Recording Amazon sales manually in QuickBooks Online can be a serious headache. With transaction fees, returns, Amazon VAT, and other complexities, manual entry is both time-consuming and error-prone. This process often leads to data inaccuracies that complicate tax season and hinder business insights.

Fortunately, tools like Link My Books automate the entire process, offering a streamlined, accurate, and real-time Amazon-QuickBooks integration that keeps your books in perfect order with minimal effort

Key Takeaways from this Post

Manual data entry for Amazon-QuickBooks integration is tedious and error-prone, often resulting in mismatched records.

Link My Books automates the entire Amazon data transfer process, including fees, VAT, sales tax, and refunds, ensuring accuracy.

With automatic syncing, businesses can access real-time insights, reconcile accounts easily, and stay compliant with tax regulations.

If You're manually recording Amazon sales in QuickBooks, you're doing it wrong

Many Amazon sellers struggle with incomplete or faulty integrations between Amazon and QuickBooks, leading to data mismatches and lost sales records.

Without proper integration, you’re left dealing with tedious manual work, risking compliance issues, and facing the frustrating task of reconciling discrepancies.

While there is a direct integration called Amazon Seller Connector by QuickBooks, this integration is often faulty and does not pull your data correctly.

For Amazon sellers, the real game-changer is pairing QuickBooks with Link My Books. It automatically categorizes sales, fees, VAT, and refunds directly from Amazon Seller Central to QuickBooks, ensuring accurate and up-to-date records.

Unlike traditional integrations, Link My Books is designed specifically for Amazon sellers, keeping everything from inventory costs to taxes in line, so you don’t have to worry about missed entries or manual errors.

And you can do it in five simple steps.

How to Record Amazon Sales in QuickBooks

- Start a free trial of Link My Books

- Connect your Amazon and QuickBooks accounts

- Configure with the guided setup wizard

- Choose automatic or manual sync

- Reconcile payouts from Amazon with Link My Books in QuickBooks

Step #1: Start a free trial of Link My Books

Head over to Link My Books and start a 14-day free trial. This allows you to explore the tool and understand how it automates your Amazon bookkeeping by directly integrating Amazon Seller Central with QuickBooks.

