Choosing the right accounting software can be a minefield. There are plenty of features to consider, from multi currency support and expense tracking, to COGS tracking and inventory management.

This article is going to focus on the best accounting software that UK businesses can use to ensure they comply with their tax obligations. I'll talk you through top features, how they can help you streamline your accounting processes, and how they tie in with the all-important Making Tax Digital initiative.

Key Takeaways from this Post

All VAT-registered businesses (unless exempt) are legally obligated to keep digital records and submit VAT returns online.

You need a HMRC-compatible software to comply with the Making Tax Digital initiative.

Link My Books helps eCommerce businesses simplify their bookkeeping processes by calculating taxes and exporting financial data to accounting software.

Making Tax Digital: What UK businesses & Accountants Need to Know About Accounting Software

.webp)

Who Does MTD Apply to?

In April 2019, the UK government began rolling out its Making Tax Digital initiative. Since April 2022, all VAT-registered UK businesses (unless exempt) have to maintain digital records, as well submit their VAT returns online.

From April 2026, all businesses with an annual income of £50,000 or more will be required to comply. This includes income from properties. And then the following April (2027), those with an income of over £30,000 will join them.

Why is MTD Being Rolled Out?

The MTD initiative is supposed to make things easier for all involved. Done correctly, it can help ensure correct tax calculations, greater productivity, and better financial management. It's essentially a compulsory transition from offline to online accounting.

The UK government has conducted and published many research reports around the subject of MTD. One report in particular explores the ways in which the benefits can outweigh the costs for many business owners. Benefits include things like greater confidence in submitting taxes, better record keeping, and saving time. The report looks at tangible and intangible costs and benefits, of both the transition to MTD and ongoing compliance.

You can read the full report here.

How do You Comply With MTD?

The bottom line is, MTD requires HMRC-compatible software. But this inevitably strikes fear into the hearts of the not-so-tech-savvy, as well as those old school folks who've been doing traditional accounting for many years. Plus, let's face it, it sounds just a little bit scary too!

But fear not. MTD is not as complicated as it sounds. The software you choose will play a big part in your compliance and will probably make your life much easier. That's why we recommend choosing a software that has a strong focus on the UK's MTD initiative. Look for a dedicated MTD page on an accounting software's website, along with references to submitting your returns directly through it.

Best Accounting Software UK

1. Link My Books: Best Accounting Software for eCommerce Sellers & Accountants

Link My Books is a specialised type of eCommerce accounting software, ideal for both eCommerce sellers and accountants. It links eCommerce stores with either Xero or QuickBooks accounting software. Once set up, your data is automatically transferred from one to the other for a seamless accounting experience.

Link My Books integrates with the following online stores:

- Shopify

- Etsy

- Amazon

- eBay

- TikTok Shop

- Walmart

Features

- Automatically exports data in clean summary invoices

- Accurately calculates taxes

- Calculates and tracks COGS

- Reconciles data from multiple online stores

Automatically Exports Data in Clean Summary Invoices

If you're an eCommerce store owner, or an accountant managing multiple eCommerce store accounts, it's time to stop with the manual data entry. Link My Books takes all of the raw data from your eCommerce stores, compiles it into clean summary invoices, and sends it over to your online accounting software. No hassle, no fuss.

Get daily summaries of profits and losses. These summaries include financial data like sales, fees, shipping, and refunds. Plus, Link My Books supports multiple payment gateways, including PayPal and Klarna.

