eBay fees can quietly eat away at your margins. Between final value fees, optional upgrades, ad spend, and VAT on seller fees, most sellers either miscalculate their true cost, or don’t track them at all. And when it’s time to reconcile with your bank or prep for tax season, the spreadsheets get messy fast.

Many sellers overpay on fees or VAT without realizing it, because they rely on monthly invoices that bundle charges without proper breakdowns. If you're manually parsing eBay reports, reconciling payouts, and guessing your tax obligations, you're flying blind.

This guide breaks it all down, every fee, every cost center, and the reports you need to stay compliant and profitable. We’ll also show you how to eliminate manual work and avoid costly mistakes with one smart automation tool.

Key Takeaways from this Post

eBay charges multiple fees, including insertion fees, final value fees, and optional listing upgrade fees, many of these are taxable.

eBay doesn’t charge separate payment processing fees - your international selling fees are automatically deducted from the sales proceeds.

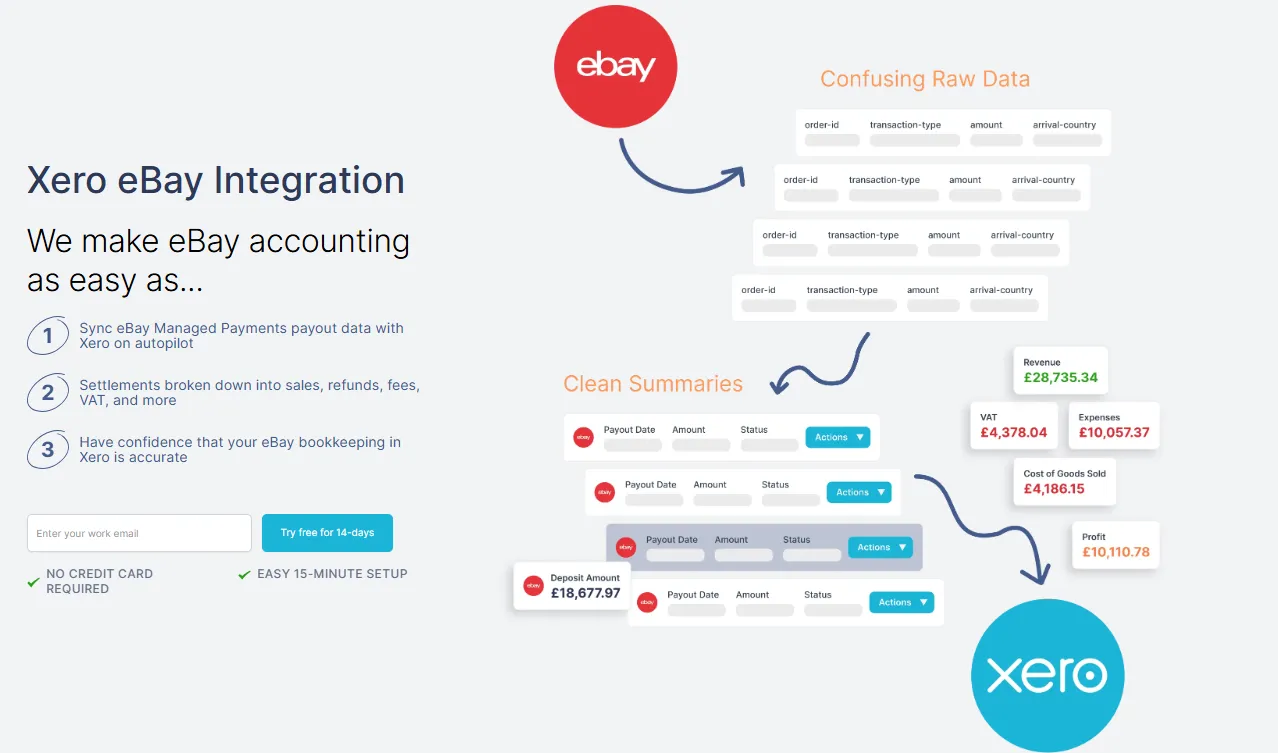

Link My Books automates the process, syncing eBay sales, fees, refunds, and taxes directly into Xero or QuickBooks, preventing overpayments and saving hours of manual work.

