Managing Amazon payments is no small task. With high transaction volumes, fees, refunds, and payouts spread across different calendar months, reconciling these numbers manually can quickly turn into a time-consuming and error-prone nightmare. Sellers often spend hours sorting through spreadsheets, identifying discrepancies, and matching transactions with bank deposits, only to still question the accuracy of their financial records.

In this guide, we’ll highlight the best Amazon payment reconciliation software that’s going to help you with reconciling deposits from Amazon Seller Central. Whether you’re a small seller or running a large Amazon business, these tools will help you streamline your reconciliation process.

And we’ve also included a table so you can compare them at a glance.

Automation Saves Time: Reconciliation software reduces manual work and eliminates errors by automating transaction matching.

Integration Is Essential: You need to integrate Amazon with accounting platforms to make reconciliation a one-click process.

Scalability for Growth: Whether you handle 10 or 10,000 orders, Link My Books help you scale effortlessly to match your business needs.

What is Amazon payment reconcillation?

Amazon payment reconciliation is the process of accurately matching the transactions from your Amazon seller account to the payouts that land in your bank account. This ensures that every sale, refund, fee, and the taxes are accounted for.

When Amazon sends you a payout, it includes a mix of components:

- Sales Revenue: The total income from customer purchases

- Refunds: Any returns or reimbursements to buyers, which need to be deducted from your income

- Amazon Fees: Referral fees, FBA fees, subscription costs, or advertising charges that Amazon deducts before depositing funds

- Marketplace Facilitator Tax/VAT: Taxes collected and remitted by Amazon on your behalf in states or countries with marketplace facilitator laws

- Sales Tax/VAT/GST: Taxes collected by Amazon from customers that is your responsibility to remit to tax authorities

Reconciling these components manually means going line by line through your Amazon settlement reports, bank statements, and accounting records to ensure everything matches. The process typically involves:

- Matching Amazon settlement amounts to bank deposits

- Identifying and categorizing fees deducted by Amazon

- Ensuring refunds and returns are subtracted from total revenue

- Verifying tax amounts and checking if they are your responsibility or Amazon’s in terms of remittance

For small-scale sellers, this might seem manageable at first. However as order volumes grow, manual reconciliation becomes increasingly complex and time-consuming. Mistakes, like overlooking fees or misclassifying refunds, can snowball into inaccurate financial statements, tax misreporting, and wasted hours of cleanup, that’s why it’s important to invest in good accounting software for Amazon.

Why does Amazon payment reconciliation matter?

Accurate reconciliation is critical for:

- Profit and Loss Clarity: Understanding your true profitability after accounting for all Amazon deductions

- Cash Flow Management: Knowing exactly what’s being deposited into your account and when

- Tax Compliance: Ensuring you’re reporting the correct income and claiming eligible deductions during tax season, so you always know what’s your Amazon VAT and you can fill out your Amazon 1099 k, knowing there are no mistakes

Why automated payment reconciliation is the way to go

Amazon sends payouts in bulk, consolidating multiple transactions (sales, refunds, fees) into a single deposit. However, your accounting records need these individual components to be broken down for accurate reporting. This complexity makes manual reconciliation a slow, tedious, and error-prone process.

For example:

- A $1,000 payout might include:some text

- $1,200 in Sales Revenue

- $50 in Sales Tax Collected

- -$50 in Sales Tax Withheld

- -$100 in Refunds

- -$100 in Amazon Fees

Without automation, sellers must dig into Amazon settlement reports, split these amounts manually, and match them to bank deposits, a process that can take hours or even days each month.

Automated reconciliation tools like Link My Books solve this problem by:

- Pulling Data Directly from Amazon: Automatically importing settlement data, including sales, fees, refunds, and taxes.

- Generating Accurate Summaries: Breaking down payouts into clean, organized reports that align with your bank deposits.

- Syncing with Accounting Software: Ensuring all transactions are correctly categorized in platforms like Xero or QuickBooks.

- Providing Real-Time Accuracy: Eliminating the guesswork and saving hours of manual work.

With automation, sellers can rest assured that every dollar is accounted for, financial reports are accurate, and tax obligations are met without stress.

Best Amazon payment reconciliation software (automate & save time)

1. Xero with Link My Books

Xero is a cloud-based accounting software designed to simplify financial management for small and medium-sized businesses.

Its user-friendly interface and powerful features in combination with Link My Books have made it a popular choice for Amazon sellers and bookkeepers looking to streamline their operations.

