Starting your own accounting accounting firm is an exciting yet challenging endeavour. It's certainly hard work and there are a lot of aspects to consider before taking the plunge. Before launching any business, you need to devise a solid business plan to guide you on your journey. Business plans clarify what you're doing, what you hope to achieve, and how you'll get there.

There are a lot of components that make up a business plan. Bringing everything together into a logical and cohesive document is not always an easy thing to do.

Key Takeaways from this Post

A winning business plan will clarify your goals and keep you on track as you dive deeper into your business venture. Not only does it provide numerous benefits from a practical and logistical standpoint, but it can also help you secure vital funding for your accounting firm.

There are lots of ways to structure an accounting firm business plan. This guide follows a 6-step structure that includes an Executive Summary, SWOT analysis, and a marketing and sales strategy, amongst others. If you're looking to secure funding, financial projections are crucial too.

Your business plan should also specify what tools and software you plan to use, such as accounting software and tax management tools. Link My Books saves you 6 hours every month per client by allowing you to put your bookkeeping on autopilot. It's also got powerful reporting and analytical tools.

For this reason, I've created this step-by-step guide to composing a winning accounting firm business plan. It includes all the sections that you'll need to cover in your plan, what they mean for your business, and how to craft them.

What is an Accounting Firm Business Plan?

An accounting firm business plan is a document that details a plan of action for starting and running accounting firms. It will articulate your objectives and strategies for reaching your goals. A business plan will also detail your budget, along with the services you'll provide.

A business plan is often used as a way of obtaining funding for a business venture. A finance provider will look at your business plan and use it, along with other information, to decide whether or not to offer you a business loan or to invest in your firm.

Business plans should be updated annually and used as a guide for understanding whether your business is on track. Adjust your business plan as needed to help you grow your business further, get more funding, and gain more clients through your marketing efforts. Your plan must also specify the best business structure for your firm.

Why do You Need an Accounting Firm Business Plan?

An accounting firm business plan has the following advantages:

- Articulate your vision: Having an idea is great but you need to hone in on it and articulate the exact steps to bring your vision to life.

- Viability: A business plan will help you learn whether or not your business strategy or idea is actually viable, both financially and practically.

- Secure investments: As touched upon earlier, a business plan can help you bring investors onboard and secure the funding you need to take off.

- Identify and address risks: Creating a business plan should force you to look at your business idea from all angles, while asking yourself important questions that'll help you identify and address potential risks.

- Create a marketing strategy: A marketing strategy is a big part of your business plan. It'll make you think about who you'll market to and precisely how you'll do it.

- Reach your goals: A business plan can clarify your goals, both long-term and short-term, and give you something to focus on to reach them.

How to Create Your Accounting Firm Business Plan

There is no definitive rule for what components to include in a business plan. Here is a potential structure for your accounting firm business plan:

- Executive Summary

- Company Description

- SWOT Analysis

- Market Analysis

- Marketing and Sales Strategy

- Financial Operations, Projections, and Plan

1. Executive Summary

Your Executive Summary summarises your business. It begins with a short text that includes key elements of your business and services, like what you'll do, how you'll do it, and what you'll require to do it. For example:

[Name of firm] provides eCommerce accounting, tax management, and bookkeeping services to small eCommerce businesses within the UK. Currently a one-person accounting firm owned and run by [your name], the business will hire an administrative assistant and invest in marketing solutions to bring in new clients. This business plan outlines the business objectives and strategies for growth over the next one year, three years, and five years.

Products and Services

After your initial statement, detail the products and services your firm does/will provide. List your services and then any subgroups within the services. For example:

Tax services

- Tax planning

- Tax return preparation

- Tax return filing

- Audit representation

Underneath each section, write a paragraph discussing the services in more detail, including the charge to clients and any potential cost to yourself. Although it might be difficult at this early stage, you can specify how many hours per week you are able to dedicate to each service.

Vision

Your vision is basically your objectives; that is, your business goals. These could be goals for different interims, such as one year, three years, and five years. And, they can include goals for growth, such as gaining X amount of clients and generating X amount of revenue. You could also include goals to hire more staff to achieve these overall goals and enable you to offer more services.

