If you're looking for a quick guide on how to view your eBay sales reports to use to account for your eBay sales, refunds, and fees without loads of waffle, then you're in the right place.

Let's dive straight in.

DISCLAIMER

We are not Tax Advisors and so our advice and suggestions on the application of tax rules cannot be construed as tax advice. We highly recommend that users seek advice from qualified accountants for their tax compliance.

Key Takeaways from this Post

What Figures do you Need for Accurate eBay Bookkeeping?

Firstly, taking a step back, let's have a think about what figures from your eBay reports you actually need for accurate bookkeeping of your eBay sales.

You will need the following:

- Sales (by destination country)

- Refunds (by destination country)

- eBay Fees

The sales and refunds figures need to be split by destination country because they may need to be treated differently for VAT. For example, a sale going to a UK customer would typically incur 20% VAT, but a sales going to a customer outside the UK is classed as an export and, as such, is typically zero rated for UK VAT.

Depending on where your business is established, you may also need to consider sales where eBay is responsible for collecting and remitting the VAT directly to HMRC too. We can discuss this more later.

Where to Obtain These Figures?

You can keep track of eBay sales and your financial data in your eBay Seller Hub under the 'Payments' tab. From there, you can choose to view and download transaction reports, financial statements, payout report, and invoices. These reports give sellers both an overview and a detailed breakdown of their financial activity including sales, refunds, and eBay fees.

Managed Payments Payout Report

Your Payout report provides a summary of your payouts for a specific date range. Here’s how to download your Payout report:

- Go to the Payments tab in Seller Hub.

- From the menu on the left, select Reports.

- Select the Reports tab.

- Select Payout report from the dropdown menu.

- Select the Start and End date.

- Select Create report next to the report you would like to download.

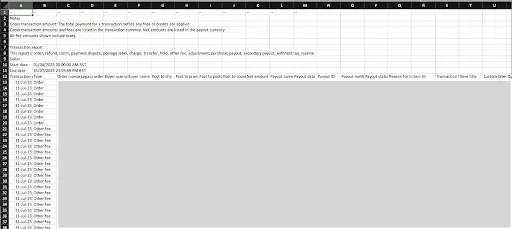

In addition to an overview of your transactions, you can get detailed breakdowns of eBay transactions in the Payouts section by simply clicking on one. When you do so, you'll be able to download the following information in CSV format:

- Transaction creation date

- Type

- Post to country

- Item subtotal

- Postage and packaging

- eBay collected tax

- Final value fee – fixed

- Final value fee – variable

- Very high 'item not as described' fee

- Below standard performance fee

- International fee

You can also choose which data to include in your reports, based on, for example, transaction type or status. You may also view transactions within a specific date range.

What to do With These Figures?

Now that you have the Payout report figures, you can enter them into your accounting software or spreadsheet.

Since eBay collect VAT on some sales but not others, you will need to sum up your sales into the following categories:

- Sales shipped to the UK (Seller VAT Responsible) - Typically 20% VAT

- Sales shipped to the UK (eBay VAT Responsible) - Typically zero rated

- Sales shipped outside the UK - Typically zero rated

To do so, follow this logic.

Sales shipped to the UK (Seller VAT Responsible) are those where:

- Post to country is GB

- eBay collected tax is blank

Sales shipped to the UK (eBay VAT Responsible) are those where:

- Post to country is GB

- eBay collected tax contains a value

Sales shipped outside the UK are those where:

- Post to country is not GB

eBay Sales

To find your sales figure, filter the report to show only "Order" types in the Type column, then total up the following columns:

- Item subtotal

- Postage and packaging

eBay Refunds

To find your refunds figure, filter the report to show only "Refund" types in the Type column, then total up the following columns:

- Item subtotal

- Postage and packaging

eBay Fees

To find your fees figure, firstly filter total up the following columns:

- Final value fee – fixed

- Final value fee – variable

- Very high 'item not as described' fee

- Below standard performance fee

- International fee

VAT on most eBay fees is 20%, but you should double check your monthly eBay fees invoice to ensure you do not have any that are zero rated.