Xero Features - For Amazon sellers seeking simplicity and accuracy

- Easy Bank Matching: Xero automatically matches your Amazon money with your bank account. This keeps your transaction records up-to-date without you having to do it manually.

- VAT Help: Xero follows UK tax rules and lets you send VAT returns right from the app. Coupled with Link My Books ensuring all your Amazon sales have the right tax rates applied, rest assured you won't overpay.

- Works with Many Apps: Xero can connect to over 1,000 other apps, like inventory management or cash flow forecasting apps.

- Learning Materials: Xero gives you lessons, videos, and online classes to help you learn and upgrade your skills.

- Get Certificates: You can take classes to get certificates in using Xero and managing pay for workers.

However, to automate your Amazon accounting, Xero needs the data from your sales channels.

While Xero offers essential accounting features, it can be time-consuming and error-prone when managing e-commerce sales without additional tools.

Here are some key disadvantages

- Manual Data Entry: Manually entering sales data from multiple e-commerce platforms into Xero is time-consuming and prone to errors.

- Complex Transaction Structures: E-commerce transactions often involve various fees, taxes, and refunds, making manual reconciliation challenging.

- Time-Consuming Reconciliations: Matching bank deposits with sales data can be a lengthy and tedious process.

- Lack of Specialized Features: Xero might not have specific features tailored to the unique needs of e-commerce businesses, such as automated fee and tax calculations.

Xero works best with Link My Books. It’s flexible and integrates with all your sales channels, making it ideal for eCommerce businesses that sell on multiple platforms.

Link My Books + Xero = Error-free accounting

Amazon selling has a lot of tricky parts. Trying to do all this manually in Xero can take a long time and lead to mistakes.

Link My Books is designed to streamline and enhance your financial management.

It integrates with Amazon to automatically import sales data into Xero.

The integration is easy to set up and you can try it out for free.

Plus it provides you with financial analytics and industry benchmarking to help you make smarter decisions on how to grow your business profitably.

Learn how to reconcile Amazon payments in Xero.

Signup for a free trial to automate Amazon payment reconciliation.

.webp)

2. QuickBooks with Link My Books - For growing businesses needing in-depth reporting

QuickBooks Online is a cloud-based accounting software trusted by millions of businesses worldwide. The software gives sales updates in real-time, as well as status alerts.

Quickbooks Features

- Simplified Self-Assessment: QuickBooks makes the often complicated process of preparing self-assessment tax returns much easier.

- HMRC Compliance: The software is fully compliant with HMRC regulations and even includes a VAT error checker.

- Cash Flow Monitoring: QuickBooks gives you a clear view of your business’s cash flow, making it easier to track, manage, and understand your finances.

- Sales Forecasting: With QuickBooks, you can create detailed sales forecasts. These reports help you anticipate future trends, plan for seasonal changes, and set realistic business goals.

- Customizable Class Tracking: QuickBooks lets you categorize and track your income and expenses by different segments of your business, like marketplaces or sales channels. When you integrate it with Link My Books, it automatically assigns sales, fees, and other transactions to the right class, making your Profit & Loss (P&L) statements even more accurate and insightful.

While QuickBooks does offer an integration called Amazon Seller Connector by QuickBooks, this integration is often faulty and does not pull your data correctly.

For Amazon sellers, the real game-changer is pairing QuickBooks with Link My Books.

Link My Books & Quickbooks = Advanced Reporting

While QuickBooks Online is packed with accounting features, it doesn’t always cover the specific needs of Amazon sellers, who face complex tax obligations, varying fees, and high transaction volumes.

That’s where Link My Books comes in, when you integrate it with Amazon and Quickbooks, you can automate the import of your transactions, handle taxes accurately, and simplify reconciliation.

Plus, it offers advanced reporting on key metrics like sales trends and profitability, making it a must-have for Amazon sellers who want to streamline and optimize their financial management.

3. Zoho Books - For growing businesses needing scalable automation

Zoho Books is a versatile accounting platform perfect for growing businesses that need scalable solutions and are working on a tight budget. With advanced automation, bank reconciliation, and integration capabilities, Zoho Books simplifies reconciliation while supporting multi-currency and multi-channel operations.

While Zoho Books offers some useful features it comes with significant limitations.

