Most business owners waste hours downloading, sorting, and reconciling Square data for accounting purposes. The built-in reporting system provides basic information, but falls short when you need to accurately track sales tax, reconcile payouts, or integrate with your accounting software.

Link My Books solves these challenges by automatically syncing your Square transactions directly to Xero or QuickBooks. No more manual data entry, spreadsheet headaches, or reconciliation errors.

In this guide, we'll show you how to pull a Square transaction report manually—but more importantly, we'll demonstrate how to automate the entire process for $0, so you can spend less time on bookkeeping and more time growing your business.

Square’s built-in reports offer basic insights, but handling them manually is a slow, error-prone process.

Sellers often get tripped up reconciling payouts, splitting out fees, and applying the right tax codes.

Link My Books eliminates the guesswork by automatically syncing your Square sales, refunds, fees, and taxes straight into Xero or QuickBooks.

Where Most Sellers Go Wrong With Square Transaction Reports

Most guides focus only on “how to download the file.” But the real problem starts after that. You still have to:

- Separate out sales, refunds, tips, and taxes

- Match bank deposits to transaction summaries

- Manually calculate VAT or sales tax liabilities

- Enter everything into your accounting software

It’s time-consuming. Error-prone. And if you're using multiple platforms (like Shopify or eBay), it’s nearly impossible to keep up.

Here’s what no one tells you:

👉 You don’t have to do this manually anymore.

Link My Books connects your Square account directly to Xero or QuickBooks, and automatically generates perfectly reconciled summaries. Sales, fees, refunds, and taxes, sorted, categorized, and posted with the right tax codes in minutes.

Automate the Entire Process with Link My Books

Forget CSVs and spreadsheets, here’s how to streamline Square reporting with Link My Books:

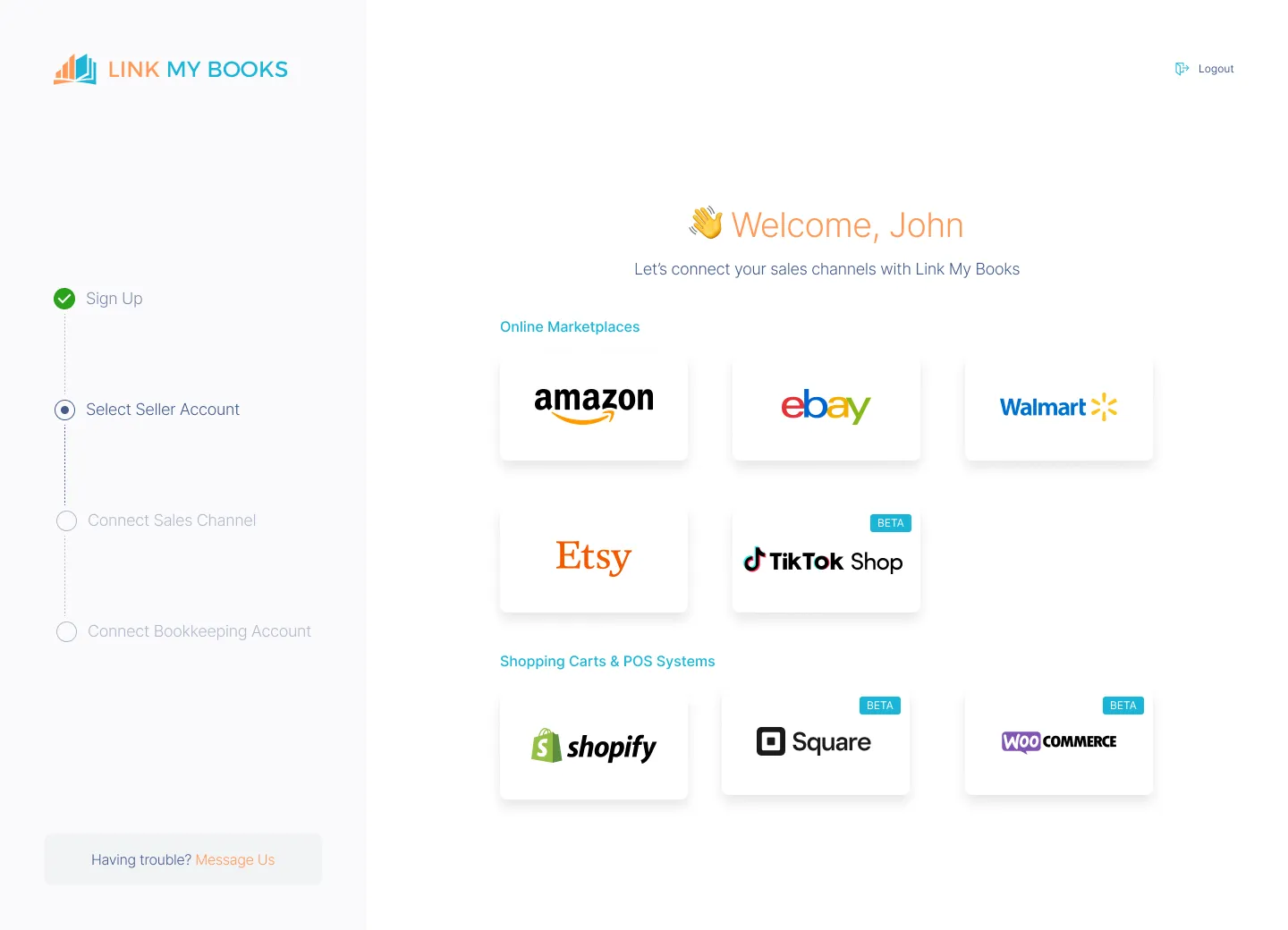

Step 1: Connect Your Square Account to Xero or QuickBooks

- Sign up for Link My Books and link your Square account.

- Connect your Xero or QuickBooks account.

- Set up your tax preferences once, LMB applies the correct rules automatically.

