Which is the better Amazon accounting software; Xero or QuickBooks? it's an age-old question that many Amazon sellers ponder as their small business expands and they need an accounting solution to help manage their books. Both online accounting software solutions have a solid reputation for being reliable, feature-packed, and reasonable value for money.

So which should you choose for your Amazon FBA business?

Key Takeaways from this Post

Although Xero and QuickBooks have similar features, understanding the differences between the two software will help you establish which one is right for your business. For example, QuickBooks includes more features in its plans while Xero has a more user-friendly interface.

Third party applications can add functionality to your accounting system. Take Xero and QuickBooks integrations into account when you're weighing up the pros and cons of each. Consider what apps will encourage business growth, and the scalability of each software and its integrations.

Those manually recording Amazon transactions in their accounting software are wasting time. Add layers of automation to your system to save considerable time and boost efficiency. Link My Books, for example, automatically transfers transaction details to your accounting software.

Today, we're looking at the top features of, along with the similarities and differences between, Xero and QuickBooks. By breaking them down, we'll help you decide which Amazon accounting software is right for you.

What Most Amazon Sellers Get Wrong When it Comes to Choosing Online Accounting Software

Link My Books has worked with thousands of Amazon sellers and accountants over the years and these are the common mistakes we've noticed when it comes to deciding on an accounting software:

- Not considering long-term needs: When you're a small business or a start up, it can be easy to overlook the features you might need in the future. Many Amazon sellers neglect the scaling capabilities of the software they choose, and also the cost of doing so. Something that's fine for you now, might turn into something that holds your business back down the road. For example, if a software doesn't have a particular feature that would save your business time and/or money.

- Mistaking low-cost for good value: Xero and QuickBooks prices fluctuate. Historically, Xero has been the cheaper option out of the two. Although more recently, the cost of each is pretty similar. However, instead of looking solely at the cost of a software, it's good practice to consider whether you're getting value for your money. The features, support, learning resources, and usability of the software can help you determine this.

- Not accounting for complexity: If you're in the Amazon game, chances are you're not a tax or accounting expert, particularly for those small businesses just starting out. Many Amazon sellers jump into an eCommerce accounting software subscription without considering how complex they are to use, and how they're going to overcome this challenge.

- Leaving it too late: You should buy accounting software as soon as your budget allows it because it will make your life so much easier. And, afford you more time to work on growing your small business. The alternative is to use spreadsheets to keep track of income and expenses, which is obviously a time-consuming endeavour. Accounting software will help you keep organised and keep on top of your taxes.

- Manually transferring data: Before signing up to Link My Books, many Amazon sellers were manually recording their Amazon transactions in their accounting software. This resulted in errors in their bookkeeping and tax calculations. Using an automation software to transfer critical data, and calculate your taxes, will serve you in good stead as your small business grows.

Xero VS QuickBooks

We're now going to take a closer look at Xero and QuickBooks. We'll be looking at their features, and how they can enhance your Amazon business.

QuickBooks Online

.webp)

QuickBooks Online is a cloud accounting software, making it convenient to access wherever you are. It has a load of features that will help you drive your business forward. It's gained a reputation for being an all-in-one accounting software that's, professional, scalable, and comprehensive. QuickBooks Online will ensure you have confidence in the data you're storing, organising, and analysing.

Who is QuickBooks Online Suitable For?

QuickBooks Online is suitable for both large and small businesses, as well as professional bookkeepers and accountants. Whether you sell on Amazon as a sole trader or limited company, QuickBooks is a solid option.

QuickBooks Online Top features For Amazon Sellers

.webp)

Let's take a look at some of the features that make QuickBooks Online a great choice for Amazon accounting:

Bank Connections

Connecting your bank account to your accounting software makes it that much simpler to reconcile bank accounts. QuickBooks Online allows you to connect multiple bank accounts, along with payment processors like PayPal. When you use this feature, bank transactions are automatically recorded and reconciled in your QuickBooks account.

You can import financial data from the past two years. And, turn this data into up-to-date cash flow reports. This cash flow analysis will give you some valuable insights into your Amazon business, along with its success over time.

