Whether you’re selling on Amazon, Shopify, eBay, or Etsy, managing your finances properly can mean the difference between profitability and financial chaos.

The challenge? Managing ecommerce finances goes far beyond tracking sales. You need to reconcile marketplace payouts that never match your bank deposits, account for platform fees, refunds, and sales tax correctly while tracking COGS and inventory across multiple sales channels. Plus, you must ensure tax compliance in every region where you sell.

Most sellers rely on spreadsheets or basic accounting software, wasting hours on manual reconciliation and risking tax compliance issues from misclassified transactions. This leads to poor financial visibility for business decisions and missed fees that eat into profits.

Without proper e-commerce accounting, you risk:

- Overpaying taxes because sales tax and refunds aren’t accounted for correctly.

- Underreporting profits due to missing or misclassified expenses.

- Making poor financial decisions without real-time profit insights.

Link My Books helps you streamline all your accounting and bookkeeping needs in a single platform, giving you time to focus on what’s most important - running your e-commerce business.

Key Takeaways from this Post

Ecommerce accounting requires more than just QuickBooks or Xero: Traditional accounting software is a starting point, but it doesn’t automatically categorize marketplace transactions, fees, or taxes.

Your accounting method affects how you report revenue: Many e-commerce sellers don’t realize the impact of cash vs. accrual accounting on their tax liabilities and financial reports.

Automating reconciliation saves time and prevents costly errors: Manual reconciliation leads to errors, but automation tools eliminate discrepancies instantly.

How ecommerce accounting is changing in 2025

In 2025, ecommerce sales are expected to reach 21% ($6.86 trillion) of total retail sales worldwide.

Multi-channel selling is seeing an increase of 143%, which creates more opportunities for sellers.

While Amazon and eBay dominate the US market, other platforms are seeing growth as well. This comes with stricter tax regulations, multi-currency challenges, and the need for automation software. Link My Books automates reconciliation, tax compliance, and provides real-time financial data across all your sales channels.

Stop spending hours on manual bookkeeping and start focusing on growing your business.

Now, let’s break down what e-commerce accounting is, how to do it the easy way, and how to streamline your finances.

What is Ecommerce accounting?

E-commerce accounting refers to the process of recording, organizing, and analyzing financial transactions for an online business. It includes:

- Tracking sales and expenses across different platforms (Amazon, Shopify, Etsy, etc.)

- Managing sales tax and VAT compliance across different regions

- Reconciling payouts from marketplaces with actual bank deposits

- Understanding profit margins and costs (e.g., COGS, advertising, fulfillment fees)

- Generating financial statements to measure business performance

Since e-commerce sellers deal with high transaction volumes, multiple sales channels, and complex fee structures, standard bookkeeping practices often fall short, and even bookkeepers prefer using accounting software.

How to do Ecommerce Accounting (in Easy Mode)

Many e-commerce sellers assume that setting up QuickBooks or Xero is all they need for effective bookkeeping. While these accounting tools are essential, they do not automatically account for the unique complexities of e-commerce transactions.

Without Link My Books automation, sellers often face issues that lead to inaccurate financial reports, tax overpayments, and time-consuming reconciliation efforts.

Some of the biggest challenges sellers encounter when using standard accounting software include:

- Amazon & Shopify payouts not matching sales totals

- Sales tax being included in deposits but not real revenue

- FBA fulfillment fees, refunds, and chargebacks affecting net income

The easiest way to manage ecommerce accounting (step by step)

- Set Up QuickBooks or Xero for Ecommerce Accounting

- Automate Transaction Imports with Link My Books

- Categorize Revenue & Expenses the Right Way

- Reconcile Transactions in One Click

Step #1: Set Up QuickBooks or Xero for Ecommerce Accounting

Before you can accurately track revenue, expenses, and profits, you need a solid accounting foundation. This starts with setting up an accounting system like QuickBooks or Xero, both of which are widely used for e-commerce businesses.

However, simply having QuickBooks or Xero is not enough. These tools are designed for general businesses, and they do not automatically categorize marketplace transactions, fees, and taxes correctly. That’s why sellers must set them up properly and integrate automation tools to ensure accurate bookkeeping.

Choose the Right Accounting Software

Both QuickBooks and Xero are excellent choices for e-commerce sellers, but they cater to slightly different needs.

QuickBooks Online is a popular option for U.S.-based businesses. It offers robust reporting, strong integration with payment processors, and user-friendly dashboards.

Xero is favored by international sellers and those who require strong multi-currency support and automated bank reconciliation.

Your choice depends on your business structure, location, and preference for integrations.

Connect Your Bank Accounts and Payment Processors

Once you have chosen your accounting software, the next step is to connect your business bank account and payment processors to ensure all transactions are imported automatically.

- Go to the Banking section in QuickBooks or Xero.

- Add your business bank account (checking, savings, credit card).

- Connect payment processors such as PayPal or Stripe if you use them.

This allows your accounting software to pull in transactions in real-time, reducing manual data entry.

What QuickBooks & Xero Don’t Do

Despite their benefits, these accounting tools don’t automatically categorize marketplace transactions. This is where Link My Books fills the gap.

✅ Automatically categorizes Amazon, Shopify, and eBay transactions.

✅ Matches payouts with bank deposits.

✅ Ensures accurate tax reporting.

Now that your accounting software is set up, let’s move to the next step, importing and categorizing transactions correctly.

Step #2: Automate Transaction Imports with Link My Books

Instead of dealing with complex marketplace reports and mismatched transactions, you can automate transaction imports with Link My Books. This ensures that every sale, fee, tax, and refund is recorded accurately without manual data entry.