Alternatives to Manual eBay Bookkeeping

.webp)

As you may be seeing by now, doing your eBay bookkeeping manually is going to take time and patience, and even so, it will be pretty susceptible to human error.

Most eBay sellers decide that this task is something they don't want to spend much time on each month. So, what are your options if you too decide this?

- Get an ecommerce accountant/bookkeeper to do it

- Use ecommerce bookkeeping software to automate it

Using an eCommerce Accountant or Bookkeeper

.webp)

If you use an accountant or bookkeeper, then this will definitely save you some time. The downside is that they will charge you per hour for doing so. The likelihood is that it will take them just as much time as it would have taken you and this could easily end up costing you a few hundred pounds per month.

Using Bookkeeping Software

Using ecommerce bookkeeping software would be most eBay sellers' preferred choice. This is quick, accurate and cost-effective. One such tool is Link My Books.

How Link My Books Makes eBay Accounting Simple

.webp)

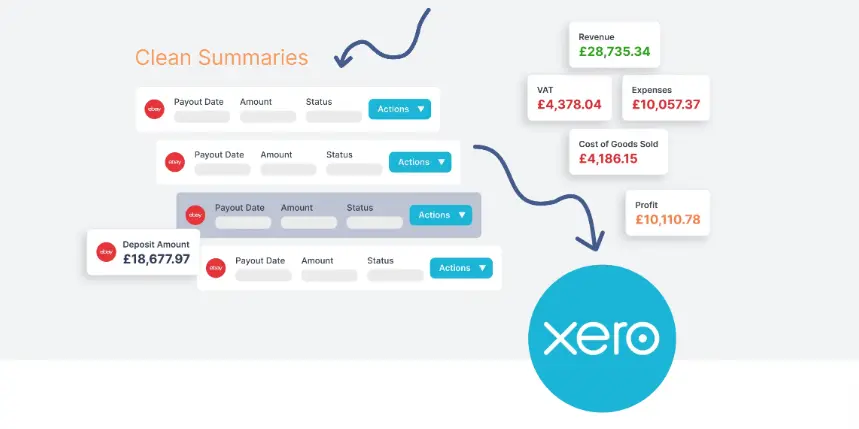

Link My Books hooks up directly to your eBay account and accounting software such as Xero or QuickBooks and posts summaries of each of your eBay payouts following the same format as we discussed above.

We are trusted by thousands of sellers and is rated 4.9/5 on average across hundreds of reviews.

You can try Link My Books for free here.

Link My Books' Automates Your eBay Bookkeeping

.webp)

With Link My Books, all your sales data from your eBay business is automatically added to your bookkeeping software. It's compatible with two of the most popular accounting software; Xero and QuickBooks.

All your transactions are reflected in your sales data. Link My Books consolidates all of this data from all your sales channels. This means that if you have multiple eBay sites, or sell through channels like Amazon and Shopify as well, you don't need to worry about manually incorporating the transactions for each channel because it's all done for you.

Link My Books Accurately Calculates Your eBay Taxes

.webp)

The importance of accurate tax calculations can't be overstated. HMRC can charge a penalty between 0% and 30% of the extra tax you owe if it considers you to have made a mistake because of 'lack of reasonable care'. This increases to between 20% and 70% if the HMRC thinks the mistake was deliberate. Therefore, due diligence is most definitely advised when it comes to tax calculations.

When you opt for a software like Link My Books for your eBay business, you don't need to worry about underpaying taxes because it automatically works them out for you. It calculates taxes on every single sale you make, taking into consideration any refunds, eBay fees for selling, and inventory costs. Link My Books then sends all this data across to your accounting software.

