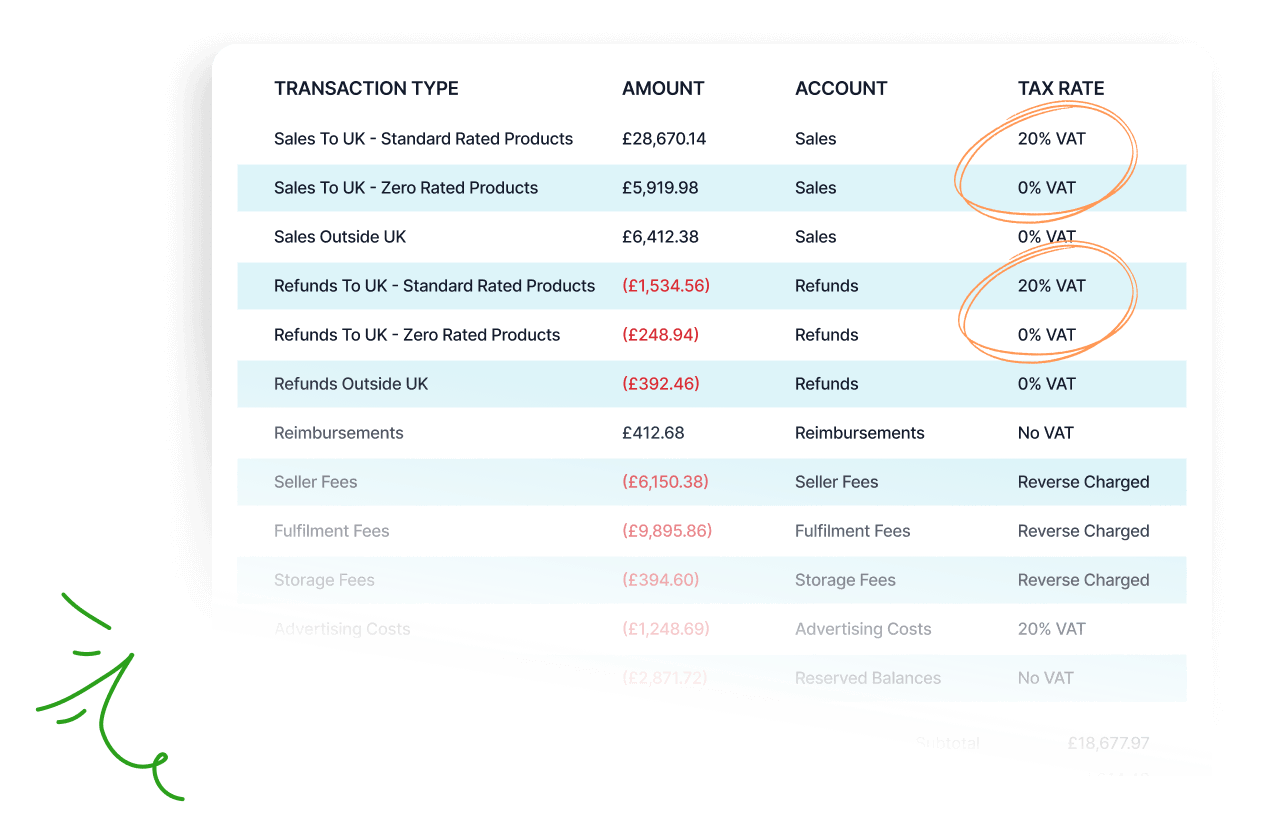

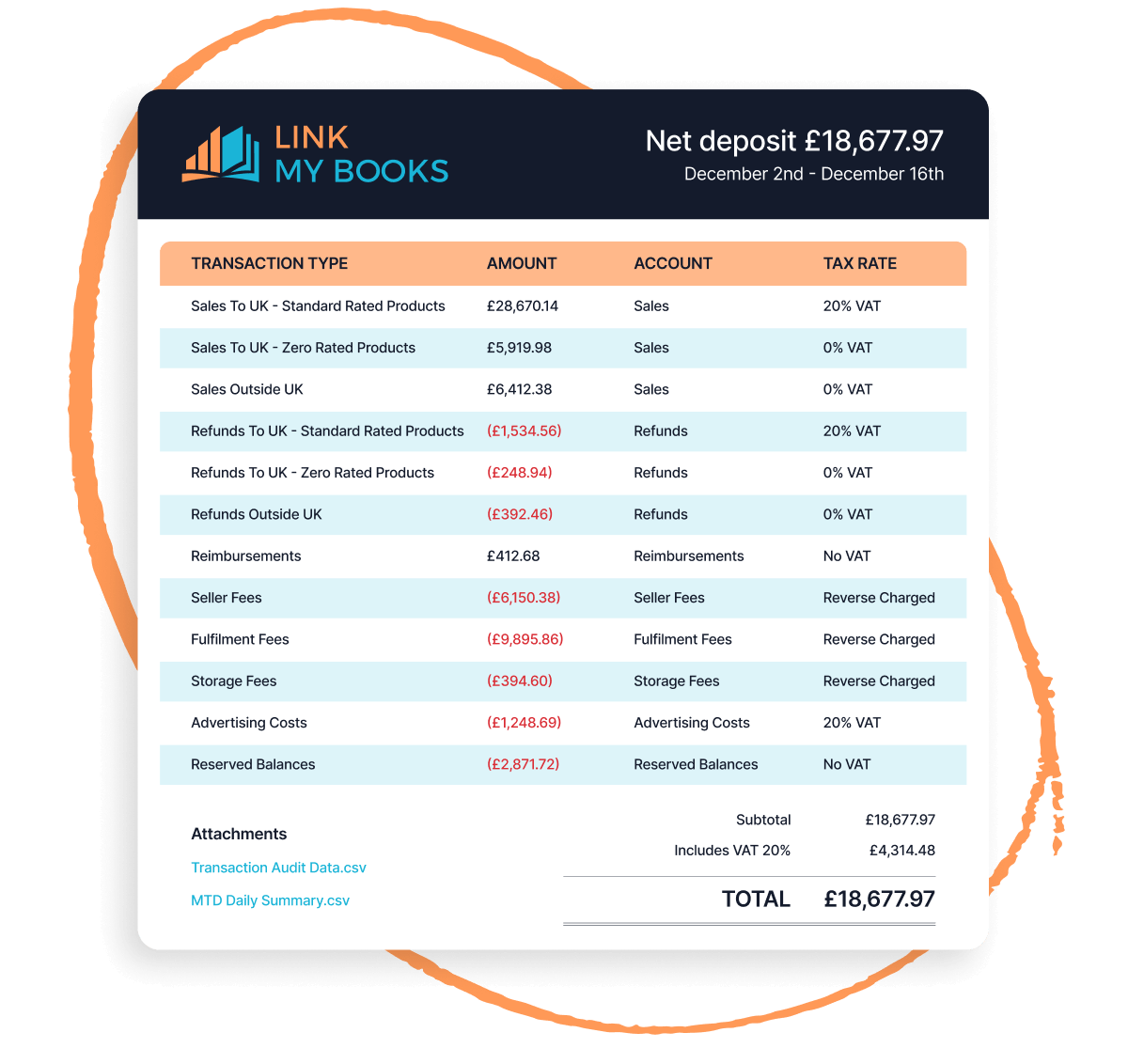

If you’re selling a mixture of standard, reduced and zero rated products then it’s vital that you account for their VAT treatment accurately. If you don’t, you could end up paying too much VAT and that can be detrimental to your businesses profits.

With Link My Books accurately automating this you can have confidence that your VAT return is correct and that you’re maximising your profits. Plus you can focus your time and energy on all the other things your ecommerce business throws at you instead.

.png)