Here’s how to do it:

Link Your E-Commerce Accounts to Xero or QuickBooks via Link My Books

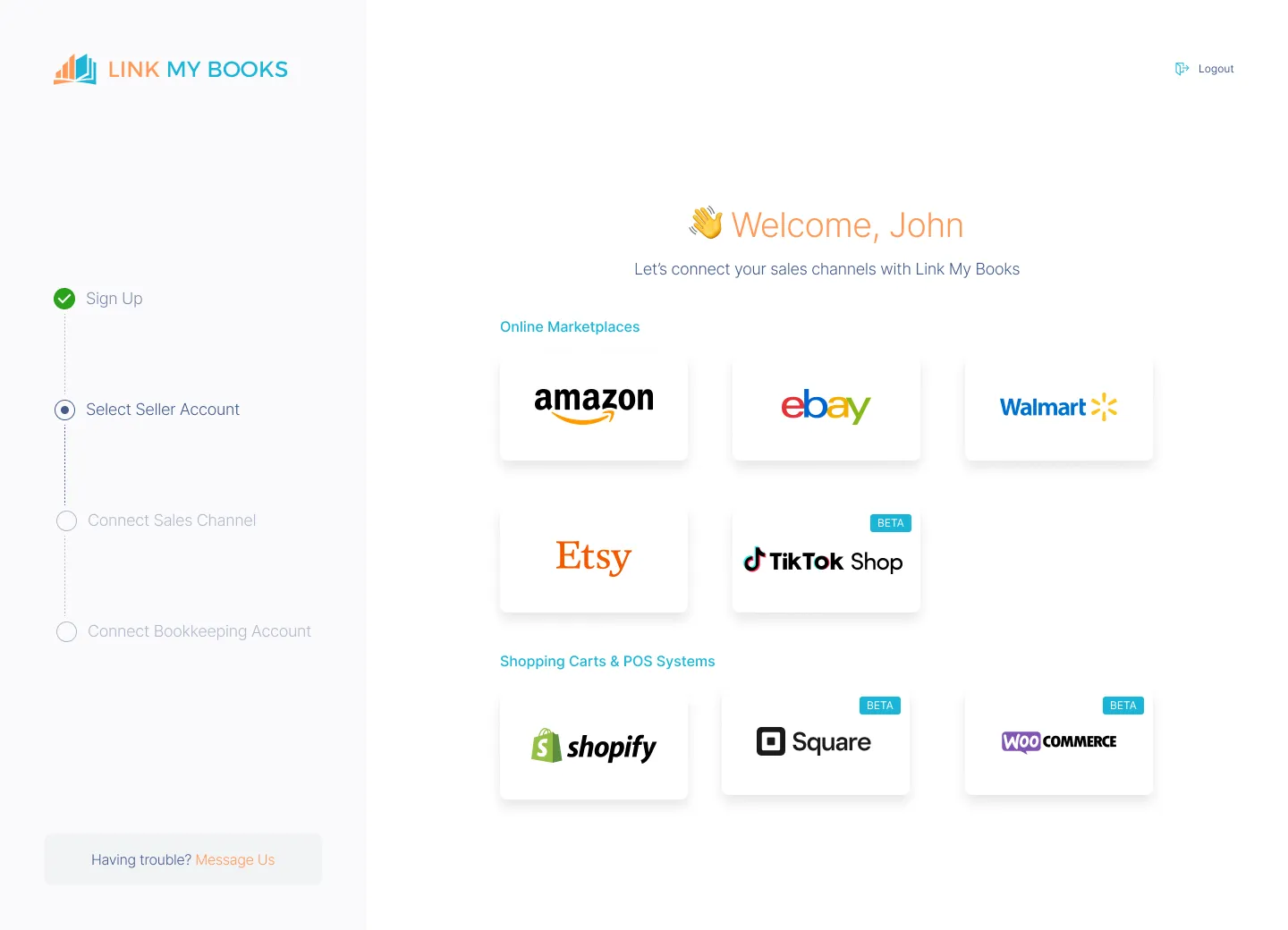

Before you can automate transaction imports, you need to connect your Amazon, Shopify, or eBay account to Link My Books and then link it to your accounting software.

- Sign up for Link My Books (free trial available) and select your accounting platform (QuickBooks or Xero).

- Connect your e-commerce platform, such as Amazon, Shopify, eBay, or Etsy.

- Authorize access to allow Link My Books to pull financial data automatically.

Once connected, Link My Books syncs your sales, refunds, fees, and tax data in real-time, eliminating the need to download spreadsheets or enter data manually.

Validate Transactions Automatically

Once Link My Books is connected, it automatically imports and categorizes transactions from your e-commerce platform.

- Separates revenue, refunds, and marketplace fees: No more overreporting or underreporting income.

- Identifies and applies the correct tax rates: Prevents tax overpayments by properly handling marketplace-collected sales tax.

- Breaks down fulfillment and advertising costs: Ensures accurate expense tracking for a clear profit-and-loss report.

This automation eliminates human errors, missed transactions, and duplicate entries, ensuring your financial records are always accurate.

Step #3: Categorize Revenue & Expenses the Right Way

One of the most common e-commerce accounting mistakes is misclassifying transactions. This can lead to incorrect tax filings, overpaying on taxes, or misstated profits.

What Needs to Be Categorized?

- Sales Revenue: Total sales made on Amazon, Shopify, eBay, etc.

- Sales Tax Collected: This is NOT income, Amazon often remits this for you.

- Refunds & Chargebacks: These must be deducted from revenue.

- Amazon & Shopify Fees: Referral fees, fulfillment fees, advertising costs, etc.

- COGS (Cost of Goods Sold): The actual cost of inventory sold.