Mission

You mission is more focused on your current situation and what you're doing to achieve your goals. For example, your mission could be to offer the best value for money, provide clients with valuable insights that'll help their businesses to grow, or to ensure tax compliance regardless of jurisdiction. And of course, you can specify multiple areas of your mission.

Keys to Achieving Vision

Note a few different ways you can achieve your vision and enhance your overall success. This could be, for example, prioritising excellent client communication, investing in further training, and developing trust with clients to build long-term relationships.

2. Company Description

Begin with a short summary of your company. Who owns it, when it was/will be founded, and what you do. If you've already launched your business, you'll want to include historical details, such as annual revenues and start up investments. You must also detail your business structure.

It would be useful to include a clear graph or table detailing past sales, and gross and net profits, showing side-by-side yearly comparisons. If you haven't yet launched, you'll want to include your specific plans for the company.

Roles and Responsibilities

In this section, discuss concisely the roles that will be filled that'll help your business achieve its visions. And, what the responsibilities are for those fulfilling the roles. Roles could include:

- HR manager

- Admin assistant

- Receptionist

- Accountant

- Bookkeeper

- Receptionist

- CEO

If you're a lone ranger, still complete this section and detail your responsibilities within the firm and how these contribute to your overall goals.

3. SWOT Analysis

Next up you'll complete your SWOT analysis. This is a method for critically analysing your business, skills, and the resources available to you. The well-known planning tool forces you to consider all angles and potential outcomes of your business, both good and bad.

Here are the components that make up a SWOT analysis:

Strengths

Your strengths are the things that your company does, or will do, well. They are the areas that you currently excel at and the qualities that set you above, and give you an advantage over, your competitors.

Ask yourself questions like:

- What skills do I have?

- What is the business's USP?

- What does my business do particularly well?

Some examples of strengths include:

- Your extensive experience and years of training.

- Your expertise in a particular area.

- Offering a personable service.

- Strong capital for starting up.

- High marketing budget.

Weaknesses

On the flip side, you have your weaknesses. These are things that go against you and your business, particularly when compared with competitors. They are the things that put you behind other firms. Understanding your weaknesses can help you to improve on them or find workarounds.

Ask yourself questions like:

- What areas of accounting do I lack skills in?

- What do competitors have that I don't?

- What are my limitations when it comes to capital and resources?

Some examples of weaknesses include:

- A small start up and marketing budget.

- Not as well known as competitors.

- Not able to offer the same services as competitors.

- Not enough staff to accommodate many clients.

Opportunities

Here, you'll identify opportunities within your business to improve, grow, learn, and develop. They are opportunities within your niche and industry, as well as within the business itself.

Ask yourself the following questions to identify opportunities:

- Are there any gaps in the market that competitors aren't taking advantage of?

- Are there any ways to secure more funding for my business?

- What technology could help my business?

- Do competitors have any weaknesses that would benefit my business?

- Are there any opportunities for business expansion, either geographically or by expanding my services.

Here are some examples of opportunities:

- Connect with potential clients on social media.

- Technology that allows you to offer more services and saves you time, such as sales tax software for accountants.

- A growing need for eCommerce accounting.

- Not much local competition for eCommerce accounting.

Threats

The 'T' in SWOT stands for Threats. These are the things that could potentially harm your business and impact it in a negative way. By identifying these possibilities early, you can take mitigating steps to eliminate or minimise the damage threats could do to your business.

These are some questions that'll help you identify possible threats:

- In what ways do our weaknesses harm our business?

- Are there any economic, social, or political factors that could negatively impact my accounting firm?

- Is our target market expanding or shrinking?

- In what ways could my competitors harm my business in the future?

- Could technology be used against me or have a negative impact on my business?

And here are some potential threats to your business:

- eCommerce accounting could become a more widely-adopted service, leading to higher competition.

- Technology that you rely on might crash or not work as intended.

- Technology might allow businesses to do their own accounting.

4. Market Analysis

A market analysis defines and articulates the current state of your market. It looks at things like the value of the market, market trends, customer segmentation, and your competitive market.

Begin this section with a market summary. This is a paragraph explaining the market, such as who you're targeting and why they'd hire or outsource an accountant that offers the same key services as you. This shows potential investors that you understand the industry and its potential.

Market Trends

There are loads of different aspects of market trends, like social media trends, historical trends, demographic trends, and seasonal trends.