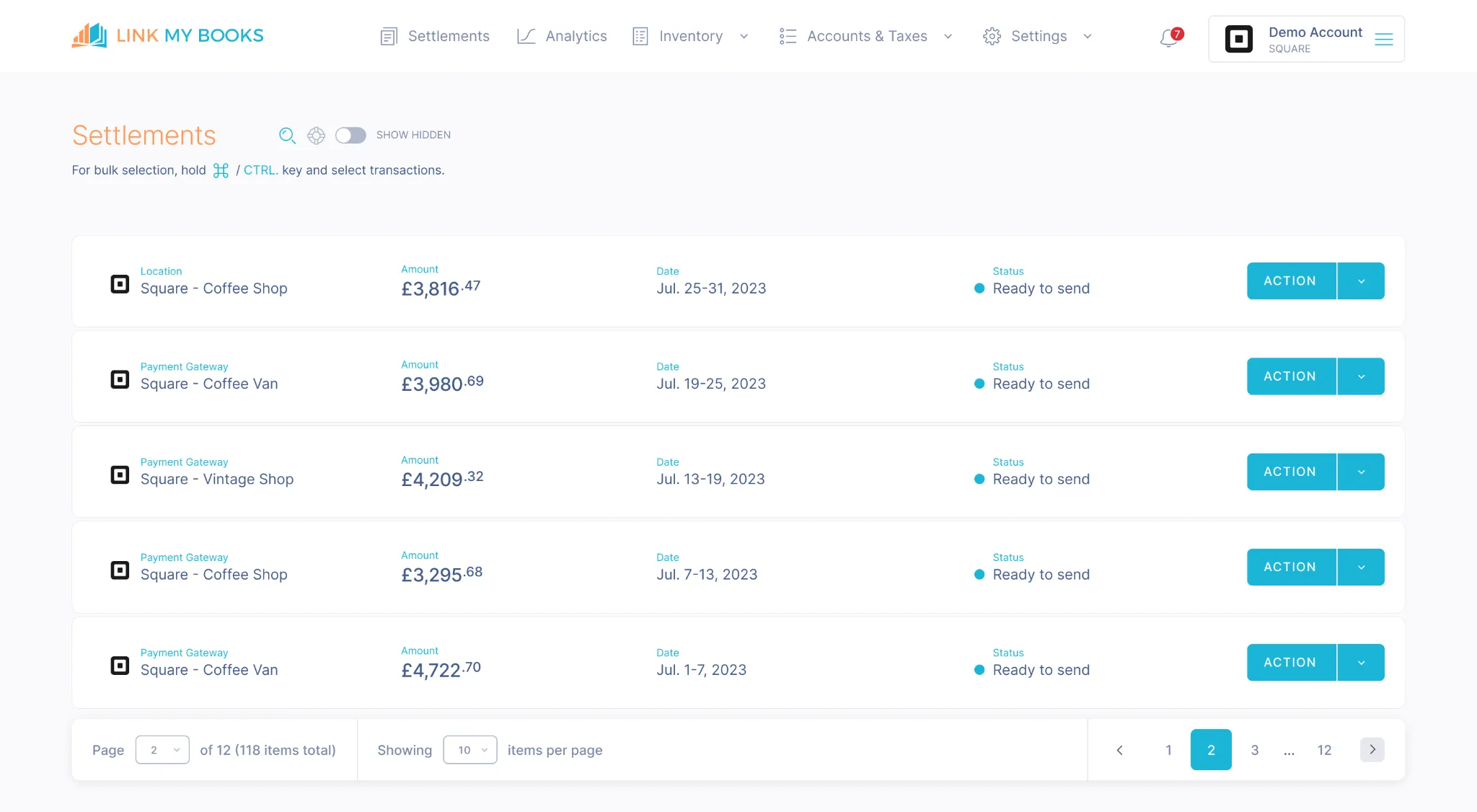

Step 2: Automatically Import and Categorize Transactions

- LMB pulls all Square sales, tips, fees, and refunds in real time.

- Every transaction is properly categorized, no manual sorting, no missed entries.