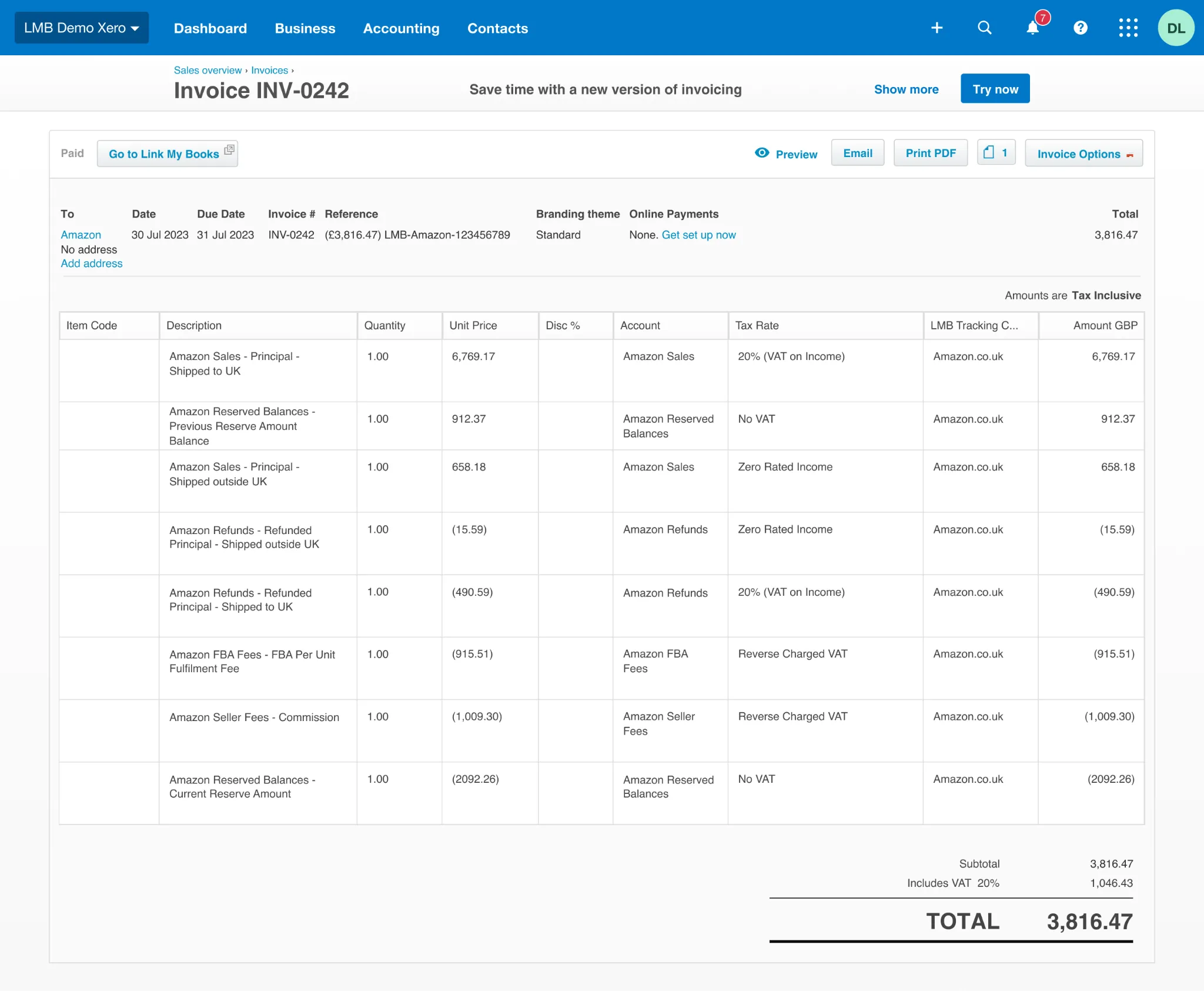

Generate an Organized Summary in Xero or QuickBooks

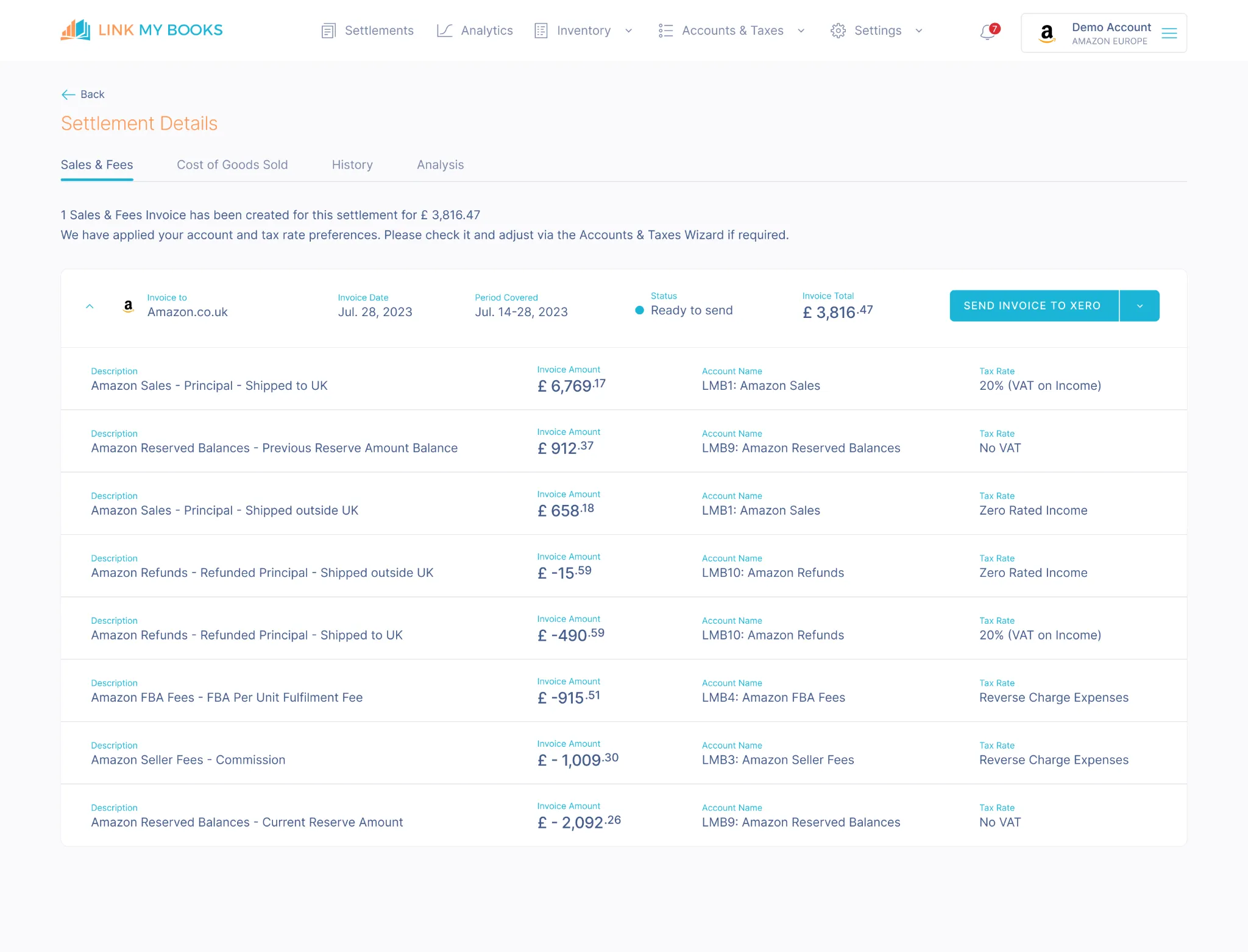

Once transactions are validated, Link My Books creates a structured financial summary inside Xero or QuickBooks. This summary includes:

- Total revenue from all e-commerce platforms.

- Breakdowns of Amazon, Shopify, and eBay fees so they are properly categorized.