Accurately Calculates Taxes

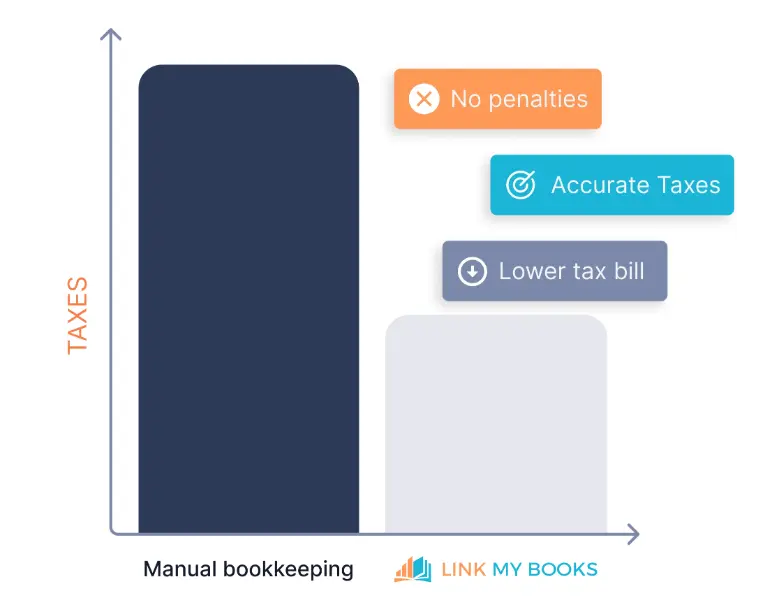

We've worked with thousands of eCommerce stores since launching Link My Books in 2018. And, we've come to a worrying conclusion; 75% of eCommerce sellers make mistakes with their taxes. This is true for small businesses and big ones.

Tax errors leave you open to HMRC penalties. In addition, inaccurate tax calculations often means inaccurate profit calculations. Therefore, these businesses risk basing vital business decisions on incorrect data.

The Guided Tax Wizard will help you get your taxes right every time. Once you've set the correct tax rates, Link My Books automatically calculates tax on all your sales and includes this in your daily summary invoices. This means when it comes to paying your taxes, you'll save hours of time (and plenty of risk) that comes with having to work it all out manually. You can be confident your business is MTD-compliant.

Calculates and Tracks COGS

COGS (cost of goods sold) is an important consideration because it determines your profit margins. The higher your COGS, the lower your profit margins will likely be. But calculating your COGS can be difficult. If you calculate them incorrectly, your profits, and by extension your VAT calculations, will be skewed.

If you are a large business, the difference in true profits and VAT when miscalculating your COGS can be significant. But small business owners need to be vigilant of this too.

With Link My Books, you don't need to worry about that because it's worked out for you. Just turn on the COGS feature and COGS is automatically included in your summary invoices.

Reconcile Data From Multiple Online Stores

Most eCommerce sellers operate multiple online stores. After all, why settle for one audience when you can reasonably reach three? Link My Books reconciles your financial data from all your eCommerce stores so you can have a clear view of your finances across all platforms.

If you are currently running just one store, Link My Books allows you to scale up easily when the time comes to open another.

Is There a Free Trial?

Yes.

2. Xero: Best All-Rounder for Business and Accountants

.webp)

Xero is a comprehensive and popular online accounting software with a wide range of features and capabilities. It caters to both small businesses and large. And, it's a great all-rounder for bookkeepers and accountants too. Users get access to an accounting dashboard. From this, they can manage their accounts, get valuable insights into their finances, and track and reconcile their bank accounts.

Features

.webp)

- Analytics: Xero has two options when it comes to analytics; Xero Analytics and Analytics Plus. You can get a cash flow projection based on your existing financial data and track different performance metrics such as expenses, income, and gross profit margin. Another cool aspect of Analytics is the ability to clearly see the difference between how making an individual payment today, or at another point in the future, will impact your finances. This means you can make smart, data-driven decisions.

- Payroll: Xero has some payroll features that make it perfect for businesses with employees. It automatically calculates payroll figures, like pensions, taxes, and take home pay. Furthermore, employees can access their payroll data through Xero's Employee Self-Service feature. Through this portal, they can complete tasks like submitting timesheets and leaving requests, among others.

- Accept payments: Xero businesses and accountants can accept payments through their Xero accounting software. It supports multiple payment methods, and allows your customers to pay directly through invoices. You can also send payment reminders quickly and easily.

- Track projects: One of the most dominant features of Xero is its ability to track projects. You can perform tasks like recording hours, linking costs, and analysing expenditure. You can then add these details to invoices before sending them out to customers. Get a complete view of each project, and edit and manage as and when you need to. You can also create as many projects as you like.

Does HRMC Recognise Xero?

