Your Shopify business is growing, but managing sales tax is becoming a headache - whether it's filing returns across multiple states or reconciling transactions in your accounting software.

Shopify calculates and collects sales tax at checkout, but you're still responsible for filing and paying those taxes.

Finding the right tool is tricky because most handle either tax filing or accounting, not both. So if you're looking for accounting apps to help you with your taxes, Link My Books integrated with either Xero or QuickBooks is the best option. And other apps we included are best for tax filing.

We’ll break it down into two categories:

- Accounting for sales tax in Xero or QuickBooks - Perfect for bookkeeping but not for filing tax returns.

- Apps for calculating and filing sales tax returns - These handle compliance and filings but don’t focus on accounting.

Let’s dive in and find the best sales tax solution for your Shopify store in 2025.

Link My Books seamlessly integrates Shopify with Xero and QuickBooks to simplify accounting processes.

For automating tax calculations and filings, apps like TaxJar and Avalara offer comprehensive solutions.

Shopify Tax provides a built-in option for basic tax management, suitable for smaller businesses.

7 Best Sales Tax Apps for Shopify

Link My Books - Best for accounting for Shopify sales tax in Xero or QuickBooks

Accurate sales tax data means less hassle during tax season. Link My Books provides organized and comprehensive reports, making it easier to file sales tax returns with confidence. For businesses using Xero or QuickBooks, this integration ensures that all tax-related information is ready and audit-proof.

Unlike generic accounting integrations, Link My Books is specifically designed for eCommerce sellers, including Shopify users. It understands the nuances of Shopify sales, such as marketplace facilitator tax rules and multi-currency transactions, ensuring that your financial data is precise and compliant.