What Most eBay Sellers Get Wrong with eBay Fees

Here’s the truth: Most sellers misreport their fees and payouts on tax returns, or they trust generic monthly invoices that fail to break things down by tax category or jurisdiction. This opens the door to errors and overpayments, especially in the UK, where VAT rules are strict.

That’s why high-volume sellers and accountants use Link My Books to automate the entire process. With each eBay payout, it breaks down your earnings into sales, fees, refunds, and taxes, and applies the correct tax rules automatically.

How Link My Books Makes eBay Fee Calculations a Breeze (and Stops Overpayments)

Manually tracking fees might seem like a small task, but once your order volume grows, it becomes a time sink. Worse, it’s easy to miss hidden costs like international transaction fees or below-standard performance charges.

Link My Books solves that by doing three things better than anything else on the market:

- It automates your eBay accounting. Every sale, refund, fee, and tax entry is pulled into your accounting software (Xero or QuickBooks) and categorized correctly.

- It prevents VAT errors. LMB applies the correct VAT rate for every fee and flags those you don’t need to reclaim, protecting your profit margins and compliance status.

- It reconciles payouts to the penny. Each eBay payout is matched with a clean summary invoice, so your bank feed lines up without drama.

This setup takes just 15 minutes and saves you hours every month.

You’ll still get access to your full eBay reports if needed, but you won’t have to sort through them line by line. Instead, Link My Books gives you real-time financial data, accurate profit-and-loss insights, and error-free reconciliation, all on autopilot.

You can try it out for 14 days free of charge!

Main Ebay Fees to Know

- Insertion fees

- Final value fees

- Additional final value fees

- Real estate listing fees

- Payment processing fees

- Promoted listing fees

- International selling fees

- Store subscription fees

- Payment processing fees

- Regulatory operating fee / Regulatory fee

- Seller performance penalties (below‑standard fees)

- Currency conversion fee

- Dispute/buyer protection fees

Insertion Fees

Insertion fees are the costs you need to pay to list your item on eBay. For most sellers, it’s free to list up to 250 items per month.

- If you exceed this limit, a $0.35 insertion fee applies per listing.

- These fees are non-refundable, even if your item doesn’t sell, so it’s important to monitor your listing volume each month to avoid unexpected charges.

Final Value Fees

Once your item sells, eBay charges a final value fee. This is calculated as a percentage of the total sale amount, including item price, shipping, and applicable taxes, plus a $0.30 fee per order.

- The percentage varies by category, generally ranging from 8% to 15%. For example, books may incur a 14.6% fee, while electronics might be closer to 8% to 11%.

- If the item price exceeds a certain threshold (e.g. $7,500), a lower rate is often applied to the amount above that cap.

Additional Final Value Fees

If your account performance drops below standard, eBay may apply additional final value fees. Sellers classified as “Below Standard” are charged an extra 6% on top of standard final value fees for all transactions.

Additionally, listings with a very high rate of “item not as described” claims may incur a further 5% fee. These penalties are reviewed monthly and are removed once your performance improves.

Real Estate Listing Fees

If you're listing real estate on eBay, you’ll pay a real estate listing fee based on the type of property and the listing format. Unlike most other items, real estate listings do not incur final value fees.

These listing fees vary depending on whether you choose an auction or fixed-price format and are charged upfront.

Payment Processing Fees

eBay manages payments directly, and payment processing fees are now included within your final value fee. However, the effective cost for processing payments is roughly 2.9% + $0.30 per transaction, based on the total sale price, including shipping and taxes.

This ensures sellers don’t need a separate payment provider, but it also means higher-value sales will incur higher total costs.