.webp)

Yes! Xero is a HMRC-recognised accounting software. It calculates your VAT and you can submit your returns online directly through it. You'll also find plenty of MTD information to help keep you stay compliant.

Is There a Free Trial?

Yes.

3. QuickBooks: Best Accounting Software for Accountants

.webp)

QuickBooks is similar to Xero but it has a slightly steeper learning curve. It's geared a little more toward accountants or those with existing accounting knowledge. QuickBooks is a professional accounting software solution with feature-rich plans at reasonable costs. It's also got a great reputation amongst businesses and accountants alike, with more than 13,000 'Excellent' Trustpilot reviews. For this reason, it's one of the most popular accounting software in the UK.

Features

.webp)

- QuickBooks Practice Manager: Accountants using QuickBooks will benefit from the software's Practice Management software. Through this software, accountants can manage their clients and their workload. Create automations, such as emailing clients and assigning tasks, and track the progress of your accounting team.

Furthermore, with QuickBooks Practice Manager, you can generate reports that give you insights into various aspects of your business. - Reports: QuickBooks gives you access to a dashboard that updates in real time. Charts and graphs give clear, visual representations of sales, expenses, and profits & losses. You can even schedule reports to automatically generate and send to your or your accountant's email inbox. When you connect your bank to QuickBooks, you can gain access to two years of historical data. Bank account reconciliation is instantaneous.

- Integrations: QuickBooks has lots of integrations to choose from (including Link My Books!) to add functionality to the software. Integrate an app like SOS Inventory to manage your inventory, or connect your CRM or project management app. There are hundreds of apps to choose from in the QuickBooks App store.

- Payroll: QuickBooks has an advanced payroll solution that you can add on to your subscription. Set up automatic pension enrolment and other time-consuming tasks. It also facilitates time tracking as employees can log their hours into the system. They can request time off, and access and edit their information as well.

Does HRMC Recognise QuickBooks?

Yes! QuickBooks allows you to submit VAT returns and corporation tax directly through the software. Its handy VAT error checker and other tools will help you prepare for self-assessments.

Is There a Free Trial?

Yes. There is currently a one-month free trial.

4. FreshBooks: Best Accounting Software for Start-ups

.webp)

Not only is FreshBooks a solid choice of small business accounting software, but it also brings some unique features to the table. It offers a range of tools and resources that are perfect for helping out a budding business. The Business Name Generator, for example, is a pretty neat tool. Furthermore, FreshBooks is easy to use and scale as you grow.

Features

.webp)

- Business Name Generator: Stuck on a name for your business? Give FreshBooks' Business Name Generator a whirl. Simply select which industry you serve, enter a keyword, and you'll be presented with some name options. If you're not keen on any of the suggestions, you can go back and start again.

- Expense tracking: With FreshBooks, you get access to a variety of resources to track business expenses. For example, you can scan paper receipts with your phone. The software extracts the important details, such as merchant and taxes, then adds the data to your FreshBooks records.

- Profitability tools: FreshBooks' profitability tools enable users to see how profitable individual projects and clients are. The profitability widget breaks down financial statements and data to give you an overview of your figures. Additionally, you can dive deeper into your data through the detailed profitability reports.

- Invoice generator: Dubbed "ridiculously easy" by FreshBooks itself, the invoice generator allows users to create personalised, professional invoices. With FreshBooks, you can also automate a lot of your invoicing tasks. For example, sending payment reminders and thank you emails, as well as charging client credit cards.

Does HMRC Recognise FreshBooks?

Yes! FreshBooks connects with HMRC so users can easily submit their VAT returns. Plus, it generates VAT Return Reports automatically, meaning less work for you.

Is There a Free Trial?

Yes.

5. Sage Accounting: Best Accounting Software for Small Businesses

.webp)

Sage has a number of products for businesses. Today, we're going to focus on Sage Accounting. This accounting software is a solid solution for small businesses. It has all the features small business owners need to keep on top of their books and remain MTD-compliant. The Sage business cloud accounting software has built-in GDPR compliance too, and allows unlimited users on two out of the three plans.