- Separate line items for refunds and chargebacks to avoid revenue misstatements.

- Sales tax adjustments so you don’t accidentally overpay taxes.

Link My Books organizes all financial data in a way that makes sense for bookkeeping and tax filing.

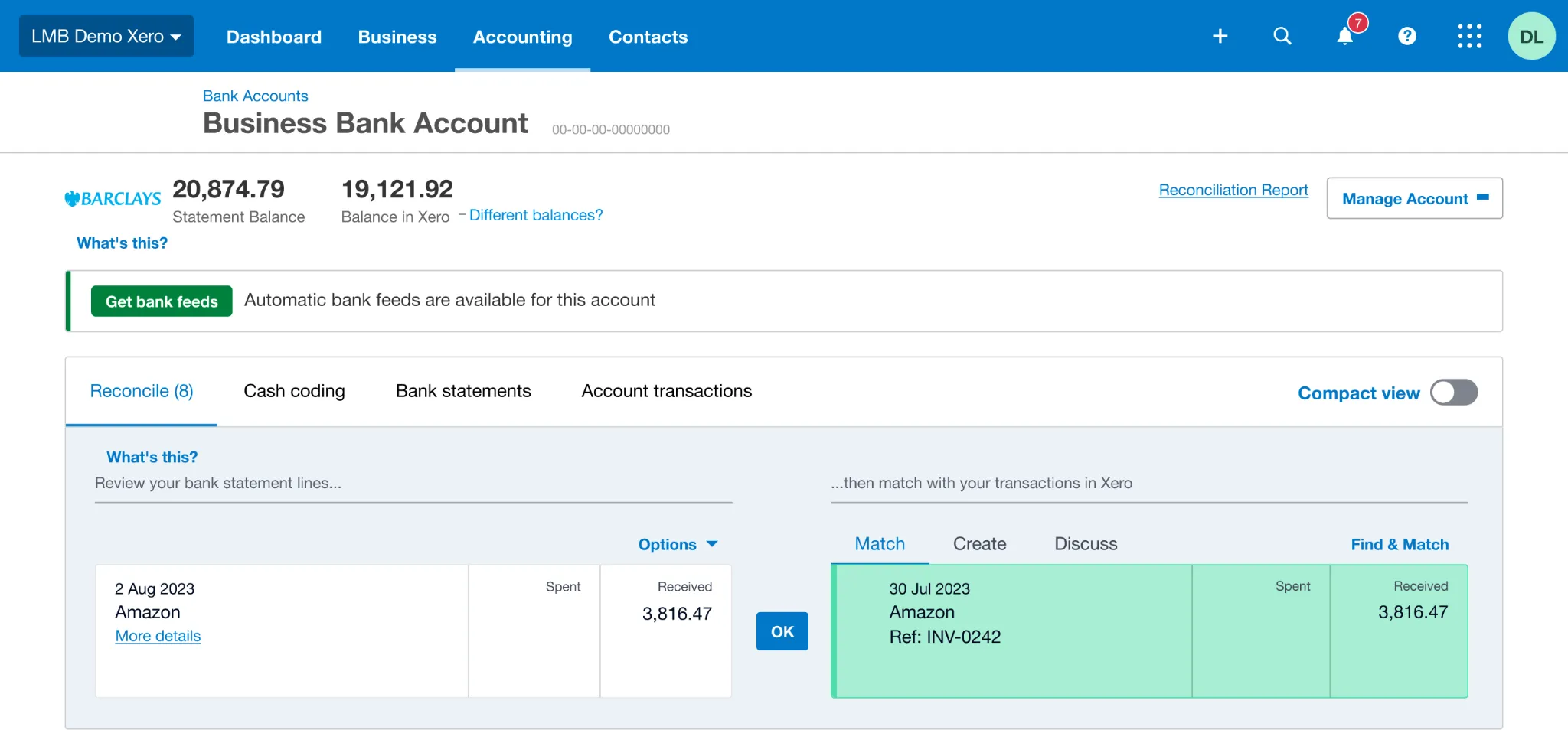

Step #4: Reconcile Transactions in One Click

Once your transactions are categorized, it’s time to match payouts from Amazon, Shopify, or eBay with actual bank deposits.

- Go to Xero or QuickBooks

- Navigate to the bank reconciliation page

- Match imported transactions from Link My Books with bank deposits

- Click “Reconcile” to finalize the process

Instead of spending hours manually matching sales and expenses, Link My Books ensures that every deposit is already broken down and categorized correctly. You simply approve the reconciliation in one click.

How Link My Books Makes Ecommerce Accounting Simple

Managing e-commerce finances can quickly become overwhelming, especially when juggling sales, refunds, fees, and tax obligations across multiple platforms. Amazon, Shopify, and eBay payouts rarely match your actual sales, leaving sellers spending hours manually reconciling transactions, fixing errors, and ensuring compliance.

Link My Books automates the entire reconciliation process, ensuring that your marketplace settlements align perfectly with your bank deposits. By accurately categorizing sales, fees, refunds, and taxes, and applying the correct tax rates, it eliminates tedious manual work and makes your records audit-ready. With just a few clicks, your e-commerce accounting is handled effortlessly.

But Link My Books goes beyond basic reconciliation, it provides deeper financial insights, tax automation, and seamless multi-currency support, making it a must-have for e-commerce sellers.

Accurate Tax Calculations Without the Hassle

Handling VAT, GST, and sales tax is one of the biggest accounting challenges for e-commerce sellers, particularly those selling across different states or countries. If tax is not recorded correctly, sellers risk overstating taxable income or missing tax payments altogether.

Link My Books automatically identifies and applies the correct tax rates for every transaction, ensuring that:

- Sales tax collected is properly separated from revenue, so you don’t overpay taxes.

- VAT and GST obligations are correctly calculated and reported, preventing underpayment penalties.

- Multi-country tax compliance is simplified, eliminating the guesswork of international selling.

With tax automation built-in, you can be confident that your tax filings are accurate and compliant.

See Your True Profitability Across Multiple Sales Channels

If you sell on multiple platforms, such as Amazon, Shopify, eBay, or Etsy, it’s critical to understand which sales channels are driving profit and which are costing you money.

Link My Books provides a detailed profit-and-loss breakdown by sales channel, helping you:

- Compare revenue, expenses, and net profits across platforms in one clear report.

- Identify which channels are the most profitable and allocate resources accordingly.