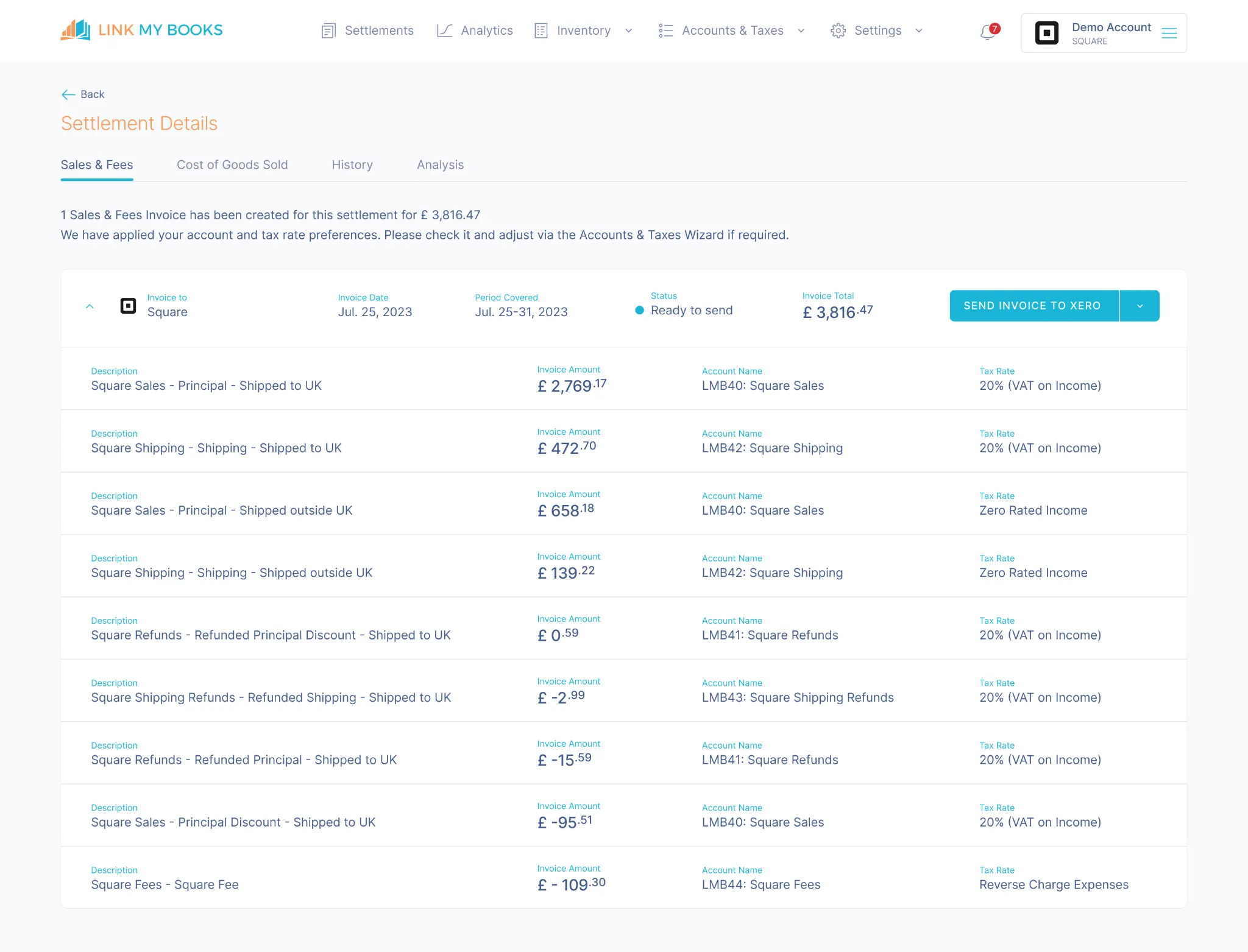

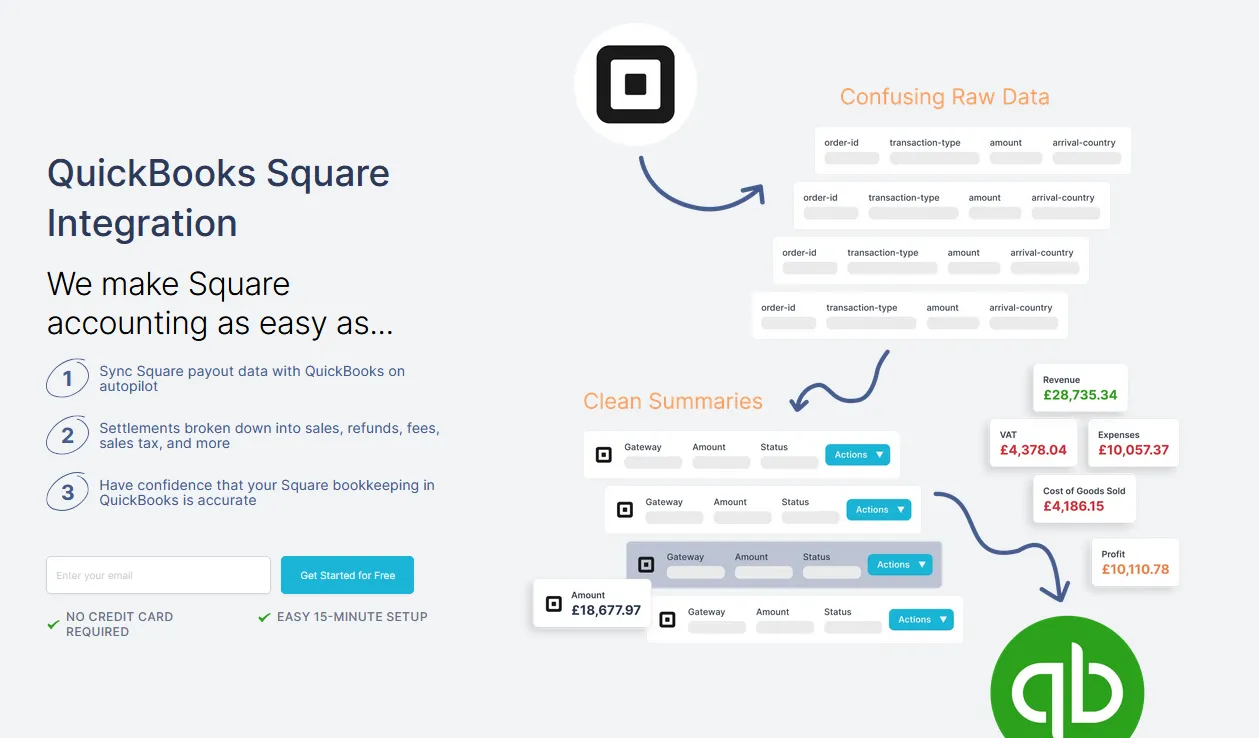

Step 3: Get Clean, Organized Summaries Inside Your Accounting Software

- Link My Books breaks each payout down into sales, fees, refunds, and tax.

- Accurate categorization ensures clean books and clear profitability.