Features

.webp)

- Expert support: One of the things that stands out about Sage Accounting (and makes it a good small business accounting software) is the support available. It has a Member's Masterclass where members can discover articles and talks from business experts. Additionally, you can get certified through courses, and study a wide range of other learning materials to help smaller businesses get ahead in their industry. There are also the Sage Community Forums where industry leaders participate in discussions and give valuable advice on different topics.

- Auto-entry: Sage Accounting's auto-entry feature is a real time-saver. It captures data from receipts, bank statements, and invoices, and categorises and stores it accordingly. You can do this through snapping a picture of the document. Or, drag and drop documents into the appropriate place within your account. As Sage is a cloud based software, all your documents will be saved in the cloud for easy access and retrieval.

- Multi-currency: If you're a small business working with overseas buyers, Sage Accounting's multi-currency support feature will come in handy. You can send invoices, track expenses, and accept payments in different currencies. You simply turn on foreign currency transactions, and choose the correct currency for your customer or supplier.

Does HMRC Recognise Sage Accounting?

Yes it does! The Sage Accounting cloud based software has a page explaining how it helps with MTD. It's even got a free downloadable guide on the subject. And just like other accounting software on this list, you can submit your returns through Sage Accounting.

Is There a Free Trial?

Yes.

6. Zoho Books: Best Free Accounting Software for Small Business Models

.webp)

If you're looking for a free accounting software, Zoho Books might very well be the perfect choice for you. Although you understandably get more with one of its paid plans, it's incredibly generous with its free plan features. Zoho Books' free accounting software plan is suitable for small businesses making under 35K per year. If your business generates more than that, the next plan up is only £10/month.

Features

.webp)

- Invoicing: With this small business accounting software, you can send up to 1,000 invoices per month with the free plan alone. Personalise your invoices with different fronts and branding elements. Additionally, you can select your desired payment method; cash, cheque, or web, and automate actions, like sending recurring invoices or follow up emails.

- Bank account reconciliation: With Zoho Books, Bank account reconciliation is quick and painless. It takes just a few clicks to reconcile multiple accounts so that all your data and transactions match up. This feature also allows you to automatically categorise transactions based on rules you set. And, the Banking dashboard gives you access to accurate cash flow forecasts.

- Mobile app: Access your bookkeeping software on the move with Zoho Books' mobile app. Through this, you can access all your accounting features from anywhere you have an internet connection, including invoicing, expense tracking, and inviting your accountant to look over your data. There's even an app for Smart Watches. Not bad for a free bookkeeping software!

- Reporting: Comprehensive reporting features are what make an accounting software stand out from the crowd. Zoho Books does reporting well by including a wide variety of report types, along with the ability to quickly share reports with others. Set up a schedule so the software generates weekly, monthly, or quarterly reports.

Does HRMC Recognise Zoho Books?

Yes. Zoho Books allows you to file tax returns to HMRC through the platform, and calculates your VAT for you. These features are included in all plans, even the free one!

Is There a Free Trial?

Yes.

7. Odoo Accounting: Best Free Accounting Solution for Large Businesses

.webp)

Odoo Accounting is a free open source accounting software with a host of impressive features and capabilities. It's far less restrictive than our previous free option as it allows unlimited users and unlimited invoices. There are no subscriptions for a monthly fee. All Odoo Accounting features are free forever. This makes it an attractive cloud accounting software for larger businesses, as well as being a strong contender for the best small business accounting solution.

Features

.webp)

- AI-powered data recognition: Odoo uses powerful AI technology to extract data from invoices. It boasts a 98% recognition rate for capturing invoice data. Invoices can be generated and received in multiple formats, and you can configure the software to automatically create invoices based on different financial information, like timesheets, sales, and subscriptions.

- Sell anywhere: You can work with clients and customers around the world with Odoo's multi-currency support. It sets up the correct tax rates, chart of accounts, fiscal positions, and legal statements according to specific countries, leaving you free to crack on with running your business.

- Bank reconciliation: The Odoo intelligent accounting solution automatically matches 95% of your bank transactions to your records within the software. You can reconcile accounts from 28,000 banks worldwide, and automatically import bank statements.