- Simplify financial reporting with real-time insights that allow for smarter decision-making.

Instead of guessing which platform is performing best, Link My Books gives you the data you need to scale your business effectively.

Automated Cost of Goods Sold (COGS) Tracking

Many e-commerce businesses struggle to calculate their true profit margins because they fail to track the cost of inventory sold. If you’re not properly accounting for COGS, your profit-and-loss statements won’t reflect actual profitability.

With Link My Books, COGS tracking is fully automated, ensuring:

- Inventory costs are assigned to the correct expense accounts.

- Profit calculations reflect actual margins, not just gross sales.

- Financial reports show an accurate picture of your business’s health.

This automation eliminates manual calculations, helping you make better-informed pricing and purchasing decisions.

Seamless Multi-Currency Reconciliation

For sellers operating internationally, currency conversions add another layer of complexity to reconciliation. Amazon, Shopify, and eBay often pay sellers in multiple currencies, and fluctuating exchange rates can cause discrepancies in financial records.

Link My Books automatically converts foreign currency transactions to your base currency at the correct exchange rate, ensuring:

- Consistent and accurate financial reporting across all currencies.

- No discrepancies between payouts and recorded revenue.

- Less time spent manually adjusting for exchange rate differences.

Whether you’re receiving payments in USD, GBP, EUR, or another currency, Link My Books ensures seamless reconciliation without financial misstatements.

Simple Setup and Scalable for Growth

Getting started with Link My Books is effortless. The guided setup wizard walks you through every step, and if you need extra help, free 1:1 onboarding calls are available to ensure everything is configured correctly.

Whether you’re processing a few orders per month or handling thousands of transactions daily, Link My Books scales with your business, keeping your books accurate and up to date.

With automation, tax compliance, multi-channel tracking, and scalability, Link My Books is more than just an accounting tool, it’s a complete solution for e-commerce bookkeeping.

Try Link My Books for free today and take the stress out of e-commerce accounting.

What About an Ecommerce Accountant?

While automation tools like Link My Books, Xero, and QuickBooks significantly streamline e-commerce accounting, some sellers may still wonder: Do I need an accountant?

The answer depends on the complexity of your business, your comfort with financial management, and the level of accuracy required for tax compliance.

An accountant is not always necessary for every e-commerce business, but hiring one can be beneficial if:

- Your business is growing rapidly: More sales channels, higher order volumes, and increased complexity mean more financial data to manage.

- You operate in multiple tax jurisdictions: Sales tax, VAT, and international compliance can be difficult to handle without professional guidance.

- You struggle with bookkeeping and tax filing: If numbers aren’t your strong suit, an accountant ensures accuracy and prevents costly errors.

- You want strategic financial advice: An accountant can help with business forecasting, profitability analysis, and cost-saving strategies.

- You have investors or plan to sell your business: Accurate financial statements are essential when seeking investment or preparing for an exit.

However, for many small to medium-sized sellers, combining accounting software with automation tools like Link My Books can eliminate the need for an accountant altogether.

What to Look for in an Ecommerce Accountant

If you decide to hire an accountant, not all accountants are familiar with the unique challenges of e-commerce businesses. Here’s what to look for:

1. Experience in Ecommerce Accounting

- E-commerce businesses have unique financial structures, including marketplace payouts, sales tax collection, fulfillment fees, and refunds. Your accountant should:

- Understand Amazon, Shopify, and eBay’s fee structures and tax policies.

- Be familiar with inventory accounting methods, including FIFO and weighted average cost.

- Know how to track multi-currency transactions and international tax obligations.

2. Knowledge of Sales Tax & VAT Compliance

Tax laws for online sellers are complicated. An e-commerce accountant should have expertise in:

- Sales tax compliance in the U.S., including state-by-state nexus rules.

- VAT and GST regulations for international sellers.

- Automated tax software like Avalara or TaxJar to simplify tax filings.

3. Proficiency in Accounting Software & Integrations

Your accountant should be well-versed in QuickBooks, Xero, and automation tools like Link My Books. They should:

- Understand how to reconcile marketplace payouts with bank deposits.

- Know how to set up proper revenue and expense categorization.

- Be able to generate tax-ready financial reports.

4. Ability to Provide Strategic Business Insights

Beyond bookkeeping, an experienced e-commerce accountant can help you:

- Optimize pricing and profitability by analyzing cost structures.

- Improve cash flow management by forecasting revenue trends.

- Identify tax-saving opportunities to reduce liabilities.

5. Transparent Pricing & Flexible Services

Some accountants charge hourly rates, while others offer monthly packages. Make sure you:

- Get clear pricing upfront to avoid hidden fees.

- Choose a plan that fits your business size and needs.

- Have the flexibility to scale services as your business grows.

Why Accountants Love Link My Books

When it comes to e-commerce bookkeeping, accountants know that efficiency and accuracy are key. That’s why many accountants recommend Link My Books as the perfect complement to their expertise. By automating time-consuming tasks like bookkeeping and reconciliation, Link My Books allows accountants to focus on higher-value services such as tax strategy and financial planning.

Rather than replacing accountants, Link My Books enhances their workflow, automating routine tasks so they can focus on helping clients grow their businesses. Whether you're an accountant or an e-commerce seller, using accounting software ensures accuracy, efficiency, and cost savings, without compromising expert financial guidance.

What Are the Vital Components of Ecommerce Accounting?

Ecommerce accounting involves more than just tracking revenue and expenses, it requires a structured system to manage multiple sales channels, tax compliance, inventory costs, and financial reporting. Without proper accounting, online sellers risk misreporting profits, overpaying taxes, and making poor financial decisions.

In this section, we’ll cover the key areas of e-commerce accounting and why they matter.

Understanding Sales Channels and Their Impact on Accounting

Ecommerce businesses often sell on multiple platforms, such as:

- Marketplaces: Amazon, eBay, Etsy, Walmart

- Self-hosted Stores: Shopify, WooCommerce, Magento

- Social Commerce: Facebook Shops, Instagram Shopping

Each platform has different fee structures, payout schedules, and tax collection policies, which can complicate accounting. For example:

- Amazon deposits payouts every two weeks, but deducts fees before transferring funds.

- Shopify payouts include sales tax collected, but sellers must remit it themselves.

- eBay and Etsy charge transaction fees and advertising fees that need to be accounted for.

To maintain accurate financial records, e-commerce sellers must use software that automatically tracks and categorizes transactions from multiple sales channels.