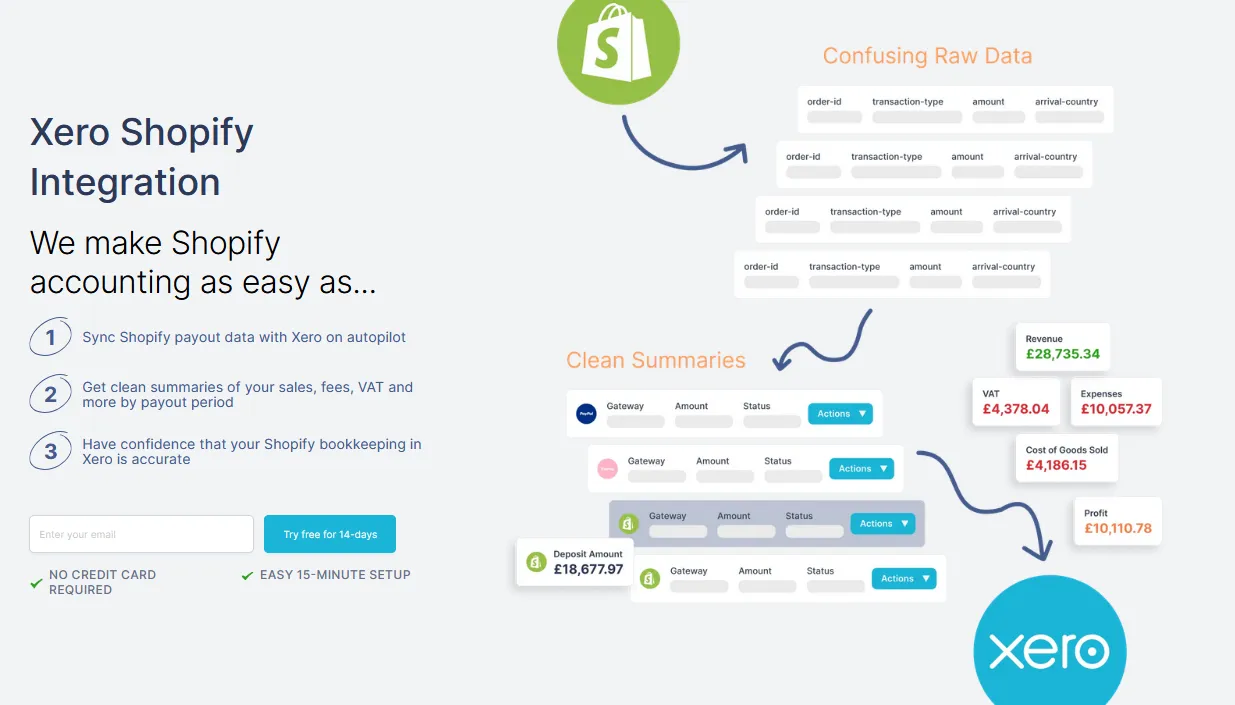

1. Xero with Link My Books Best for Error-free Accounting

Xero is a cloud-based accounting software tailored for small to medium-sized businesses. It’s a good option for Shopify sellers because it has a specific set of useful tools including invoicing and bank reconciliation. Xero is easy to use and mobile-friendly, which makes it a good choice if you need real-time updates on the go.

It has a direct integration with Shopify which is somewhat limited because it doesn’t provide the detailed sales tax information required for sales tax filing in your region.

There are a few other limitations to keep in mind when integrating Xero directly with Shopify.

- The integration doesn’t automatically calculate or apply sales tax based on your location.

- Xero won’t create separate invoices for each Shopify sales transaction.

- The integration doesn’t manage your inventory or track the cost of goods sold.

- You can’t connect multiple Shopify stores to a single Xero account.

- The integration doesn’t support Shopify stores and Xero accounts that use different currencies.

- Xero doesn’t offer automatic tax filing for multiple tax jurisdictions through this integration.

- Invoices generated through this integration won’t show individual customer payment details.

So it might not be the best way to integrate Shopify and Xero

To make sure your taxes are always in order you should consider going with the Link My Books integration instead.

Here’s what to expect:

Features

- Automated Financial Sync

- Accurate Sales Tax Calculations

- Payout Reconciliation

- Multi-Currency Support

- Cost of Goods Sold (COGS) Management

Automated Financial Sync

Link My Books syncs all Shopify sales data, including orders, fees, and refunds, directly into Xero.

You no longer need to transfer Shopify transactions into your accounting software manually. The system does it for you automatically, saving hours of repetitive work.

This reduces errors and ensures all transactions are accurately recorded, freeing up your time to focus on growing your business.

Tax-Compliant Invoices

Link My Boks breaks down all your payouts from Shopify into sales, refunds, fees, and sales tax. This simplifies audits and ensures your financial records are always up-to-date and compliant.

Accurate Sales Tax Calculations

Link My Books takes your total sales tax amount provided by Shopify and accounts for it in your bookkeeping.

This eliminates the stress of calculating taxes manually, helping you avoid costly compliance mistakes and stay organized for tax filings.

Payout Reconciliation

You can easily reconcile Shopify payouts in Xero with one click. Link My Books matches the payouts received in your bank account to the related transactions in Xero, ensuring everything adds up.

This keeps your books balanced without the hassle of finding and fixing mismatched transactions.

Multi-Currency Support

Link My Books handles transactions in multiple currencies, converting them into your base currency for accurate accounting. If your Shopify store accepts payments in multiple currencies, Link My Books ensures all transactions are recorded correctly in Xero’s base currency.

This simplifies global sales management, avoiding confusion over exchange rates and helps you maintain accurate records.

Cost of Goods Sold (COGS) Management

Link My Books tracks and manages your Cost of Goods Sold within Xero. COGS tracking gives you insights into how much you’re spending on producing or sourcing your products.

This ensures your profit margins are calculated accurately, helping you understand the true profitability of your store.

What other Shopify sellers say about Link My Books

You can try Link My Books for free for 14 days for free. You don’t need a credit card and it takes 15 min to set up.