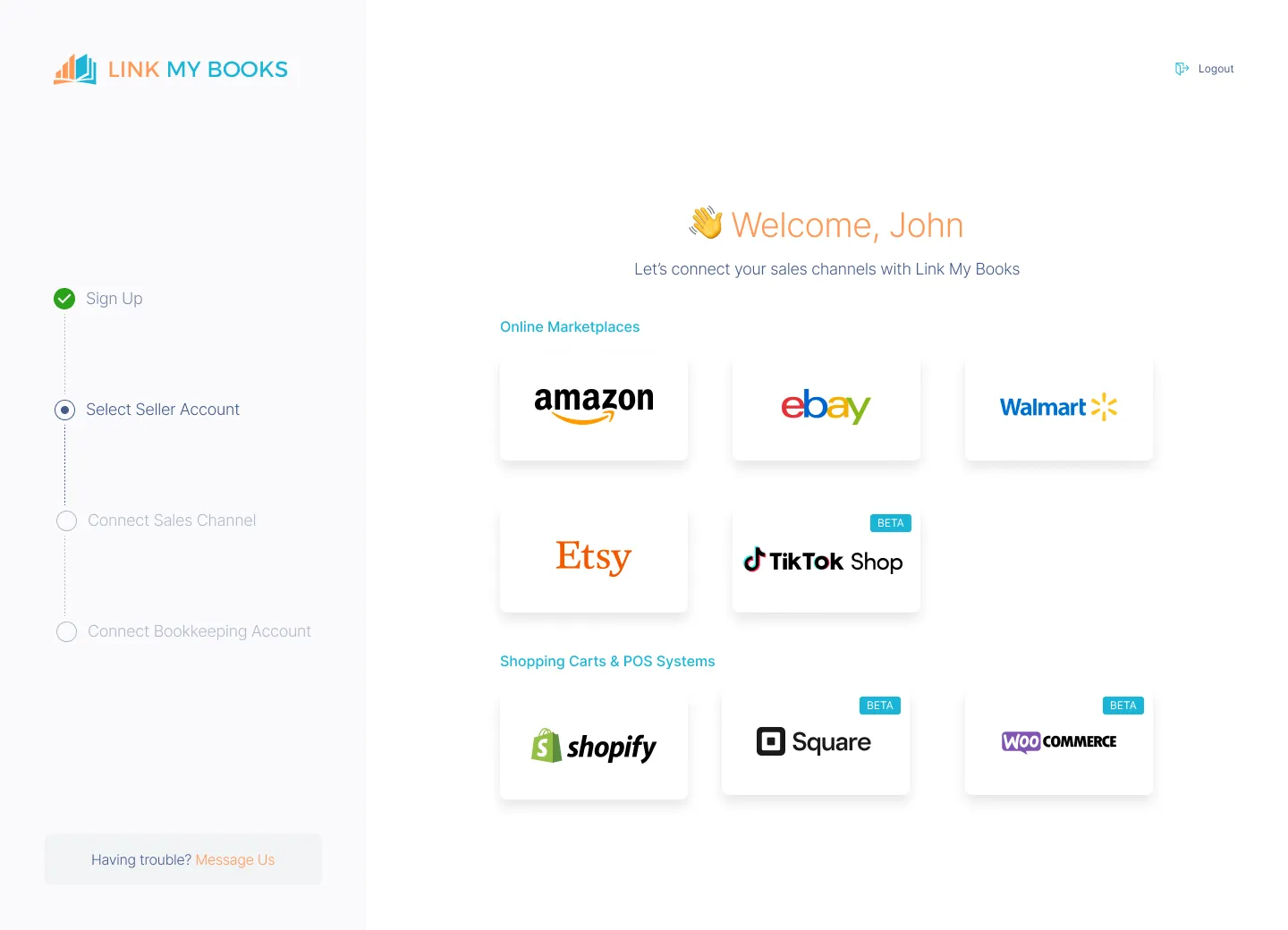

Step #2: Connect your Amazon and QuickBooks accounts

Once you’ve set up your Link My Books account, you’ll be prompted to connect your Amazon Seller Central and QuickBooks Online accounts. This step enables Link My Books to import your Amazon data directly into QuickBooks, including sales, fees, refunds, and VAT.

Step #3: Configure with the guided setup wizard

Using the Setup Wizard, configure your data mappings to ensure every Amazon transaction is categorized correctly in QuickBooks. Here’s where you’ll map sales income, shipping costs, Amazon fees, and VAT to the appropriate accounts, minimizing any chance of error.

Step #4: Choose automatic or manual sync

Select whether you’d prefer automatic syncing or manual approvals for your Amazon data. Automatic sync updates QuickBooks as soon as each new Amazon payout is processed, while manual sync allows you to review summaries before they’re recorded, offering flexibility for high-volume sellers.