Role of Accounting Software in Ecommerce

Manual bookkeeping is not scalable for e-commerce businesses due to high transaction volumes and complex payout structures. Accounting software like Xero and QuickBooks provides:

- Automated transaction tracking from bank accounts and payment processors.

- Financial reports, such as profit & loss statements and balance sheets.

- Reconciliation tools to match payouts with actual sales.

However, accounting software alone is not enough, these platforms don’t automatically categorize Amazon, Shopify, or eBay transactions. This is where Link My Books comes in, ensuring that all revenue, fees, refunds, and taxes are accurately categorized without manual entry.

Importance of Managing Sales and Expenses

Tracking sales and expenses is critical for understanding profitability. Key financial metrics that sellers should monitor include:

- Gross Sales Revenue: Total sales before deductions.

- Refunds and Chargebacks: Must be deducted from revenue to reflect actual earnings.

- Marketplace Fees: Amazon, eBay, and Shopify deduct referral and processing fees.

- Shipping & Fulfillment Costs: Includes Amazon FBA fees and third-party logistics costs.

- Advertising Expenses: PPC campaigns on Amazon, Facebook Ads, and Google Ads impact profitability.

A well-structured accounting system ensures that all sales and expenses are properly categorized, giving sellers an accurate view of their financial health.

Accounting Methods for Ecommerce

Ecommerce businesses must choose between cash-based accounting and accrual accounting. The right method impacts tax reporting, revenue recognition, and business decision-making.

Accrual Accounting vs. Cash Basis Accounting

Example:

- If you sell a product on December 30th, but Amazon deposits the funds on January 5th, cash accounting records the sale in January, while accrual accounting records it in December.

Most larger e-commerce businesses use accrual accounting because it provides a clearer picture of profitability, even if payments are delayed.

Choosing the Right Method for Your Ecommerce Business

- Use Cash Accounting if you run a small, low-volume business and want simple tax filing.

- Use Accrual Accounting if you sell high volumes, manage inventory, or deal with international tax regulations.

Many businesses start with cash accounting and switch to accrual accounting as they grow. If you’re unsure, consult with an accountant to determine the best method for tax efficiency.

Financial Statements and Reporting

Accurate financial reporting is essential for e-commerce businesses to track profitability, manage cash flow, and make informed decisions. Without well-maintained financial statements, sellers may struggle to understand their true financial position, leading to pricing mistakes, tax miscalculations, or cash shortages.

E-commerce businesses should generate three key financial statements regularly:

- Balance Sheet: A snapshot of your financial position, showing assets, liabilities, and equity.

- Profit & Loss Statement: Summarizes revenue, expenses, and net profit over a period.

- Cash Flow Statement: Tracks how money moves in and out of your business.

By automating financial reporting with accounting software and tools like Link My Books, e-commerce sellers can eliminate manual errors and ensure they have up-to-date, tax-ready financials at all times.

Preparing Balance Sheets for Ecommerce Companies

A balance sheet provides a clear picture of a company’s financial health at a given point in time. It helps sellers understand how much their business owns, owes, and is worth.

Key components of a balance sheet include:

- Assets: Inventory, cash, accounts receivable, and prepaid expenses.

- Liabilities: Business loans, unpaid supplier invoices, and outstanding tax obligations.

- Equity: The owner’s investment in the business after subtracting liabilities from assets.

For e-commerce businesses, inventory is a major asset, and seller loans or unpaid supplier bills may be significant liabilities. Regularly reviewing the balance sheet allows sellers to spot cash flow issues, optimize inventory levels, and assess financial stability.

Analyzing Financial Health Through Statements

Beyond the balance sheet, sellers must review profitability and cash flow to make sound business decisions.

- Profit & Loss Statement (P&L): Shows revenue, COGS, operating expenses, and net profit. It helps sellers determine whether their business is making money or running at a loss.

- Cash Flow Statement: Tracks incoming and outgoing cash to ensure the business has enough liquidity to cover expenses. This is especially important for inventory-based businesses, where cash is often tied up in stock.

- Sales & Inventory Reports: Provide insights into top-selling products, slow-moving inventory, and seasonal trends, helping sellers optimize purchasing and pricing strategies.

Using automated tools like Link My Books ensures that these reports are generated accurately and efficiently, giving sellers real-time financial visibility without the hassle of manual tracking.

Cost of Goods Sold (COGS) and Inventory Management

Tracking Cost of Goods Sold (COGS) and inventory is critical for e-commerce businesses because it directly impacts profitability and tax reporting. Many sellers focus on revenue but overlook the importance of accurately calculating COGS, which determines true profit margins. Without proper COGS tracking, sellers may overstate profits, underprice products, or face financial inconsistencies.

COGS includes all direct costs associated with producing or acquiring inventory and getting it to the customer. Managing this efficiently helps sellers:

- Price products correctly based on actual costs.

- Ensure accurate tax deductions (COGS is deductible as a business expense).

- Improve profitability by monitoring cost trends.

Calculating COGS for Ecommerce Businesses

COGS consists of all expenses directly related to product sales. It’s important to track these costs accurately to ensure financial reports reflect the true cost of running the business.

What’s Included in COGS?

COGS (Cost of Goods Sold) includes all costs directly associated with getting your product ready for sale. This typically covers:

- Product costs: The price paid to suppliers or manufacturers.

- Import duties & taxes: Any customs duties or taxes paid when bringing products into a country.

- Shipping to warehouse: Freight costs to transport goods from suppliers to your warehouse or fulfillment center.

- Packaging materials: Boxes, labels, and protective materials used to prepare products for sale.

What’s Not Included in COGS?

While essential to running an e-commerce business, some costs fall outside of COGS and are tracked separately in Link My Books, including:

- Amazon FBA fulfillment fees: Costs associated with picking, packing, and shipping orders.

- Storage fees: Warehousing costs, including Amazon FBA storage fees and third-party logistics (3PL) services.

- Returns & damaged inventory: Losses from refunds, returns, or damaged goods.

By accurately calculating COGS, sellers can determine gross profit margins, which are essential for making strategic pricing and purchasing decisions.

Example:

If an e-commerce seller generates $100,000 in sales but has $40,000 in COGS, the gross profit is $60,000. Without knowing these costs, the seller might incorrectly assume they are more profitable than they actually are.

Why Accurate COGS Tracking Matters

If COGS is not tracked properly, sellers risk:

- Overstating profits: Leading to higher tax liabilities than necessary.