Using Zoho Books means you'll need to manually download data from Amazon, separate revenue by country and tax rate, and categorize expenses by tax rate. Manually handling these tasks is complex and prone to errors, which could ultimately cost you more than investing in a solution like Xero and Link My Books.

With Xero and Link My Books, you can be 100% confident that your accounting is accurate, saving you time, stress, and potential financial errors.

Zoho Books features

- Bank Reconciliation: Connect multiple bank accounts and automate transaction matching.

- Multi-Currency Support: Reconcile transactions in different currencies with accurate exchange rates.

- Automation Tools: Automate invoicing, payment reminders, and transaction matching to save time.

- Detailed Reporting: Generate comprehensive reports like balance sheets, profit and loss, and cash flow statements.

- Integration with Other Tools: Seamlessly connect Zoho Books with payment gateways, e-commerce platforms, and other Zoho apps.

4. Sage 50 cloud - For small businesses needing robust reconciliation

Sage 50 cloud is a powerful accounting tool tailored for small businesses that require advanced bank reconciliation and in-depth financial management. Its robust features make it ideal for businesses handling large transaction volumes and complex reconciliation requirements.

However, while Sage does integrate with third-party vendors, this setup tends to be pricier and trickier to get right compared to using Xero with Link My Books. Xero and Link My Books offer a more cost-effective and user-friendly solution, making it easier to manage your Amazon business finances accurately and efficiently.

Sage 50 cloud features

- Advanced Bank Reconciliation: Match transactions quickly, track changes, and reverse reconciliations if needed.

- Customizable Reporting: Generate detailed financial reports to gain insights into cash flow, profitability, and tax readiness.

- Inventory Management: Track stock levels, costs, and purchases for accurate financial records.

- Multi-Currency Support: Handle transactions and reconciliations in different currencies with ease.

- Cloud Integration: Access your data from anywhere while maintaining desktop-level performance.

5. FreshBooks - For small businesses focused on invoicing

FreshBooks is a user-friendly accounting platform ideal for small businesses and freelancers who prioritize invoicing and expense tracking. While its reconciliation features are basic compared to more robust tools, it’s a solid option for businesses with simpler reconciliation needs.

Primarily designed for invoicing and expense tracking, it offers basic bank reconciliation features. However, its reconciliation capabilities are less robust than those found in more comprehensive accounting solutions. And you would still need to input your Amazon data manually.

FreshBooks features

- Bank Reconciliation: Connect bank accounts, import transactions, and reconcile balances easily.

- Invoicing Tools: Create, send, and manage professional invoices in minutes.

- Expense Tracking: Record and categorize expenses to stay on top of cash flow.

- Time Tracking: Track billable hours and add them to invoices seamlessly.

- Basic Reports: Generate profit and loss statements, tax summaries, and payment reports.

6. Wave - Free accounting solution for solo entrepreneurs

Wave is a free accounting software designed for freelancers and solo entrepreneurs who need basic bookkeeping and reconciliation without the cost of premium tools. Its intuitive design makes bank reconciliation simple for businesses with low transaction volumes.

However, it also has limitations, particularly for Amazon FBA sellers. With Wave, you’ll need to download data from Amazon manually, then separate revenue by country and tax rate, as well as expenses by tax rate, before accounting for those figures yourself. This manual process is complex and can easily lead to errors, which can potentially cost you more in the long run.

Investing in a solution like Xero with Link My Books will make sure your accounting is accurate and efficient, giving you peace of mind that your financials are correct.

Wave features

- Bank Connection: Sync bank and credit card accounts for real-time transaction imports.

- Transaction Reconciliation: Match imported bank transactions with recorded entries for accuracy.

- Invoicing: Create professional invoices and accept online payments.

- Expense Management: Track expenses and receipts to manage cash flow efficiently.

- Basic Reporting: Generate key financial reports, including income and expense summaries.

How to choose the best Amazon payment reconciliation software for your business

Finding the right Amazon accounting software can feel overwhelming, but it doesn’t have to be. The key is to focus on what really matters, accuracy, time-saving features, ease of use, and overall value. While free tools can be tempting, they often come with limitations that can cost you more in the long run.

Here’s what to consider when making your decision:

1. Accuracy: Get it right the first time

Mistakes with Amazon fees, refunds, or taxes can be costly and time-consuming to fix. The right software should ensure all your numbers are precise, every time and make your Amazon seller accounting easy to manage.

- What to Look For: Tools that automate sales data imports, tax calculations, and financial reporting to eliminate manual errors.