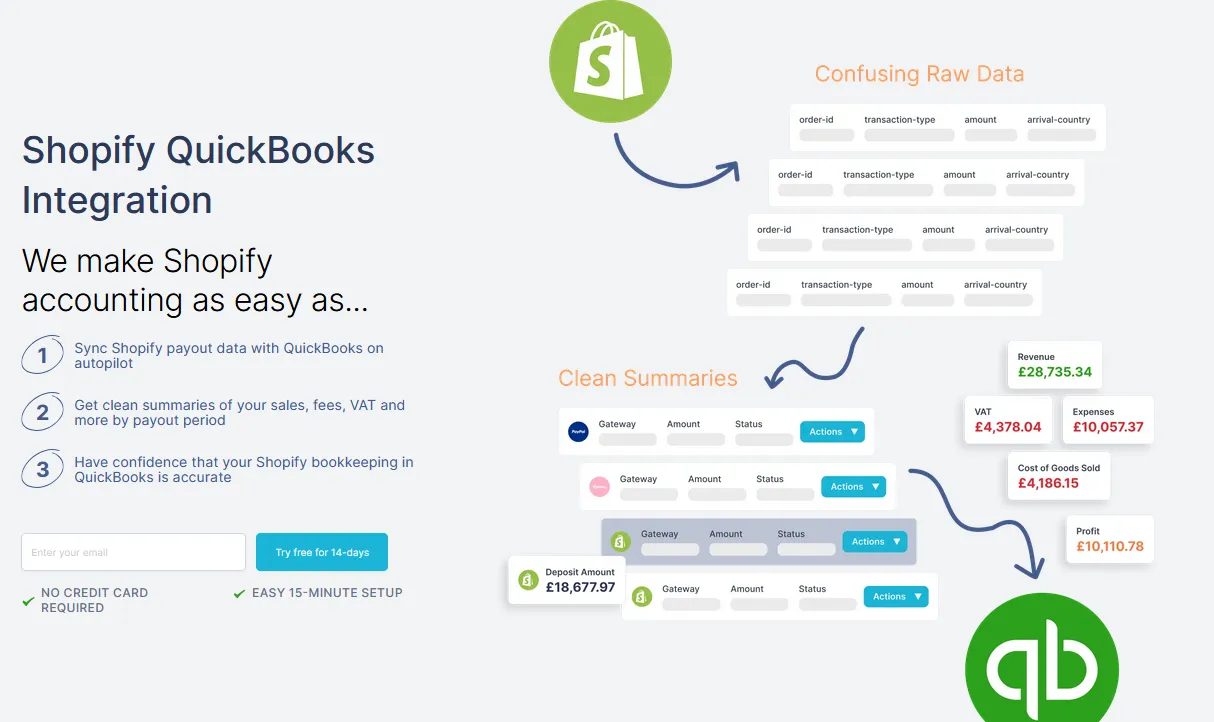

2. QuickBooks with Link My Books is best for Advanced Reporting

QuickBooks Online, is an accounting platform that caters to small business owners. It provides a clean, intuitive interface and a wide range of accounting tools, making it easy for newcomers to manage their finances.

While it does integrate directly with Shopify, this integration is often faulty and can lose data when transferring. It also doesn't map to the products and inventory in Quickbooks, and the reviews are quite underwhelming.

That’s why Link My Books integration is definitely a better option. You can try it for 14 days free of charge, and it doesn’t require a credit card to start.

Here’s what you can expect:

Features

- Automatic Order Sync

- One-Click Payout Reconciliation

- Clear Financial Summaries

- Multi-Currency Support

- Historical Data Import

Automatic Order Sync

Link My books Sync all Shopify orders, including line items, taxes, and fees, directly into QuickBooks Online. Any order processed through Shopify is automatically recorded in QuickBooks with detailed breakdowns, so there is no need to do any manual entry.

This saves you time while ensuring accurate and complete records of all your Shopify transactions.

Accurate Sales Tax Calculations

Link My Books automates the accounting of your total sales tax reported by Shopify, integrating it directly into your bookkeeping.