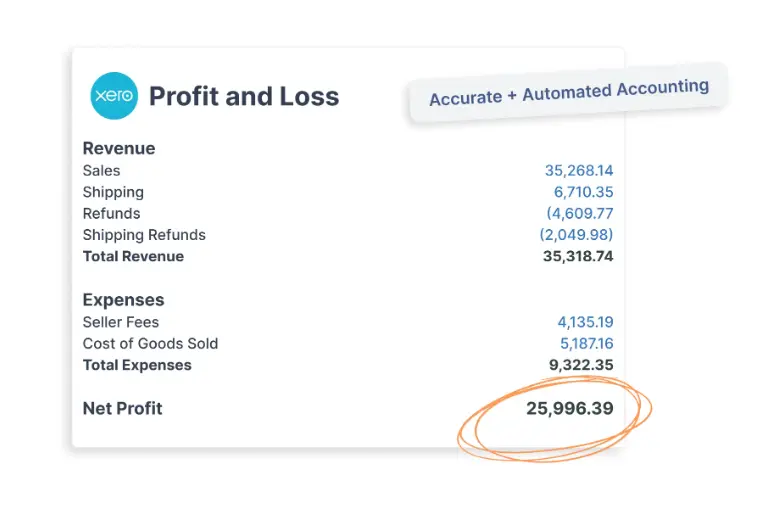

Link My Books Generates Clean Summary Reports

Link My Books automatically generates summary reports of all your income and outgoings. Every time you get a payment from eBay, you'll receive a summary invoice which contains detailed information like:

- Sales

- Refunds

- Cost of ads

- Sales tax

- Fees by type

- Net profit

You can move your reports from eBay to Xero or QuickBooks with a click of a button so each transaction is recorded and accounted for.

Additionally, Link My Books facilitates one-click bank reconciliation so that your records match your banking activities.

FAQs on eBay Sales Reports

Have some questions about managing your eBay sales reports? Read on.

How Often Should I Review my Reports for Optimal Bookkeeping?

Even if you opt for automating your eBay accounts, you should still review them regularly to ensure your businesses remain profitable. Reviewing your reports can also highlight areas of your business that can be improved.

You might identify new investment opportunities, for example, or decide to cut costs in a specific area. You should review details like taxes, ads, payments, number of buyers, and revenue.

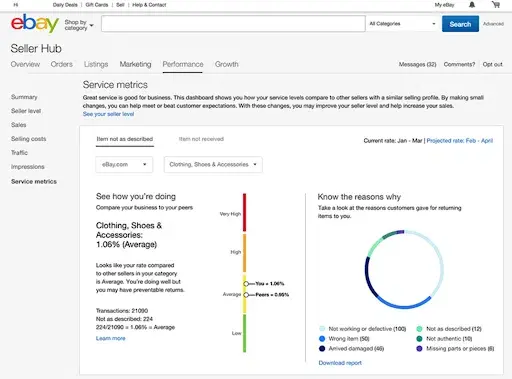

Another reason you should review your reports regularly is to optimise the customer experience. Once a month eBay provides its sellers with 'Service metrics'. This is a measure of customer satisfaction and includes data like return requests and refund requests. It's essentially a report on how smoothly your eBay sales transactions have gone throughout the month compared to other sellers. You might receive penalties, like withholding of funds, if your rating is very high.

We recommend reviewing your sales reports at least once per month, after you've received your service metrics from eBay. This is your chance to take stock of your ins and outs, and optimise your business budget. If you've had a lot of returns or issued a lot of refunds, this is something you'll obviously need to address to minimise the negative impact on your business as you move forward.

How do I Find Out How Much I Sold on eBay Per Year?

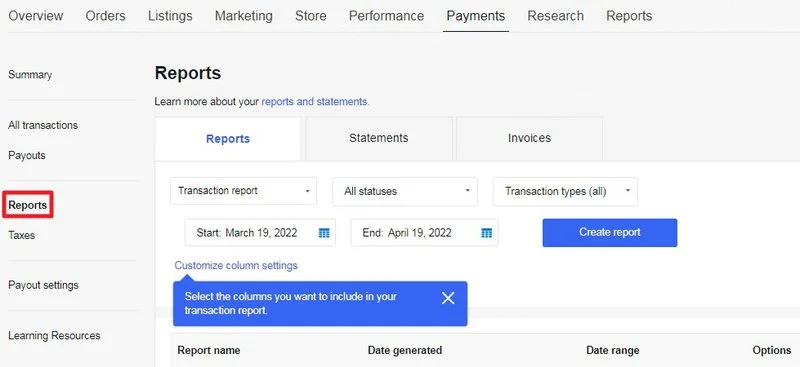

To view your annual sales, you need to navigate to your Seller Hub. From there, you hover over 'Payments' and click on 'Reports' in the menu. You'll be presented with three tabs; 'Reports', 'Statements', and 'Invoices'. To view your annual sales, you need to stay on the 'Reports' tab.