- Why It Matters: Accuracy keeps your books clean, ensures tax compliance, and saves you stress during audits or tax season.

2. Save time with automation

The goal of accounting software is to simplify your workload—not add to it. Look for tools that streamline repetitive tasks like reconciliation, invoicing, and tax calculations.

- What to Look For: Integration with platforms like Xero or QuickBooks, automatic data imports, and reconciliation features.

- Why It Matters: Time saved on bookkeeping means more time to focus on growing your business.

3. eCommerce Insights: Beyond the basics

Good accounting software doesn’t just track numbers, it helps you understand what those numbers mean for your business.

- What to Look For: Built-in reporting tools, performance analytics, and insights tailored to eCommerce sellers.

- Why It Matters: Knowing your top-performing products, margins, and cash flow helps you make smarter, more strategic decisions.

4. Ease of use: Simple & straightforward

Even the most feature-packed software won’t help if it’s too complicated to use. Look for tools that strike a balance between power and simplicity.

- What to Look For: A user-friendly interface, intuitive navigation, and features that match your needs without unnecessary clutter.

- Why It Matters: If you’re new to accounting, an easy setup and shallow learning curve are game-changers.

5. Customer support: Help when you need it

Technical issues are inevitable, so it’s important to choose software with reliable support.

- What to Look For: Responsive support through live chat, email, or phone. Bonus points for free onboarding or training resources.

- Why It Matters: Quick answers mean less downtime and fewer disruptions to your workflow.

6. Value for money: Invest wisely

Cost matters, especially for small businesses, but don’t just go for the cheapest option. Look at the value you’re getting for your money.

- What to Look For: Features like automated reconciliation, tax management, and eCommerce-specific tools. Avoid free software that lacks critical features or forces you to manually fix errors.

- Why It Matters: Paying for the right software upfront can save you money, time, and frustration down the road.

7. eCommerce-specific features: Tailored to Amazon sellers

Not all accounting software is built with eCommerce businesses in mind. You need tools that can handle the unique challenges of selling on Amazon.

- What to Look For:some text

- Amazon Integration: Direct sync with Amazon Seller Central.

- Inventory Tracking: Keep tabs on stock levels and cost of goods sold (COGS).

- Sales Tax Automation: Automatically calculate and track taxes like VAT or GST.

- Why It Matters: As your Amazon business grows, having these features will save you from bottlenecks and manual work.

Additional tips for choosing the right software

- Prioritize Features: Make a list of what you need now and what you’ll need as your business grows. Divide them into “essential,” “nice to have,” and “not necessary.”some text

- Essential: Bank reconciliation, accurate tax reporting, Amazon integration.

- Nice to Have: Inventory management, in-depth analytics, multi-currency support.

- Test Before You Commit: Take advantage of free trials to see if the software meets your needs. Testing the interface, features, and ease of setup will help you make a confident decision.

How do they compare

We’ve made a simple table to help you compare these at a glance.

Why do Amazon sellers choose Link My Books for accounting?

Link My Books automates bookkeeping for eCommerce businesses, especially Amazon sellers. What makes Link My Books stand out is how it tackles the specific challenges that Amazon FBA sellers face.

Top Features of Link My Books

Automated Payout Reconciliation

Link My Books automatically matches your Amazon sales, refunds, fees, and taxes with your accounting software, giving you clear and accurate financial data.

It supports all Amazon marketplaces and integrates with other platforms like eBay, Etsy, and Shopify, so you can manage your entire eCommerce business from one place.

Accurate Tax Calculation

Managing taxes across different regions with varying tax laws is a major challenge for Amazon sellers. Link My Books calculates the correct VAT or sales tax on every sale, ensuring accuracy based on each jurisdiction.

Cost of Goods Sold (COGS) Tracking

Tracking your Cost of Goods Sold on Amazon (COGS) is vital for understanding your profit margins. Link My Books ensures that COGS is accurately recorded, helping you get a clear picture of your true costs and how they impact your bottom line. By keeping a close eye on COGS, you can make smarter pricing decisions and improve your overall profitability.

Real-Time Reporting and Analytics

Link My Books gives you access to real-time financial reports and analytics, tailored for eCommerce businesses. You'll get insights into your profitability, sales performance, Amazon account level reserve, and cash flow, helping you make informed decisions.