This removes the hassle of manual tax calculations, reduces the risk of compliance errors, and keeps you organized for seamless tax filings.

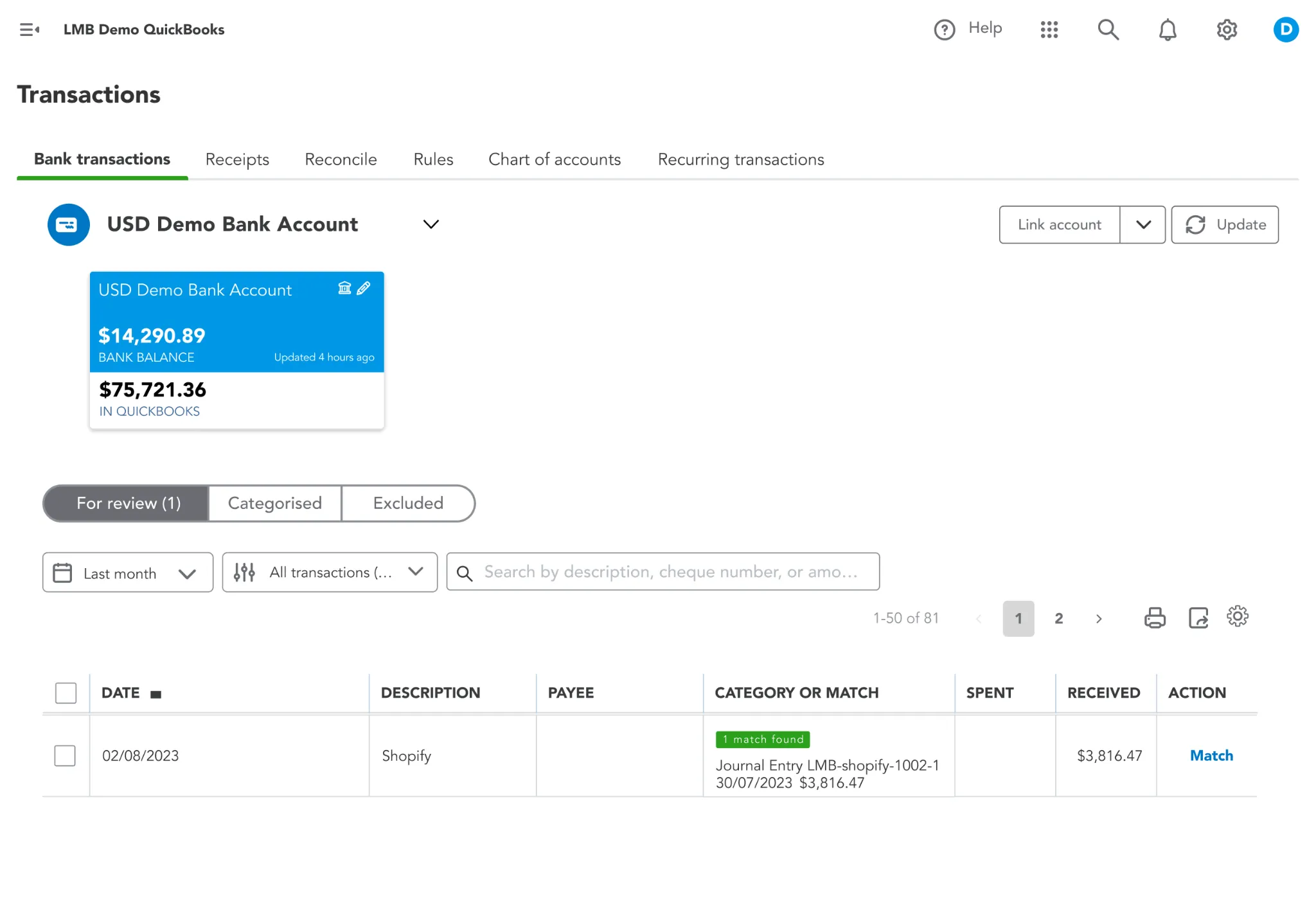

One-Click Payout Reconciliation

You can quickly reconcile your Shopify payouts in QuickBooks with a single click. The app matches payouts from Shopify to the corresponding transactions in QuickBooks automatically.