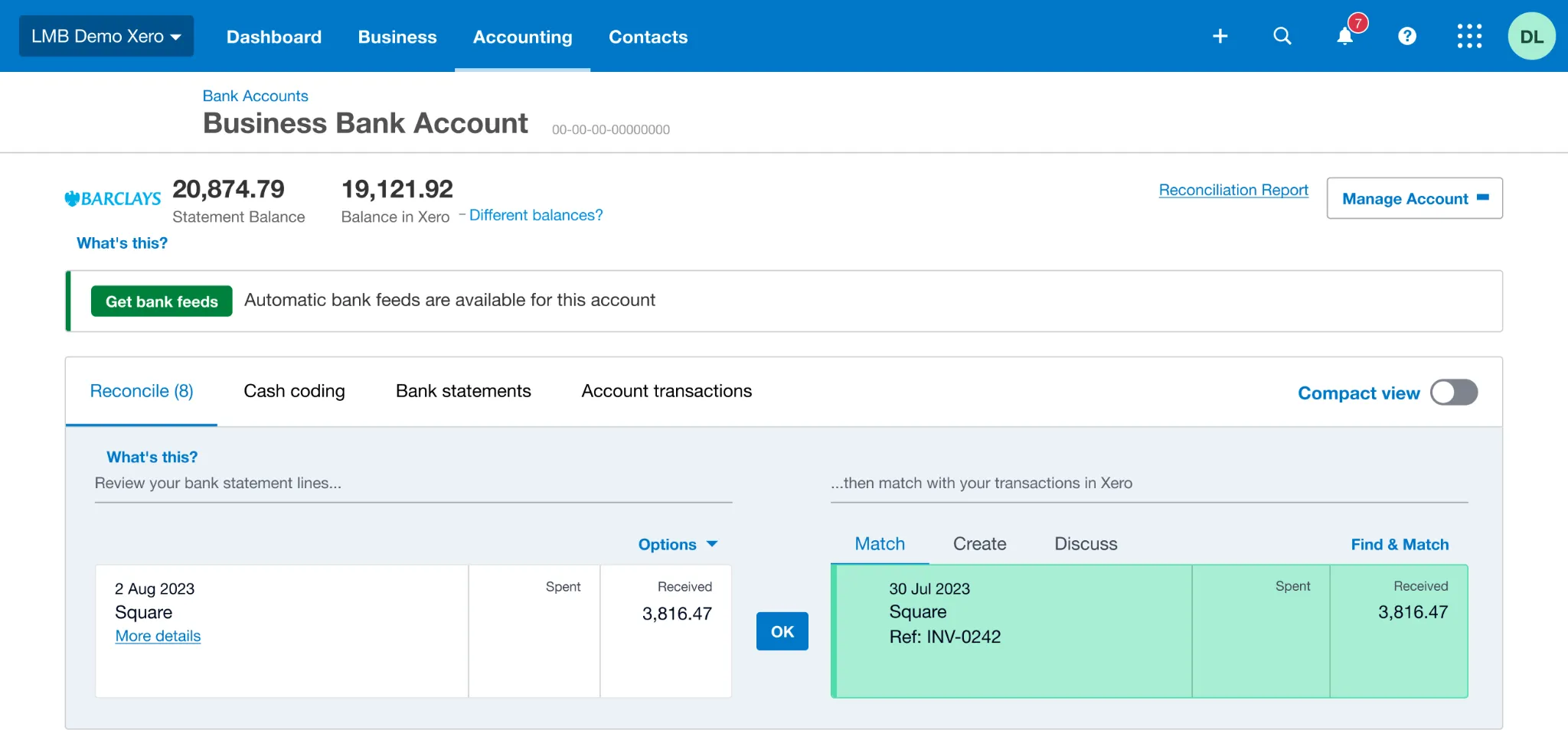

Step 4: Reconcile Square Payouts in a Single Click

- Each Square deposit is automatically matched to your bank records.

- No spreadsheet headaches, no discrepancies, just simple, accurate reconciliation.

- You can reconcile your Square payments in Xero or record your Square sales in QuickBooks in just a few clicks.

🔹 With Link My Books, your Square bookkeeping is fully automated, saving you hours every month.

And yes, you can try it totally free, no credit card required.

But if you still insist on doing it the manual way, here’s how:

How to Get a Transaction Report on Square

- Step 1: Log In to Your Square Dashboard

- Step 2: Access Reports Tab

- Step 3: Customize Your Report

- Step 4: Export the Report

Step #1: Log In to Your Square Dashboard

Head to squareup.com, and sign in using your Square seller account. Make sure you’re accessing the business account associated with the transactions you want to analyze.