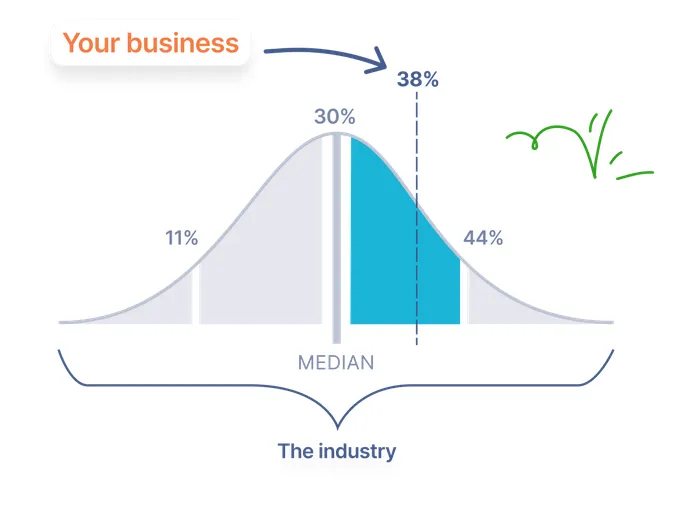

Benchmarking

Gain industry insights from anonymous data on key metrics like sales growth, refund ratios, and fee ratios. Link My Books focuses on percentage changes and trends rather than exact numbers, helping you see if your business is following broader market trends or experiencing unique changes.

User-Friendly Setup and Interface

Link My Books is designed to be easy to use, even if you're new to bookkeeping for Amazon sellers. Setup is quick, with most users up and running in just 15 minutes. If you need help, we offer a free onboarding call with our team of experts, or you can explore our blog posts, webinars, guides, and videos for additional support.

FAQ

What’s the best software to reconcile inventory with Amazon?

The best software to reconcile inventory with Amazon depends on your business size and needs. Tools like Link My Books integrate seamlessly with accounting platforms like Xero and QuickBooks, pulling accurate sales, refunds, and fees while providing insights into inventory performance.

For businesses that need dedicated inventory management alongside reconciliation, platforms like Zoho Inventory are worth considering. These tools track stock levels, order fulfillment, and costs of goods sold (COGS), giving you a clear picture of your inventory.

For streamlined accounting and inventory tracking, QuickBooks with Link My Books or Xero integrations are the most comprehensive solutions for Amazon sellers.

Can you do Amazon payment reconciliation in Excel?

Yes, you can reconcile Amazon payments manually in Excel, but it’s far from ideal. While Excel provides flexibility, it requires significant time, effort, and attention to detail. Here’s why manual reconciliation can be a challenge:

- Time-Consuming: You need to download Amazon settlement reports, break down sales, refunds, fees, and taxes, and manually match them to bank deposits.

- Prone to Errors: Human mistakes, like missing refunds or misclassifying transactions, are common, especially with high transaction volumes.

- Lack of Automation: Unlike reconciliation software, Excel doesn’t automatically sync with Amazon or your accounting system, so everything has to be updated manually.

Link My Books will automate your Amazon payment reconciliation by pulling data directly from Amazon and summarizing it into clean, error-free reports. These summaries align perfectly with your bank deposits and sync with Xero or QuickBooks, saving you hours of work each month.

Automate your Amazon Payment Reconciliation with Link My Books

Automating Amazon payment reconciliation is a game-changer for sellers managing growing order volumes. Here’s why automation is the smarter, faster, and more reliable choice compared to manual methods:

- Saves hours of manual work: Manually breaking down Amazon payouts, tracking fees, and matching transactions to bank deposits can take hours, or even days, every month. Automation handles all of this in minutes.

- reduces human error: Manual reconciliation leaves room for mistakes, like missing refunds, misclassifying fees, or duplicating entries. Automated software ensures accuracy by categorizing transactions and matching payouts perfectly.

- Provides real-time insights: Automated tools give you real-time financial summaries, helping you understand your true revenue, costs, and profit margins at a glance.

- Scales with your business: As your business grows, manual methods become unsustainable. Automated reconciliation tools effortlessly scale to handle high transaction volumes while maintaining accuracy.

- Prepares you for tax season: Clean, organized data ensures you’re always tax-ready, helping you avoid penalties and claim every eligible deduction.

Need a solution that ticks all the boxes?

Link My Books integrates seamlessly with Xero and QuickBooks to automate reconciliation, track fees, and keep your Amazon business running smoothly.

Start your free trial with Link My Books today! 🚀

.webp)

.png)