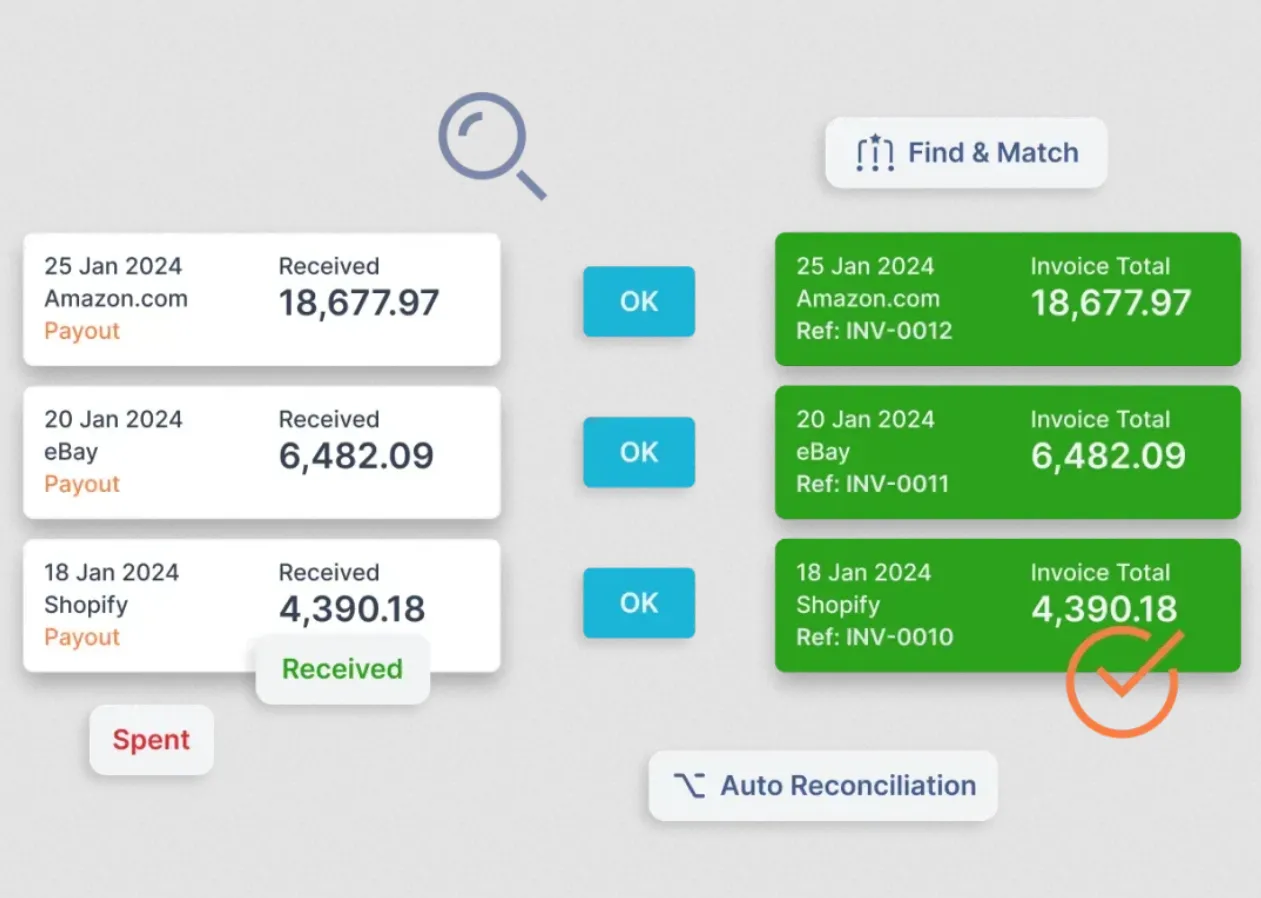

Step #5: Reconcile payouts from Amazon with Link My Books in QuickBooks

Finally, Link My Books simplifies the reconciliation process by matching Amazon payouts with the corresponding entries in QuickBooks. With this one-click reconciliation, you’ll avoid manual adjustments, keeping your accounts accurate and balanced

How Link My Books makes recording Amazon Sales in QuickBooks automatic & easy

Link My Books automates bookkeeping for eCommerce businesses, especially Amazon sellers. What makes Link My Books stand out is how it tackles the specific challenges that Amazon FBA sellers face.

Here’s what you can expect:

Automated Payout Reconciliation

Link My Books automatically matches your Amazon sales, refunds, fees, and taxes with your accounting software, giving you clear and accurate financial data.

It supports all Amazon marketplaces and integrates with other platforms like eBay, Etsy, and Shopify, so you can manage your entire eCommerce business from one place.

Accurate Tax Calculation

Managing taxes across different regions with varying tax laws is a major challenge for Amazon sellers. In fact, 75% of our Amazon sellers discovered they were overpaying taxes before using Link My Books. Our software calculates the correct Amazon VAT or sales tax on every sale, ensuring accuracy based on each jurisdiction.

Cost of Goods Sold (COGS) Tracking

Tracking your Cost of Goods Sold on Amazon (COGS) is vital for understanding your profit margins. Link My Books ensures that COGS is accurately recorded, helping you get a clear picture of your true costs and how they impact your bottom line. By keeping a close eye on COGS, you can make smarter pricing decisions and improve your overall profitability.

Real-Time Reporting and Analytics

Link My Books gives you access to real-time financial reports and analytics, tailored for eCommerce businesses. You'll get insights into your profitability, sales performance, Amazon account level reserve, and cash flow, helping you make informed decisions.

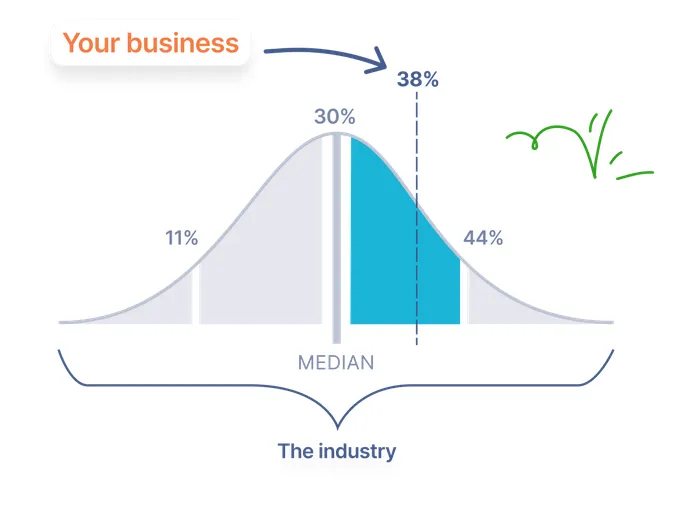

Benchmarking

You can gain industry insights from anonymous data on key metrics like sales growth, refund ratios, and fee ratios. Link My Books focuses on percentage changes and trends rather than exact numbers, helping you see if your business is following broader market trends or experiencing unique changes.