Expense Management

With the QuickBooks Online app, you can take photos of sales receipts and bills, and the software extracts key information from them. It then automatically sorts it into appropriate tax categories. You can also upload these expense documents manually, and bulk upload multiple documents at the same time.

In addition to comprehensive expense management capabilities, QuickBooks Online enables Amazon sellers to collaborate with their accountant through the software. It has an in-built messaging feature and updates your financial and statements in real-time.

Detailed Financial Reporting

.webp)

QuickBooks Online has some impressive real-time reporting features. Your dashboard gives you clear, at-a-glace insights by way of graphs and charts. You can also dive deeper into each metric for a thorough analysis of profit & loss, sales, expenses, and invoice status, to name a few. You can also get projections and forecasts to gauge the trajectory of your business based on your decisions.

Your QuickBooks Online reporting dashboard is customisable. Choose what data you want to see when you log in and set up recurring reports. This means the software will automatically generate reports and email them to you and/or your accountant at the ideal frequency for your Amazon business.

Inventory Tracking and Management

QuickBooks has inventory tracking and management features that enable users to keep track of their stock and orders. You can view stock quantities, and track the value of your inventory in real time. QuickBooks Online accounting software will also notify you when stock levels are low, minimising the chances of unexpectedly running out of products.

QuickBooks Online's inventory management features give you plenty of data to analyse the profitability and success of your Amazon products. With it, you'll be able to identify which products are popular amongst your customers and which one's aren't. With this information, you can make sound decisions about which products to continue selling on Amazon. And, which one's you need to shift quickly.

Xero

.webp)

Xero is an online accounting software that is rich in features and capabilities. It's known for being user-friendly and boasts a smooth UI. From reconciling bank transactions to paying employees, Xero makes managing the accounting process simple.

Whether you're doing your books yourself or working with a professional accountant or accounting firm, Xero is a cloud accounting software that'll help ensure your books are consistently accurate and up to date.

Who is Xero Suitable For?

Xero is aimed at small businesses. It's also a good choice if you're an accountant or bookkeeper, or, an accounting firm. Being user-friendly, it's the preferential option for those with little-to-no experience with accounting software.

Xero's Top Features for Amazon Sellers

.webp)

Now we're going to look at the top features of Xero for Amazon sellers:

Expense Management

Xero accounting software makes it easy for Amazon sellers, and eCommerce sellers in general, to manage expenses. You can keep on top of all your business's expenses, whether that's monitoring employee expenditure, tracking your mileage, or processing pay with the payroll software. Xero is the perfect solution for maintaining an organised accounting system for expenses.

The Xero mobile app enables you to scan receipts with its receipt scanner. The intuitive accounting software then extracts key data and automatically adds it to Xero. This tool also allows you to auto-fill expense claim forms, while attaching the expense receipt to the claim.

Bank Reconciliation

.webp)

Bank reconciliation is an essential task for all businesses. But for eCommerce sellers operating on Amazon in addition to other platforms, it can be complicated. With Xero's reconciliation feature, whether your small business uses the cash-based or accrual accounting method, Xero makes it nice and simple to reconcile bank accounts.

Amazon and eCommerce sellers can reconcile their accounts quickly and easily, and on a daily basis. Reconciliation takes just a few clicks and you can even reconcile your accounts while you're on the go using the app.

Xero enables you to reconcile transactions in bulk, in addition to applying rules to different, or groups of, transactions. The software automatically suggests transaction matches and categorises them based on set rules.

Pay Bills

You can pay your bills directly through Xero accounting software. This features helps you to stay on top of your cash flow and accounts payable, by giving you a clear view of payments that are due and payments that you've made. Xero's bill paying feature ensures you remain on good terms with associates like suppliers by paying on time, every time.

One of the useful aspects of Xero for paying bills is the ability to replicate bills and set up recurring bills. Schedule your payments in advance, whether you're paying one bill or multiple bills to the same supplier. And of course, all your bills, their status, and their related data, is stored and organised within the Xero accounting software.