Promoted Listing Fees

If you promote your listings to gain more visibility, eBay charges a promoted listing fee. This fee is only charged if a buyer clicks on your ad and purchases the item within a 30-day window.

The cost depends on the ad rate you choose when setting up the promotion and is deducted from the sale proceeds after the transaction is complete.

International Selling Fees

When you sell to a buyer located outside your registered country, eBay charges an international selling fee.

This fee is typically 1.65% of the total transaction amount, including item price, shipping, and taxes. It’s added to your standard final value fees and helps cover the costs associated with cross-border transactions.

Store Subscription Fees

Opening an eBay Store allows you to access additional tools, lower fees, and more free listings.

Subscription fees depend on the store level you choose, and you can pick from

- Starter

- Basic

- Premium

- Anchor

- Enterprise

Prices range from $4.95/month to $2,999.95/month. While this is an added cost, the benefits can significantly reduce your per-item selling fees, especially if you list in high volumes.

Regulatory Operating Fees

eBay charges a regulatory operating fee in certain countries to comply with local regulations.

This fee is usually around 0.35% of the total sale amount, including shipping and taxes. It is charged on a per-transaction basis and appears in your monthly invoice. The fee is only refunded if the transaction is fully refunded.

Seller Performance Penalties

Sellers with underperforming accounts may be subject to seller performance penalties.

These include a 6% surcharge on final value fees for sellers classified as “Below Standard,” and a 5% surcharge for listings with a high rate of item-not-as-described returns.

These penalties are reassessed monthly and can be avoided by maintaining high service standards.

Currency Conversion Fees

If a buyer pays in a different currency than your registered payout currency, eBay applies a currency conversion fee.

This fee is typically around 3% and is deducted from the converted amount. It applies to both the sale proceeds and any applicable fees, which can impact your actual net earnings on international sales.

Dispute and Buyer Protection Fees

If a buyer opens a dispute and eBay determines you are responsible, or if you don’t respond in time, a dispute fee of $20 may be charged.

This includes chargebacks, cases escalated through eBay’s Money Back Guarantee, or payment disputes.

If you’re covered under seller protection, the fee may be waived. Otherwise, it’s deducted directly from your earnings.

Breakdown of eBay fees

Here's a visual breakdown of the different types of eBay fees:

You can use our FREE eBay spreadsheet to keep track of all this manually.

In Sum, How Much Does eBay make on a Sale?

The amount eBay earns from a sale depends on several factors: the item category, final selling price, shipping costs, and any optional services used. On average, eBay takes between 12% and 15.55% of the total transaction amount (including item price, shipping, and tax) in final value fees.

This percentage can increase if you're using promoted listings, selling to international buyers, or if your account has performance-related penalties.

Always factor in all potential fees, including payment processing and VAT where applicable, when setting your prices to ensure your margins remain healthy.

How to Never Calculate eBay Fees Again

With Link My Books, you don’t need to calculate final value fees, promoted listing charges, international selling costs, or eBay VAT, ever. The software connects your eBay account to Xero or QuickBooks, breaks down each payout automatically, and categorizes every transaction correctly. Here's how to set it up and make manual fee tracking a thing of the past:

- Connect your eBay and accounting software with Link My Books

- Complete the setup wizard

- Enable fee and tax breakdown

- Reconcile payouts in Xero or QuickBooks

Step #1: Connect Your eBay and Accounting Software with Link My Books

Start by signing up for your free trial. Once inside your dashboard, you’ll connect:

- Your eBay seller account (for importing sales and payout data)

- Your Xero or QuickBooks account (for syncing transactions)

This secure connection allows Link My Books to automatically import all future eBay payouts and begin categorizing them.

Step #2: Complete the Setup Wizard

The setup wizard will guide you through mapping your eBay income, fees, refunds, shipping, and taxes to the correct accounts in your chart of accounts.

You’ll also configure your VAT or sales tax settings depending on your region. UK and EU sellers can enable VAT Product Grouping, which automatically applies the correct VAT rate for each item (standard, reduced, or zero-rated).