There are three dropdown menus under the 'Reports' tab. These allow you to change the information included in your reports. To find out how many products you've sold in a year, ensure these options are set to:

- 'Transaction report'

- 'All statuses'

- 'Transaction types (all)'

You can then go ahead and input your chosen start date and end date before clicking on 'Create report'. It will take a couple of minutes to generate. When it's done, you'll have the option to download it. Your report will download in CSV format as an eBay spreadsheet and will open with Microsoft Excel as default.

However, you can download reports through OpenOffice if you have that instead of Microsoft Excel. Additionally, after the CSV file is downloaded, you can upload it to Google Sheets if you like.

Once you've downloaded your eBay sales transactions report for the year, you'll be presented with a wealth of data on every sales transaction throughout that time-frame. This includes different types of fees for your eBay transactions, Buyer IDs, number of items sold, selling costs, and taxes that eBay collected.

Alternatively, if you're using Link My Books with accounting software, you can access and review reports through those.

Are There Any Specific Features That Can Help me Track and Improve my Selling Performance?

Reports in themselves are incredibly useful for tracking and improving your performance as a seller. In the Seller Hub, you can manage your listings and your orders. You can also customise your dashboard to reflect what you deem most important for your business.

For example, you might decide that traffic data is critical for your overall goals, which you can compare with your number of sales. Additionally, eBay sends businesses tips and tricks to help them improve their selling game and provide a better customer experience.

An eBay Shop is highly recommended for serious businesses. eBay Shops give you access to a multitude of features such as:

- Marketing tools: Build your brand and sell more products.

- Graphs and charts: Visualise your data and hone in on all the details of your business.

- Newsletters: Attract more customers by sending monthly newsletters.

How Can I Customize my eBay Sales Report to Focus on Specific Data Points Relevant to my Business?

.webp)

You can customise select reports through the 'Payments' tab and then under the 'Reports' section we discussed earlier. You can generate and download reports based on transaction status, i.e. available funds or processing funds. To do this, you simply select the status from the drop-down menu when you enter the 'Reports' section.

You can also filter your reports by transaction type. For example, Orders, Refunds, and Payment disputes. The process is similar to downloading an annual sales report, but you select different specifications. You then create your report and download it.

What Should I do if There are Discrepancies in my eBay Sales Report, Such as Missing Transactions or Incorrect Fees?

If there is anything untoward in your reports, the best thing you can do is to contact eBay. Perhaps, for example, you were accidentally charged fees when customers didn't pay. Whether or not this gets resolved is at eBay's discretion. It might depend on how long it's been since the 'sale' happened. You could send eBay a PayPal statement, for instance, to strengthen your case.

If you're unsure if you've been overcharged a specific fee, you can use an eBay fees calculator, like eBayFeesCalculator.com, to check.

Discrepancies within your eBay reports can throw off your whole accounting process. It can mean you pay an incorrect amount of sales tax, for example. This is one reason why it's always better to automate your accounts with software like Link My Books.

Wrap up

When it comes to eBay bookkeeping, knowing which eBay reports to use and where to find them is just the beginning. Picking them apart and correctly putting all your sales, refunds and fees figures together is the hard part.

If you have the time and patience to learn the process, then do so.

Most sellers decide to focus on growing their business, so they either outsource their eBay bookkeeping or automate it.

Make eBay Bookkeeping Easy

.webp)

You can accomplish many things with the eBay Seller Hub. However, you can accomplish even more with automated bookkeeping added to the mix. Link My Books will save you time with managing your eBay reports, sales data, and taxes. It records each eBay transaction and conveniently syncs with your accounting software for easy consolidation of data.

Selling on eBay and not sure where to start? No problem. We've got plenty of resources to guide you through the process of integrating Link My Books with your eBay business and your accounting software. Better still, each of our customers gets a two week free trial and a one-to-on onboarding call. Sign up today to dramatically simplify your bookkeeping.

%20an%20Accountant%20for%20My%20eCommerce%20Business.webp)

.png)