Inventory Management

.webp)

If you're looking for a way to manage your inventory, Xero might be the solution for you. The cloud accounting software features inventory management tools with which you can track inventory and analyse critical inventory data. Clearly view your most profitable products, along with the one's with the most sales.

Another of the inventory management tools within Xero is one that enables you to add items to invoices. Invoices are pre-populated and highly customisable. You can create text to reuse in invoices. And, manually adjust invoice details as required.

What is the Best Accounting Software for Amazon Sellers?

So we've looked at the top features of both QuickBooks and Xero accounting software. We need to now take this further to decide which one is best to use as an Amazon accounting software.

Let's go through some considerations and determine which software comes out on top:

Useful Features to Run Your Business

When it comes to features for running your Amazon business, Xero and QuickBooks are very similar. They both offer inventory, expense, and invoice management, along with robust reporting tools and the ability to work with multiple currencies. There are, however, some areas where QuickBooks excels. For example, it offers better sales tax support. And, its plans include more features in the set cost.

QuickBooks also feels somewhat more professional in its features. It's more geared toward accounting experts and those with experience in using accounting software. This makes it ideal for larger companies working with either in-house accountants or outsourced accountants.

Ease-of-Use

Its ease-of-use and UI are the things that really set Xero apart from QuickBooks. It has a more modern interface, and is easier to use and navigate. And, learning Xero's ins and outs is more straightforward than QuickBooks.

In contrast, QuickBooks comes with a steeper learning curve. While it certainly has a more professional feel about it with its range of features and tools, it's simply not as enjoyable to use. For this reason, many accounting software newbies opt for Xero.

Pricing

There was a time, not too long ago, when Xero came out on top when it came to pricing. However, QuickBooks has recently shaken things up and now the prices are very similar. And, QuickBooks is actually a little cheaper. Xero's 'Standard' plan is £30/month while QuickBooks' similar 'Essentials' plan is £28 per month. QuickBooks also has regular, and generous, deals running.

It's also worth noting that QuickBooks includes more features in its plans. For example, in the ones described above, you can use multiple currencies in QuickBooks but not in Xero. There are also optional extras with Xero plans that are included in QuickBooks' plans of similar cost.

Educational Resources

Both Xero and QuickBooks have a certification program through which you can become a certified advisor of their software. They also both have a good range of webinar and events surrounding all-things-accounting. Course subjects range from understanding and paying sales tax to customising your reports.

However, Xero has a larger, more comprehensive, and accessible range of courses. They also offer in-person training, in addition to live and on demand sessions.

Integrations

Integrations with third party apps enhance the functions, features, and capabilities of Xero and QuickBooks software. Therefore, to decide the right Amazon accounting software for you, you might want to look to their app stores.

You'll find hundreds of business-boosting apps like Dext, PayPal, Tradify, and Jibble, along with customer reviews. And, Link My Books has overwhelmingly excellent reviews on both QuickBooks and Xero app stores.

When it comes to the number of apps, Xero wins with over 1,000 apps available to download. QuickBooks, on the other hand, has more than 750. While this isn't necessarily indicative of a better experience for customers, more choice of apps does inevitably mean more flexibility when it comes to running your business.

How to Choose Between Xero and QuickBooks

To choose between these two accounting software powerhouses, you need to establish what aspects are more crucial for your Amazon business. You must also consider how this may change in the future as you scale your Amazon FBA business. First, establish your current budget and weigh this up with the pros and cons of each software.

For example, you might appreciate the extra features that QuickBooks includes in its plans. However, you might find that these features can be easily integrated into Xero through one of the third party apps. Or, that Xero's smooth user interface makes it a better choice.

On the other hand, if cost is the only factor, then QuickBooks has some really good deals for new signups, in addition to lower costs. Ultimately, only you can decide which one is right for you.