This keeps your books balanced effortlessly and eliminates the guesswork in matching transactions to payouts.

Clear Financial Summaries

You can receive detailed summaries of your Shopify sales, refunds, and fees in QuickBooks. Link My Books provides concise reports summarizing all Shopify transactions, giving you a bird’s-eye view of your business finances.

This helps you understand your store’s financial performance at a glance and make informed decisions.

Multi-Currency Support

You can handle international sales with automatic currency conversions for accurate financial reporting. Any transactions you made in foreign currencies are automatically converted to your home currency in QuickBooks.

This simplifies accounting for global sales, ensuring you have accurate records and consistent financial reporting.

Historical Data Import

You can import up to 2 years of previous Shopify sales transactions into QuickBooks. The integration retrieves past sales data from Shopify, giving you a complete financial history in QuickBooks.

This offers a comprehensive view of your financials from the start, even if you’re just now syncing Shopify with QuickBooks.

VISUAL CTA

Best apps for calculating and filing sales tax returns in Shopify

When managing sales tax in Shopify, there’s a clear distinction between filing and calculating sales tax and accounting for sales tax. Apps for calculating and filing sales tax focus on ensuring compliance by automatically determining the correct tax rates, collecting sales tax, and filing returns across various jurisdictions. However, these apps don’t handle bookkeeping tasks or integrate deeply with accounting software like Xero or QuickBooks.

If you’re looking to file sales tax returns accurately and stay compliant, this section highlights the best apps for the job.

Why the Distinction Matters

- Purpose:some text

- Accounting for Sales Tax: Apps like Link My Books focus on integrating sales tax data with accounting platforms for streamlined bookkeeping, not tax filing.

- Calculating and Filing Sales Tax: These apps automate compliance tasks, such as calculating tax for each sale and filing returns for multiple states or countries.

- Suitability:some text

- If you sell in multiple states or countries and need help with filing tax returns, choose a filing app.

- If you primarily need to sync sales data with accounting software, choose an accounting-focused app.

- Functionality Gap:some text

- Filing apps don’t integrate seamlessly with accounting platforms.

- Accounting apps don’t calculate and file taxes by jurisdiction.

Let’s explore the top apps for calculating and filing sales tax.

1. TaxJar – Best for Automating Tax Compliance

TaxJar is a powerhouse for Shopify sellers managing sales tax compliance in the U.S. Its standout feature, AutoFile, handles filing sales tax returns for you in multiple jurisdictions, making it particularly helpful for merchants dealing with economic nexus laws. With its robust dashboard, you can track tax liabilities in real time, ensuring you’re always aware of where and how much tax to remit.

TaxJar also integrates seamlessly with Shopify and other platforms like Amazon and Walmart, making it a versatile solution for multichannel sellers. Its advanced analytics allow you to dive deeper into tax trends and liabilities, offering insights to optimize your operations.

Ideal for:

- U.S.-based sellers managing multi-state taxes.

- Businesses growing into new regions and dealing with nexus compliance.

Features

- Real-Time Tax Calculations: Automatically calculates sales tax based on the customer’s location at checkout.

- AutoFile Services: Files sales tax returns on your behalf for multiple states or countries.

- Economic Nexus Tracking: Tracks your sales volume to identify where you’re required to collect and remit taxes.

Why Choose TaxJar?

TaxJar handles compliance end-to-end, making it ideal for businesses operating in multiple jurisdictions. It’s particularly valuable for U.S. sellers dealing with the complexities of economic nexus laws.