- Integrations: Odoo Accounting is part of a wider network of apps. This makes it a good choice if you're looking to add advanced features and functionality, and diversify your software. Odoo software packages include apps that support marketing, sales, website building, HR, and inventory processes. Therefore, it's a perfect solution for enterprise resource planning too.

Does HMRC Recognise Odoo Accounting?

Yes. You can find Odoo in the government's list of HMRC-recognised software. You won't, however, find much MTD information on the Odoo website itself.

How to Choose the Best Accounting Software for you

So out of all the options, how do you choose the best accounting software for you? Let's go through some considerations to narrow it down:

Accountant or Business?

An accountant might need access to more in-depth features. They'll also need the ability to share their data with others. Larger limited companies might also need this. On the other hand, a basic accounting software for one-user might be ideal for a very small business or sole traders. Take note of how many people you'll need to access the online accounting software and compare plans from each company.

Features

Have a look at whether the features of each online accounting software align with your business objectives. For example, is payroll processing included in the plans or do you need to pay extra? Does it need to facilitate eCommerce accounting processes? Does it support multiple currencies, stock management, or project tracking? You should also consider whether it has a user friendly interface and what kind of financial reports it produces.

Make a list of accounting software features and sort them into business ‘essentials’, ‘nice-to-haves’, and ‘don't needs’. There are some features that will be beneficial for both UK small businesses and large, as well as sole traders. Cash flow forecasting, for instance, and self assessment preparation.

On the other hand, more advanced features like time tracking, or the ability to create unlimited invoices and connect multiple bank accounts, will be useful for large businesses. Reading accounting software reviews might help you discover different software features.

Look at what each accounting software provider offers in terms of features. If you're a small business, also consider the features you might need as you grow and how easy it is for growing businesses to scale up with the software.

Budget

.webp)

Unless you're opting for a free software for small business, you'll obviously need to allocate a budget for your online accounting software. Work out your monthly or annual budget by analysing your business finances and go from there. Compare this with your list of online accounting software that has the features you need.

Remember, cheaper is not always better, especially if you're an accountant. In this case, you should prioritise value for money rather than the lowest cost. That being said, free accounting software is a fantastic option for small businesses with a really tight budget.

Integrations

Online accounting software doesn't always stand alone. Sometimes, you need to connect it with other applications for a smooth business operation. For example, Link My Books can connect your accounting software with your eCommerce store. Without it, transferring data is both time-consuming and tedious.

Or perhaps you want to connect your online accounting software with a separate inventory management or project management solution? In which case, I'd recommend looking at the Xero or QuickBooks App Store to see what integrations each have available.

Criterion

See below for a quick summary of the best accounting software criterion for new businesses:

Common UK Accounting Software Questions

What Software do Bookkeepers Use in the UK?

There's no one answer to this question. However, both Xero and QuickBooks are very popular software for bookkeepers and accountants.

Which is Best in the UK? QuickBooks or Xero?

There are pros and cons to both QuickBooks and Xero. Both maintain accurate financial records and assist with income tax obligations.

The best online accounting software will depend on what you need from it. For example, QuickBooks has a great range of professional features but can be a bit tricky to get to grips with. Xero, on the other hand, also has great features but you have to pay extra for some of them.

Go through our list of considerations discussed earlier on in this article to decide which online accounting software is best for you.

What is the Best Accounting Software for a Self-Employed Person in the UK?

Xero and Sage Accounting are good options for self-employed people in the UK. Alternatively, if you're a freelancer, sole trader, or a startup, I'd recommend considering FreshBooks because of its ease-of-use. However, if you're self-employed with an eCommerce store, Xero would be the better option because it gives you more choices when it comes to integrations.

Simplify Your eCommerce Accounting (in Minutes)

eCommerce accounting now requires software in the UK. However, it no longer needs to be the time-consuming task it used to be. With third-party integrations like Link My Books, you can significantly simplify your accounting and streamline financial processes. There's no need to manually transfer your data, work out your taxes, or track your COGS. All this can be set up automatically in a matter of minutes.

Are you ready to start your Link My Books trial? Go ahead and sign up for a free today, and transform how you do your accounting.

.webp)

.png)