User-Friendly Setup and Interface

Link My Books is designed to be easy to use, even if you're new to bookkeeping for Amazon sellers. Setup is quick, with most users up and running in just 15 minutes. If you need help, we offer a free onboarding call with our team of experts, or you can explore our blog posts, webinars, guides, and videos for additional support.

Why manually entering Amazon sales in QuickBooks is problematic

Manually entering Amazon sales data into QuickBooks might seem straightforward, but it often leads to significant issues that can affect your business’s accuracy, efficiency, and compliance. Here’s why manual entry is a risky approach:

1. Time-consuming and tedious

For Amazon sellers handling a high volume of daily transactions, manually logging each sale, fee, refund, and tax can quickly eat up hours every week. This process is not only repetitive but also diverts valuable time away from higher-priority business tasks like marketing or product development. The more time you spend on data entry, the less time you have to focus on growth.

2. High risk of human error

Manual data entry inevitably leads to mistakes. With the variety of Amazon fees, shipping costs, returns, and VAT calculations, it’s easy to accidentally enter incorrect numbers or forget a transaction altogether. These errors may go unnoticed until tax season or an audit, where they can create serious issues, from incorrect tax filings to misstated financial statements.

3. Inconsistent data and mismatches

Without automation, each transaction has to be recorded individually, increasing the likelihood of inconsistencies. For example, if you forget to account for Amazon fees or returns in QuickBooks, your records may not match your Amazon reports, causing headaches when it’s time to reconcile. Inconsistent data complicates financial tracking, making it harder to generate accurate reports on profitability, cash flow, and tax liabilities.

4. Delayed financial insights

Manual entry delays access to real-time financial insights. When your records aren’t updated daily, you lose visibility into your current cash flow, profitability, and inventory costs. Without this data, it’s challenging to make informed business decisions, and you may miss out on critical opportunities or overlook potential financial risks.

5. Compliance and tax risks

Accurate bookkeeping is essential for tax compliance. Incomplete or incorrect records can lead to discrepancies in your tax filings, resulting in penalties or audits from tax authorities. This is especially critical for businesses that manage Amazon VAT across multiple jurisdictions. Misreporting sales or VAT can have costly repercussions, making precise data management essential for compliance.

6. Missed efficiency gains from automation

Tools like Link My Books automate Amazon sales entry into QuickBooks, eliminating repetitive manual work and syncing all sales, fees, VAT, and refunds in real-time. By using Link My Books, you not only streamline your accounting process but also reduce the risk of manual errors, saving time and enabling instant access to accurate financial data.

Key takeaways for recording Amazon sales in QuickBooks

Manually entering Amazon sales into QuickBooks is tedious, error-prone, and creates gaps in your financial reporting. Managing fees, Amazon VAT, and inventory costs by hand often results in inaccurate records and missed opportunities for growth. Throughout this article, we’ve outlined how automating with Link My Books can solve these challenges by syncing your sales, fees, taxes, and expenses directly into QuickBooks, ensuring accuracy and saving you valuable time.

Here’s why automation with Link My Books is a game-changer:

- Reduce Manual Work: Automation eliminates repetitive data entry, freeing up your time for more important tasks.

- Enhance Accuracy: Every transaction, from fees to refunds, is automatically categorized, reducing errors in your financial records.

- Stay Tax Compliant: With automatic VAT calculations and tax mapping, Link My Books ensures that you’re compliant and ready for tax season without the extra stress.

- Gain Real-Time Insights: With your Amazon data synced instantly, you’ll have up-to-date reports, helping you make smarter business decisions based on accurate numbers.

Record your Amazon transactions with Link My Books

Link My Books is tailored specifically for Amazon sellers and e-commerce businesses, making it ideal even for those with no accounting experience. It automatically breaks down all your sales, refunds, fees, and taxes, posting summaries directly into your QuickBooks accounts.

You can get started with Link My Books for Amazon sellers for free today. Sign up and try it for 14 days, no strings attached.

.webp)

.webp)

.png)