This step ensures your reports are tax-compliant and ready for reconciliation from day one.

Step #3: Enable Fee and Tax Breakdown

Link My Books automatically splits each payout into:

- Gross sales

- Refunds

- eBay fees (including final value fees, promoted listing fees, payment processing, international fees, and more)

- Taxes collected

- Net payout

Each fee is pulled directly from your eBay reports and itemized within a clean summary invoice. You’ll always know what you were charged, and why, without lifting a finger.

Step #4: Reconcile Payouts in Xero or QuickBooks

Once your summary invoice is created, it’s automatically matched to your bank feed in Xero or QuickBooks. No manual entry, no spreadsheet matching, no errors.

Each payout is already broken down and categorized, so you can reconcile it in one click and move on with confidence.

FAQs about eBay Seller Fees

Do I pay eBay fees if an item doesn’t sell?

Yes, you’ll still pay insertion fees for listings that don’t result in a sale, $0.35 per item after your first 250 listings each month (unless you have a Store subscription, which may offer more free listings).

However, you won’t pay a final value fee unless the item actually sells. To avoid unnecessary fees, be strategic about how many items you list and consider bundling similar products to stay within the free limit.

How do I reduce eBay seller fees?

To lower your eBay selling costs:

- Open an eBay Store: Store subscriptions reduce final value fees and increase your free monthly listings.

- Avoid optional listing upgrades like bold titles or subtitles unless they’re driving results.

- Use shipping discounts and offer free shipping where possible, this improves buyer appeal without increasing fees, since final value fees include shipping.

- Consider using automation tools like Link My Books to optimize your eBay bookkeeping and monitor unprofitable listings.

📌 Note: eBay now uses Managed Payments, so linking a PayPal account no longer affects your fees.

What percentage does eBay make on a sale?

eBay takes between 12% and 15.55% of the total sale amount, including item price, shipping, and tax.

The exact percentage depends on the item category and whether the transaction includes international shipping, promoted listings, or seller performance penalties. For high-value items (e.g., above $7,500), a reduced rate may apply to the portion above that threshold.

Are there discounts or fee reductions for high-volume sellers or long-time members of eBay?

Yes, high-volume sellers and Store subscribers benefit from:

- Lower final value fees

- More free listings per month

- Access to advanced analytics and promotional tools

These benefits scale with Store level (e.g., Basic, Premium, Anchor). eBay does not reduce fees simply based on account age, but long-time sellers who meet Top Rated Seller criteria can also earn discounts and priority support.

If you’re scaling your eBay business, these savings can add up, especially when combined with smart eBay accounting software and automated reconciliation.

How are eBay fees calculated for international sales?

When you sell to a buyer outside your registered country, eBay charges an international selling fee of 1.65% of the total sale amount (item + shipping + tax). This fee is added on top of the standard final value fee. The percentage is fixed but may appear higher in countries with marketplace tax rules or complex currency conversions.

You can review these fees in your eBay Sales Report, or use automation tools like Link My Books to break them down by transaction and destination.

Can I deduct eBay fees on my taxes?

Yes, eBay fees are fully deductible as business expenses. This includes:

- Insertion fees

- Final value fees

- Promoted listing fees

- International and regulatory fees

- Store subscription costs

To stay compliant, keep clean records or use tools like Link My Books to generate audit-ready reports. For accuracy, it’s best to automate your records using tools like Link My Books and consult a tax advisor. You can also review our guide on how to report eBay sales on taxes for more help.

Make eBay bookkeeping simple with Link My Books

Calculating your eBay fees doesn't have to be a headache. With the best eBay tools and information, you can quickly and easily estimate your fees and maximize your profits.

So why wait?

Start simplifying the tracking & management of your eBay fees today! Start Your Free 14 Day Trial!

With Link My Books and see the power automated bookkeeping can add to your business!

.webp)

.webp)

.png)