Step #2: Access Reports Tab

Once logged in, go to the left-side navigation and click “Reports”. This is where you’ll find a range of financial summaries including:

- Sales Summary

- Item Sales

- Payments

- Taxes Collected

- Fees

Step #3: Customize Your Report

Select the time period you want to review (day, month, or custom range). You can also filter by location, employee, or transaction type.

👉 Pro tip: Choose “Payments” > “Transactions CSV” to get the most granular data.

Step #4: Export the Report

Click the Export button in the upper-right corner and choose “CSV.” This will save the report to your device for further review or import into accounting software.

How Link My Books makes recording Square sales in QuickBooks automatic & easy

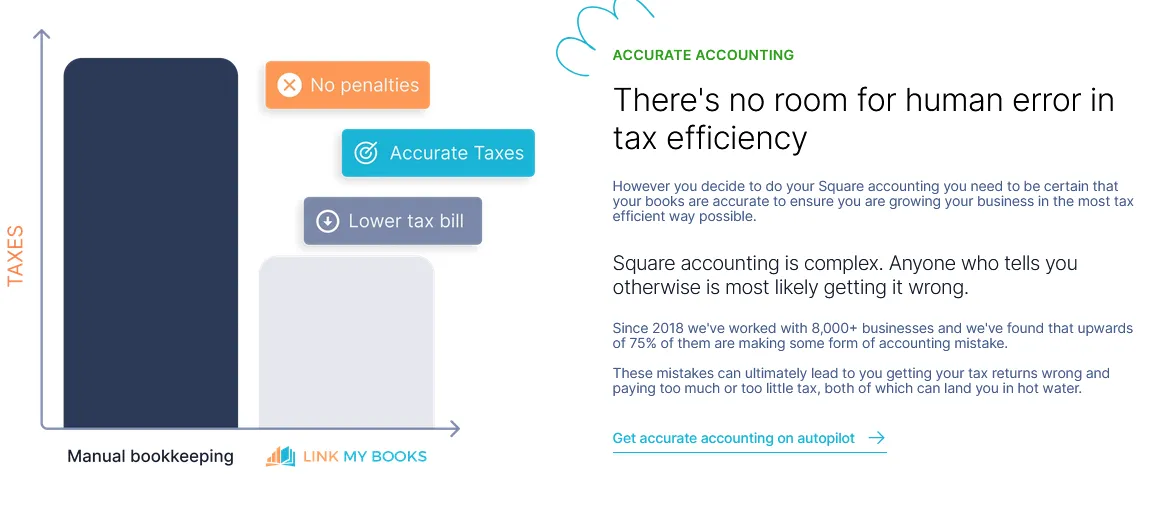

Square sellers looking to streamline their accounting choose Link My Books to maintain tax compliance and gain deeper insights into their business’s financial health.

Link My Books directly integrates with Square, automating the import of sales data, refunds, and fees into Xero or QuickBooks. This integration reduces manual entry, minimizes errors, and saves time, making it easier to keep financial records accurate.

Here’s what you can expect:

Payout Reconciliation

Link My Books simplifies reconciliation by automatically matching Square payouts with bank statements, ensuring all transactions are accounted for accurately. This feature reduces time spent on reconciliation, making it a set and forget process.