2. Avalara – Best for Large Businesses Needing Robust Tax Tools

Avalara caters to larger businesses with complex tax needs. Its services extend beyond U.S. sales tax, covering international VAT, GST, and customs duties. Avalara’s AvaTax engine ensures real-time tax calculations during checkout, while its compliance document management feature stores exemption certificates and other critical documents.

The platform’s API integration capabilities make it customizable for enterprise-grade systems, allowing businesses to tailor Avalara to their specific workflows. It’s a trusted solution for companies with significant sales volume, where accuracy and scalability are paramount.

Ideal for:

- Enterprises operating across multiple countries.

- Businesses with high transaction volumes require robust automation.

Features

- Comprehensive Tax Compliance: Covers U.S. sales tax, international VAT, and GST regulations.

- Integration with Shopify: Provides real-time tax calculations at checkout.

- Document Management: Tracks and stores compliance documents like exemption certificates.

Why Choose Avalara?

Avalara is a scalable solution for enterprises handling high sales volumes across multiple regions. Its advanced tools ensure compliance while minimizing manual intervention.

3. Shopify Tax – Best Built-In Option for Shopify Sellers

Shopify Tax is relatively new, but it’s already making waves as an accessible and straightforward solution. Built directly into the Shopify platform, it offers seamless integration without requiring any additional apps. It automatically calculates sales tax based on customer location, giving you peace of mind with minimal effort.

Its pricing model is also appealing for smaller businesses, as it’s free for the first $100,000 in annual sales and caps at $5,000 per year for larger stores. While it lacks the advanced features of dedicated tax apps, its simplicity makes it a go-to for many merchants.

Ideal for:

- Smaller or newer businesses.

- Sellers looking for a low-cost, integrated solution.

Features

- Location-Based Calculations: Automatically determines and applies the correct tax rate for each transaction.

- Integrated Dashboard: Offers insights into tax liabilities and where you need to collect taxes.

- Transparent Pricing: Free for the first $100,000 in U.S. sales annually, with capped fees for larger stores.

Why Choose Shopify Tax?

For smaller businesses or those new to sales tax compliance, Shopify Tax is a cost-effective and simple option. It’s ideal for sellers who prefer built-in functionality without needing third-party tools.

4. Taxify – Best for Detailed Reporting and Filing

Taxify by Sovos excels at providing detailed reports and automating sales tax filings. The platform supports multi-state filings and delivers a clear breakdown of tax liabilities across regions, making audits much less daunting.

Taxify also integrates with Shopify and other eCommerce platforms, ensuring that all transactions are accounted for. Its user-friendly interface allows you to review and manage filings without feeling overwhelmed by the complexity of multi-jurisdiction tax compliance.

Ideal for:

- Mid-sized businesses managing tax compliance across several states.

- Sellers needing advanced reporting to prepare for audits or tax reviews.

Features

- Automated Filing: Submits tax returns across multiple jurisdictions.

- Detailed Reporting: Offers insights into collected taxes, making audits easier to manage.

- Multi-Platform Integration: Works with Shopify, Amazon, and other marketplaces.

Why Choose Taxify?

If your business needs detailed reporting and automated filing, Taxify is a strong contender. It’s particularly helpful for mid-sized stores expanding into new regions.

5. Quaderno – Best for International Tax Compliance

Quaderno stands out for its ability to handle international tax compliance. Its real-time calculations ensure that VAT, GST, and other local taxes are applied correctly at checkout, regardless of where your customers are located. The app also generates tax-compliant invoices automatically, saving you time and reducing the risk of human error.

One of Quaderno’s most valuable features is its threshold tracking, which helps you monitor when you’ve reached sales limits in different countries that trigger tax obligations. For global Shopify sellers, this feature ensures compliance without manual calculations.

Ideal for:

- Shopify stores selling internationally.

- Businesses seeking simplified invoicing and global compliance.

Features

- Global Tax Calculations: Applies VAT, GST, and other local taxes based on the customer’s location.

- Compliant Invoicing: Automatically generates tax-compliant invoices for every sale.