- Underpricing products: Resulting in low margins and unprofitable sales.

- Mismanaging inventory levels: Causing stock shortages or overstocking.

To ensure accurate COGS tracking, e-commerce sellers should use automated inventory and accounting software that integrates with their sales platforms.

Inventory Management Systems for E-commerce Sellers

Effective inventory management is essential to maintaining healthy cash flow, avoiding stockouts, and optimizing product availability. Without an organized system, sellers risk tying up too much cash in unsold inventory or running out of best-selling products at critical times.

Key Challenges in Inventory Management

- Stockouts: Running out of inventory can lead to lost sales and lower rankings on Amazon or Shopify.

- Overstocking: Holding too much inventory ties up cash and increases storage costs.

- Inventory discrepancies: Errors in stock levels lead to misreported financials.

Best Inventory Management Tools for E-commerce Sellers

To streamline inventory tracking, sellers should use software that automatically syncs stock levels with sales. Popular options include:

- Amazon Seller Central: Amazon FBA sellers can track stock levels and restock alerts.

- Shopify Inventory Management: Tracks product availability, sales, and fulfillment status.

- Dedicated inventory software: Platforms like Unleashed, Cin7, or Katana help businesses manage stock across multiple sales channels.

Automating COGS and Inventory

For sellers with high transaction volumes, manually tracking COGS and inventory is impractical. Using accounting automation tools like Link My Books, you can:

- Track COGS in real time for more accurate financial reporting.

- Ensure inventory expenses are correctly categorized and deducted.

Automating these processes helps you gain better visibility into your financials, avoid costly errors, and make data-driven decisions to scale profitably.

By managing COGS and inventory efficiently, e-commerce sellers can improve profitability, maintain healthy stock levels, and ensure accurate tax reporting, a crucial part of sustainable business growth.

Tax Compliance and Challenges

E-commerce businesses face unique tax challenges, especially when selling across multiple states or internationally. Unlike traditional brick-and-mortar stores, online sellers must navigate complex sales tax regulations, VAT compliance, and varying tax remittance rules based on where their customers are located.

Failing to comply with tax laws can lead to penalties, audits, and unexpected tax liabilities, making it essential for you to understand and manage your tax obligations correctly.

Understanding Sales Tax and Remittance

In the U.S., sales tax compliance depends on where you have a tax nexus, a connection between your business and a state that requires you to collect and remit sales tax.

Many online marketplaces like Amazon, eBay, and Etsy automatically collect and remit sales tax on behalf of sellers, but this doesn’t always mean you’re in the clear. You may still have tax obligations in certain states, especially if you sell through your own Shopify or WooCommerce store.

Key factors that determine whether you need to collect sales tax:

- Physical Presence Nexus: If you have a warehouse, office, or employees in a state, you likely have a tax obligation there.

- Economic Nexus: Some states require sales tax collection if you exceed a certain sales threshold (e.g., $100,000 in revenue or 200+ transactions).

- Marketplace Facilitator Laws: If selling through Amazon FBA or eBay, these platforms may collect tax on your behalf, but you still need to track and report these amounts properly.

If you sell internationally, Value-Added Tax (VAT) and Goods and Services Tax (GST) regulations add another layer of complexity. VAT is required in the European Union, the UK, Canada, Australia, and many other regions. Sellers must register, collect, and remit VAT based on country-specific rules, and incorrect reporting can lead to hefty fines.

Tax Compliance Across Different States

Sales tax rates and regulations vary widely across U.S. states, which makes compliance challenging.

For example:

- Florida and Texas do not have an economic nexus threshold, but many states like California and New York require sellers to collect sales tax once they hit $100,000 in revenue or 200+ transactions.

- Some states have local tax rates in addition to state sales tax, meaning sellers may have to calculate and remit different amounts for different locations.

- If you sell internationally, VAT registration rules vary by country. Some require foreign sellers to register before making any sales, while others have thresholds similar to U.S. economic nexus laws.

Tracking tax compliance manually is nearly impossible at scale, which is why automated tax software like TaxJar, Avalara, or Link My Books is essential.

Paying Taxes and Avoiding Penalties

Staying compliant with tax laws doesn’t have to be overwhelming. By following best practices and using automation, you can ensure that your business remains fully compliant while minimizing tax burdens.

To stay on top of tax obligations:

- Use automated tax software: Tools like TaxJar, Avalara, or Xero's tax modules calculate and remit sales tax automatically.

- Track marketplace-collected taxes separately: Just because Amazon collects sales tax doesn’t mean it’s included in your revenue reports. Using Link My Books ensures that marketplace-collected taxes are recorded separately to avoid overreporting income.

- File sales tax and VAT returns on time: Many jurisdictions have strict deadlines, and missing them can result in late fees or penalties, Link My Books calculates it automatically.

By implementing automated accounting solutions and tax software, e-commerce sellers can eliminate manual errors, reduce compliance risks, and avoid costly penalties while ensuring their tax obligations are met accurately.

Bank Reconciliation and Account Management

Gain Financial Clarity with Link My Books

One of the most crucial yet overlooked aspects of e-commerce accounting is bank reconciliation, the process of matching transactions in your accounting records with actual bank deposits and withdrawals. Without regular reconciliation, sellers may encounter missing payments, duplicate charges, or tax miscalculations, leading to financial discrepancies that can be difficult to resolve.

Why Bank Reconciliation is Essential for E-commerce Sellers

Since e-commerce businesses handle high transaction volumes, multiple payment processors, and frequent marketplace deductions, bank reconciliation becomes more complex than for traditional businesses. Issues that commonly arise include:

- Mismatched Sales and Deposits: Marketplaces like Amazon, eBay, and Shopify deduct fees before sending payouts, meaning your bank deposits rarely match your actual sales revenue.

- Unrecorded Refunds and Chargebacks: Sellers may overlook customer refunds, return fees, or chargeback penalties, leading to overstated income.

- Multiple Payment Gateways: Payments may come from PayPal, Stripe, Amazon Pay, and direct credit card processors, requiring sellers to track and reconcile transactions across several platforms.

Failing to reconcile accounts regularly can lead to misstated financial reports, incorrect tax filings, and cash flow issues.

Use automation to simplify the process – Link My Books integrates directly with Amazon, Shopify, and eBay, ensuring that every transaction is properly categorized and reconciled in one click.