We've put together a useful comparison table. This gives you our take on what software we consider the winner for each of the points above:

Accurate and automated Amazon accounting: Integrating Amazon Seller Central and your accounting software with Link My Books

.webp)

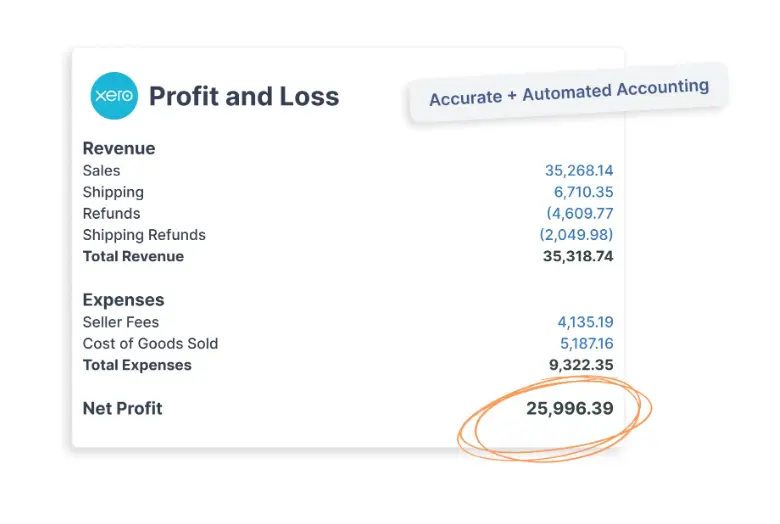

Xero and QuickBooks are two of the best accounting software available. That's why Link My Books integrates with each of them smoothly and hitch-free. Link My Books is an eCommerce accounting automation software that takes over the bookkeeping process for eCommerce sellers.

Bookkeeping tasks take less than 15 minutes per month, regardless of how big your business is or how many Amazon sales you make.

Ideal for small businesses and large, Link My Books sits in between your eCommerce platform and accounting software. It automatically sends your financial data across to your accounting software in the form of summary statements.

Link My Books breaks down your Amazon sales to give you a clear idea of revenue and expenses, such as fees, shipping, and sales revenue, and presents this to you in clear and concise format. This data is automatically sent to your accounting software to be categorised and stored accordingly.

Link My Books conveniently works out your sales tax on all the items you sell. And, can keep track of your COGS (cost of goods sold) too. Additionally, Link My Books Benchmarking tells you precisely how your Amazon business is performing compared to similar Amazon businesses.

How to Connect Link My Books to Your Accounting Software

.webp)

The setup process for Link My Books is really easy:

#1: Bag Your Free Trial

Firstly, sign up for your two week free trial. We don't require any information from you at this stage, not even your credit card details. You simply sign up using your Xero or QuickBooks details.

#2: Connect Amazon

Now you need to connect your Amazon account which takes only a few clicks. Rest assured we are an approved Amazon software partner. And, the software just needs read-only access to your account.

#3: Set and Confirm Tax Rates

You now need to answer a few questions about your business and tax rate preferences. This ensures the software calculates the correct sales tax every time. We do suggest some defaults which are based on our extensive experience.

#4: Set to Autopilot

Finally, set your bookkeeping to autopilot. Switch it on and set a date that you want it to begin.

And you're good to go.

This whole process takes around 10 minutes, so you'll be up and running super quickly.

Xero or QuickBooks: Which Cloud-Based Accounting Software Will You Choose?

.webp)

As an Amazon seller, you need an accounting solution that's comprehensive, flexible, and reliable. Naturally, you'll gravitate toward two of the most reputable accounting software companies; Xero and QuickBooks.

But choosing between these two is not always easy. You need to weigh up what's important to you and your business needs. More integrations, features, or learning resources? Or perhaps the cost is going to be the deciding factor. Small businesses might prefer Xero while large businesses might consider QuickBooks to be a better choice.

Whether you choose Xero or QuickBooks, Link My Books is on-hand to help with your bookkeeping. Integrating with all the major eCommerce platforms and payment processors, our software will automate your bookkeeping, freeing up valuable time to spend on other areas of your business.

Sign up today for your free Link My Books trial.

.webp)

.png)