- Threshold Tracking: Monitors sales thresholds for international tax obligations.

Why Choose Quaderno?

If your Shopify store operates globally, Quaderno ensures you remain compliant with varying international tax laws.

How to choose the best Shopify tax app for sales

Selecting the right tax app for your Shopify store depends on your business's unique needs. Here are the key criteria to consider, along with a feature comparison table to help you make an informed decision.

Compliance Coverage

Does the app cover the jurisdictions where your business operates?

- Tax regulations vary between countries, states, and even cities. An app with comprehensive compliance coverage ensures you’re always meeting your obligations, whether it’s U.S. state sales tax, EU VAT, or international GST.

Automation

How much of the tax process does the app automate?

- Automation reduces the time spent calculating taxes, filing returns, and reconciling payouts. The more automated the process, the fewer errors and manual interventions are required.

Integration

Does the app integrate seamlessly with Shopify and other tools you use, like QuickBooks or Xero?

- An app that integrates with your accounting or eCommerce platforms streamlines data management, eliminating double-entry errors and saving you time.

Value for Money

Is the pricing structure suitable for your business size and needs?

- Some apps charge a flat fee, while others take a percentage of sales. The right pricing model depends on your revenue and the level of service you require.

Ease of Use

How intuitive is the app’s interface, and how easy is it to set up?

- A user-friendly app reduces the learning curve, enabling you to focus on running your business instead of struggling with software.

Scalability

Can the app handle your business as it grows?

- Your tax obligations will increase as your sales grow and expand into new jurisdictions. A scalable app ensures you won’t outgrow its capabilities.

Criterion

We’ve made a table so you can compare them at a glance.

Key Takeaways:

- If compliance coverage and automation are your top priorities, TaxJar or Avalara are excellent choices.

- For small businesses with straightforward needs, Shopify Tax offers an affordable and easy-to-use solution.

- If you operate internationally, Quaderno is ideal for handling VAT, GST, and threshold tracking.

Why sellers choose Link My Books for Shopify accounting?

Managing Shopify sales tax and accounting can be a hassle, especially as your business grows. That’s where Link My Books stands out, it’s a purpose-built tool designed to simplify and automate your Shopify bookkeeping, making your financial management smoother, faster, and more accurate.

Here’s why Shopify sellers love Link My Books:

1. Saves Time with Automation

Link My Books automatically syncs your Shopify transactions, fees, and payouts into Xero or QuickBooks. Instead of spending hours manually reconciling data, sellers can focus on growing their business.

2. Error-Free Bookkeeping

With features like one-click payout reconciliation and accurate sales tax categorization, Link My Books ensures your books are balanced and compliant. No more headaches over discrepancies or missed details.

3. Tailored for Shopify

Unlike generic accounting tools, Link My Books is specifically designed for Shopify sellers. It integrates seamlessly, providing tailored reports that give you clear insights into your business performance.

4. Scales with Your Business

Whether you’re a small Shopify store or scaling to thousands of orders per month, Link My Books adapts to your needs. Its automation tools grow with you, handling increased transaction volumes effortlessly.

Automate Your Shopify Bookkeeping with Link My Books

If bookkeeping feels like a chore, Link My Books is the solution. Here’s what makes it the go-to choice for Shopify sellers:

- Fast and Easy Setup: Get started in minutes, even with no accounting experience.

- Advanced Reporting: Create accurate financial reports to streamline your accounting process.

- Industry Benchmarking: Leverage precise data for effective benchmarking and performance analysis.

- Multi-Currency Support: Simplify accounting for international sales with automatic currency conversions.

- Expert Support Team: Our support team, made up entirely of qualified accountants, ensures expert guidance and exceptional service every step of the way.

By automating Shopify bookkeeping, Link My Books helps you reduce errors, save time, and stay compliant, all while providing real-time insights into your finances.

Ready to automate your Shopify accounting?

Get Started with Link My Books

.webp)

.png)