- Begin this section by defining what market trends you'll be looking into. Once you know this, you can go ahead and define your goal for analysing market trends. For instance, you might want to identify purchasing patterns or gather data to help project revenue. Whatever your goal is, write it down.

- Write a plan as to how you'll carry out your market trend analysis. This needs to be done over a period of time so you can identify patterns within the market. You should also do this regularly so you can keep up with changing trends.

- Now you can choose your tools. Different software can reveal critical insights into market trends, patterns, and opportunities. Prioritise tools that offer a user-friendly dashboard that clearly shows your data in the form of easy-to-understand graphs.

- Play around with different filters, asking the right questions, and analysing the right data. Record your findings in this section of your business plan, along with how you found them and why it matters.

Target Market

You must now define and segment your target market. So for example, you might target small businesses and new businesses within a specific geographical area, such as the UK.

During your research for your business plans, you identify that there are currently X amount of businesses that meet that specific criteria. Write a short paragraph defining each segment. For example, you could classify a new business as one that's less than a year old.

This is your target market.

You can break your figures down further by specifying the percentage of each segment. For example, small businesses might make up 65% of your potential customers. New businesses might make up 30%, while 5% could be classified as 'Other businesses'.

Write how and why you'll accommodate each segment.

Competitive Analysis

Next up you must analyse your competitors and the competitive landscape. Separate your direct competitors from your indirect ones. Your direct competitors are other accounting firms. Indirect competitors are the other options that businesses have, such as subscribing to a SaaS or a bookkeeping firm.

Once you've identified your direct competitors, detail things like pricing, types of customers, services they offer, and their strengths and weaknesses. Now articulate what you'll do to set your accounting firm apart from competitors and give you a competitive advantage. For example, offering a different service or better prices.

Side note: We touched on this competitive landscape analysis earlier during our SWOT analysis. The Swot analysis should be short, scannable bullet points while this section dives in deeper into the analysis.

5. Marketing and Sales Strategy

Developing marketing and sales strategies is a critical part of your business planning efforts. They define your long term and short term plans for promoting your business and selling your accountancy services, in addition to a sales forecast.

Marketing

Your marketing plan clarifies your long-term marketing goals, along with the methods and channels you'll use for marketing. Marketing focuses on promoting your services and getting your key points out there for potential clients to see.

List each of your marketing methods, and include some details and context about each. For example:

- Monthly advertisements of specific or general services in local publications. Track the ads' performance over time to determine ROI.

- Optimise website for search engines by investing significantly in SEO. Work with a specialised SEO agency that'll ensure your site is at the top of search engines.

- Implement social media marketing by creating engaging content for our target audience. Reply to comments, ask for reviews, and maintain an open dialogue.

- Apply to be in accountant directories, such as Xero or QuickBooks. (Link My Books also has an accountant directory where customers can find an expert accountant that meets their specific needs.)

Sales

Your sales strategy is more focused on how you'll convert potential clients into actual paying clients. So for example, you might communicate directly with leads, offer special discounts, or run a referral scheme that directly gets you more sales. Specify your sales tactics in this section, similar to how you did it with marketing.

Sales Forecast

Begin this section by creating your pricing strategy. Now detail your sales forecast of each service and how much you expect to earn on each. Create a table and possibly graphs displaying your projections.

Take into account how your marketing efforts are likely to impact your sales. Also outline what your sales forecast shows and what the circumstances are for each particular forecast. For instance, costs associated with travelling to meet clients, the number of hours you'll dedicate, and how many members of staff you'll have.

6. Financial Operations, Projections, and Plan

A financial plan is the final component of your business planning document. It is an important and detailed inclusion that could help you secure funding for your new business venture. The financial projections are essential and must be as detailed as possible.

Your financial plan will consist of the following:

- Costs: Specify your assumed costs such as rent, marketing, paying staff, necessary equipment, and technology. If this is set to change, for example, you might spend more on marketing during the first year before word of mouth kicks in, include this in your costs outline too.

- Capital requirements: In this section, write down how much capital you need and break down what it's for. Detail what the funds will be spent on, such as marketing, salaries, etc. Write your plan on how you'll gain funding for your new business.

- Key assumptions: Summarise your expenses based on key assumptions like how many clients you'll have per year (increasing year on year) and how much rent you'll need to pay.