Other Considerations for Ecommerce Sellers

Beyond core accounting tasks, e-commerce businesses must also manage fulfillment, marketing expenses, and financial planning to ensure long-term success. These areas directly impact financial performance and should be integrated into your accounting workflow.

Fulfillment and Logistics

Managing fulfillment costs is essential for maintaining healthy profit margins. Common fulfillment-related expenses include:

- Warehousing and storage fees: Whether using Amazon FBA, 3PL providers, or self-storage, tracking these costs is critical.

- Shipping and freight expense: E-commerce sellers must monitor domestic and international shipping rates to avoid unexpected cost fluctuations.

- Order processing and returns: Customer returns can quickly reduce profitability if not tracked and managed effectively.

To optimize fulfillment costs, you should:

- Compare fulfillment options (e.g., Amazon FBA vs. in-house shipping) to choose the most cost-effective solution.

- Use inventory management tools to prevent stock shortages and overstocking.

- Ensure fulfillment fees are categorized properly in accounting software for accurate expense tracking.

Advertising and Marketing Budgets

Advertising costs can drastically impact profitability, especially in competitive e-commerce niches. Common marketing expenses include:

- Amazon PPC and Sponsored Ads

- Facebook and Instagram Ads

- Google Shopping and Search Ads

- Influencer Marketing and Affiliate Commissions

E-commerce sellers should:

- Monitor Return on Ad Spend (ROAS) to ensure marketing investments are profitable.

- Categorize ad expenses separately in accounting software for better financial visibility.

- Optimize advertising strategies to reduce unnecessary spending and improve profit margins.

Cash Flow Management and Financial Planning

Maintaining a healthy cash flow is essential for sustaining an e-commerce business. Since inventory purchases, fulfillment costs, and advertising expenses often require upfront payments, poor cash flow management can lead to stock shortages, late supplier payments, or missed growth opportunities.

Best practices for e-commerce cash flow management include:

- Projecting future cash needs based on sales trends and seasonal fluctuations.

- Separating operating expenses from reinvestment funds to maintain business stability.

- Using automated accounting tools like Link My Books and Xero to track cash flow in real time.

By combining strong accounting practices with automation, e-commerce sellers can streamline financial management, reduce tax burdens, and make data-driven decisions to scale profitably.

FAQ

How Do I Handle Accounting for Ecommerce Pre-Orders and Backorders?

Pre-orders and backorders present a unique accounting challenge because payment and revenue recognition don’t always happen at the same time. Proper accounting depends on whether you use cash basis or accrual accounting.

- Cash Basis Accounting: Revenue is recorded when the payment is received. If a customer pre-orders a product today but the item ships in two months, the sale is still recognized today.

- Accrual Accounting: Revenue is recorded when the product is shipped, not when the payment is received. This ensures that income aligns with when the sale is fulfilled.

Best Practices for Managing Pre-Orders and Backorders

- Track pre-order payments separately: Use liability accounts in QuickBooks or Xero to record unfulfilled sales.

- Recognize revenue at fulfillment: Ensure sales are reported when orders are shipped for accurate tax reporting.

- Monitor inventory closely: If products are on backorder, keep detailed records of outstanding orders and expected delivery dates.

By using automated accounting tools, e-commerce sellers can track pre-orders accurately, recognize revenue correctly, and maintain accurate financial records.

Which is Better for Ecommerce Accounting: Xero or QuickBooks?

Both Xero and QuickBooks are excellent accounting solutions for e-commerce businesses, but the best choice depends on your business size, needs, and budget.

Comparison of Xero vs. QuickBooks for Ecommerce

What’s the Best Way to Manage Cash Flow in Ecommerce?

Cash flow management is critical for e-commerce businesses because sellers often have large upfront expenses (inventory, advertising, fulfillment) before receiving revenue. Poor cash flow management can lead to stock shortages, late supplier payments, or inability to scale.

Key Cash Flow Management Strategies for E-Commerce Sellers

- Forecast future cash needs: Use past sales trends to predict upcoming inventory and expense requirements

- Separate operating cash from reinvestment funds: Avoid spending all available cash on new inventory without reserving funds for taxes and expenses.

- Monitor inventory turnover rates: Overstocking ties up cash, while understocking leads to missed sales.

- Use accounting software to track cash flow: Xero and QuickBooks generate cash flow statements, helping sellers see when cash enters and exits the business.

- Automate reconciliation with Link My Books: Ensures that all transactions, fees, and payouts match accounting records accurately, preventing cash flow discrepancies.

By managing cash flow strategically, e-commerce sellers can avoid financial stress, keep inventory moving, and reinvest in business growth effectively.

What Do I Need to Know About Gross Profit vs. Gross Margin in My Ecommerce Business?

Understanding gross profit and gross margin is essential for tracking business profitability and pricing strategies.

Gross Profit vs. Gross Margin: What’s the Difference?

- Gross Profit ($) = Total Revenue - Cost of Goods Sold (COGS)

This tells you how much money you made before deducting operating expenses. - Gross Margin (%) = (Gross Profit ÷ Total Revenue) × 100

This tells you what percentage of revenue remains after deducting COGS.

Example Calculation:

If an e-commerce store generates $50,000 in revenue and has $30,000 in COGS, then:

- Gross Profit = $50,000 - $30,000 = $20,000

- Gross Margin = ($20,000 ÷ $50,000) × 100 = 40%

Why These Metrics Matter

Gross Profit shows the actual dollars earned before business expenses.

Gross Margin allows for easier comparison across different products or time periods.

Higher gross margins mean the business keeps more of its revenue after product costs.

By tracking gross profit and gross margin, sellers can adjust pricing, reduce costs, and optimize profit margins for long-term business growth.

For accurate financial tracking, automation tools like Link My Books help sellers categorize COGS, fees, and revenue correctly, ensuring profitability calculations are always accurate.

Streamline Your E-commerce Accounting With Link My Books

Instead of relying solely on QuickBooks or Xero and manually sorting through transactions, you should implement an automated system that syncs marketplace data with your accounting software, ensuring that every fee, tax, and adjustment is accurately categorized.

Do this:

- Integrate QuickBooks or Xero with Link My Books.

- Automatically categorize sales, refunds, fees, and taxes without manual data entry.

- Reconcile marketplace payouts with bank deposits accurately to prevent discrepancies.

- Track Cost of Goods Sold (COGS) properly to maintain accurate profit margins.

With Link My Books, e-commerce accounting is no longer a headache, it’s fully automated and always accurate.

.webp)

.png)