- Cash flow statement: Use the key assumptions, along with your sales forecast above, to create a cash flow statement, income statement, and balance sheet for a five year period. Include how much revenue you'll generate for each service.

How Link My Books Can Help

.webp)

Link My Books is an automated bookkeeping software that let's you put your clients' bookkeeping on autopilot. Designed for eCommerce businesses and accountants, our specialised software automatically transfers sales data to accounting software, like Xero or QuickBooks.

Link My Books will save you around six hours per month on every one of your clients. This affords you considerably more time to take on more clients, and offer a more comprehensive and complete service.

These are some of the core features that make Link My Books an essential tool for accountants:

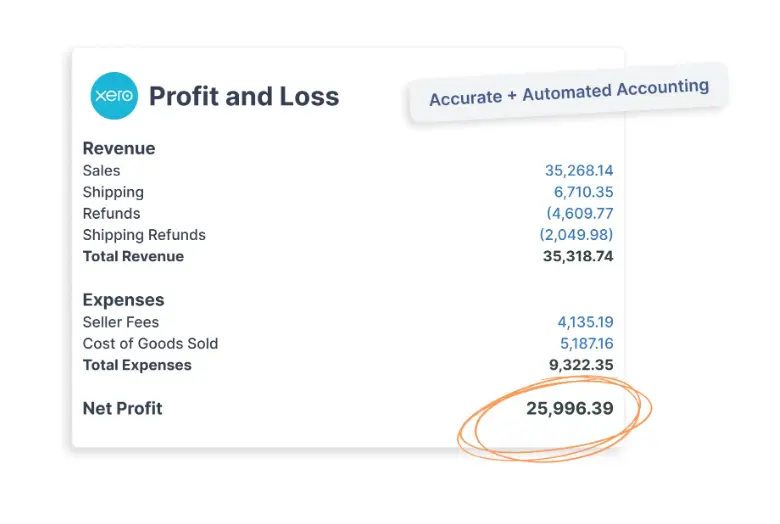

Profit and Loss Summary Statements

Link My Books produces accurate profit and loss summary statements for each of your clients' sales channels. It breaks down data, clearly showing revenue and expenses, like sales, refunds, fees, advertising costs. You can manually transfer these to your eCommerce accounting software, view them in your Link My Books dashboard, or set it to autopilot so it transfers them automatically.

Tax Management

Link My Books calculates taxes on every product your clients sell. When you sign up, you'll complete the Guided Tax Wizard (or opt for a free onboarding session), where you'll input information that'll ensure the correct tax rates are applied to each sale.

The calculations are accurate, regardless of where in the world your clients operate. This information is also sent to accounting software, simplifying the preparation and sending of tax returns

Analytics and Reporting

.webp)

Link My Books has some powerful analytical tools that'll help you with your business planning efforts, including market analysis. One tool is called Benchmarking and this gives you a percentile ranking of how your client's business is performing compared to others in their industry. It looks at data like sales growth percentage and refund ratio, to name a couple.

Another tool is called P & L by Channel. This tool allows you to compare performance across different sales channels. You can do side-by-side comparisons of data like sales, fees, shipping costs, and refunds. You can also apply date filters.

Integrations

Link My Books facilitates thorough eCommerce accountancy services by having plenty of available integrations. Connect with sales channels like Amazon, Shopify, TikTok Shop, and eBay, among others. And, connect as many as you and your clients need.

Link My Books integrates with both Xero and QuickBooks (two of the best accounting software), along with all payment processors, including PayPal and Klarna.

Start Your Business Planning Efforts With a Solid Accounting Firm Business Plan

.webp)

While business planning is not an easy thing to do, it doesn't have to be as complicated as you might think either. Following business plan templates like the one above can keep you on the right track and ensure you include everything you need to.

Successful businesses almost always begin with solid business plans. These plans should detail your business structure, legal structure, accountancy services, and financial projections, to name a few aspects. They're also essential for clarifying your goals and pinpointing any challenges you might face.

Part of your business planning endeavours also involves choosing what technology to use. Accounting firms around the world trust Link My Books to save them hours every month on every client. It does this by taking bookkeeping off your hands and putting it on autopilot.

Start as you mean to go on. Sign up for your free Link My Books trial and make sure you have the time to dedicate to your clients and your business growth.

.webp)

.png)