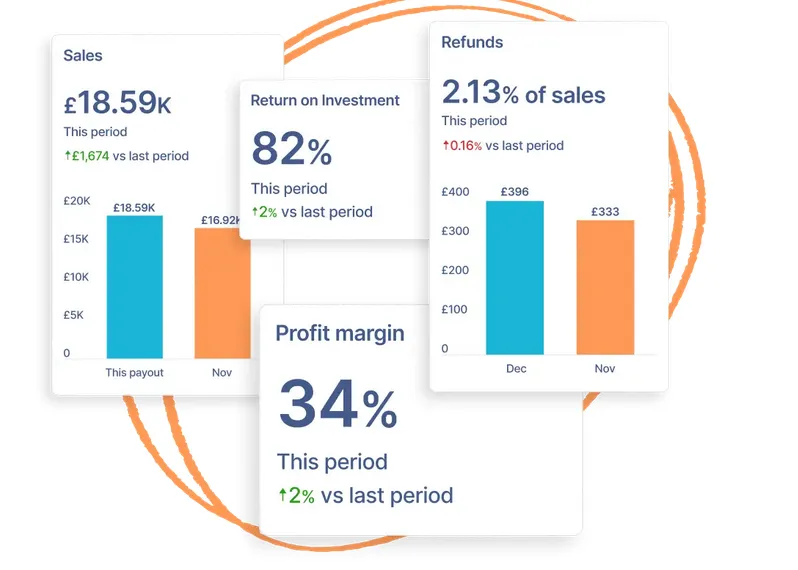

Financial Analytics

Link My Books provides real-time financial analytics, giving you insights into your business performance. This includes detailed reports on sales trends, profitability, and cash flow. With up-to-date data, you can make informed decisions quickly, and stay competitive and responsive to market changes.

Industry Benchmarking

Link My Books offers benchmarking tools that allow you to compare your business performance against industry standards. By analyzing anonymous data from similar businesses, you can identify areas where you’re doing well and where you need improvement.

Instead of focusing on exact figures, Link My Books looks at percentage changes and trends, giving you a clear picture of how your business is performing relative to others.

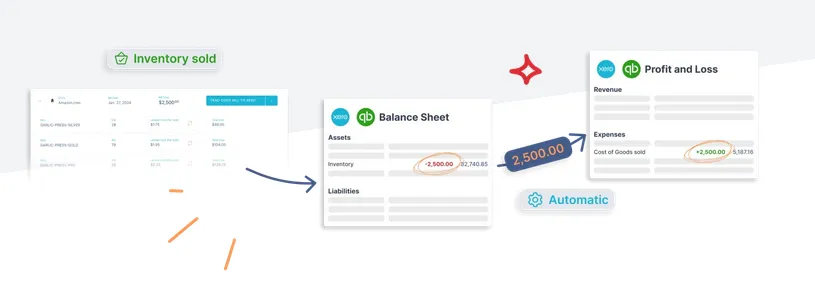

Cost of Goods Tracking

Tracking the cost of goods sold (COGS) is essential for understanding product profitability. Link My Books will take account of each of the products sold as part of your Square payouts. Then move their monetary value (landed cost) from your chosen inventory account to your chosen cost of goods sold account on the profit and loss statement.

By tracking COGS alongside revenue, you can make informed decisions about pricing, inventory management, and overall business strategy.

Accurate Tax Calculation

Managing taxes across different regions can be complex, especially if you operate in multiple jurisdictions. Link My Books automates tax calculations, applying the correct rates based on where the sales occur. This automation ensures compliance with local tax laws, reducing the risk of errors and penalties.

Multi-Channel Support

If you’re active on multiple platforms, like Shopify, or eBay, or you have your own website. Link My Books consolidates financial data from all these channels, providing a unified view of your finances. This is crucial if you need to manage inventory, track profitability, and generate financial reports across different platforms.

Essential Square Transaction Report Figures to Know

How to Use Square Transaction Report Figures for VAT Calculation

If you're registered for VAT, calculating it correctly is non-negotiable. But with Square, this often means digging through exported reports and manually separating sales, refunds, and taxes by country and product type.

To calculate VAT manually, you’ll need to:

- Filter sales by destination country

Identify which transactions were made in the UK, EU, or internationally. This matters because VAT rates vary by location, and post-Brexit, so do the rules. - Apply the correct VAT rate

Use the appropriate rate for each sale:

- 20% for most goods sold in the UK

- 0% for exports outside the UK and EU

- Reduced or zero-rated for applicable goods (like children’s clothing or certain food items)

- Subtract refunds from taxable revenue

Refunds reduce your VAT liability. You must offset them against your gross sales to calculate the correct net VAT. - Adjust for fees and promotions

Square deducts fees before payouts, these aren't subject to VAT, but they affect your net margin. Promotions and discounts should also be accounted for accurately, as they change the taxable amount.

Or, automate everything with Link My Books.

Instead of juggling spreadsheets and VAT rules, Link My Books handles the entire process for you:

- Groups products by VAT rate using its VAT Product Grouping feature

- Automatically applies the correct rate to each transaction

- Separates Square sales into taxable and non-taxable categories

- Accounts for refunds and adjustments without manual input

- Pushes clean, accurate data to Xero or QuickBooks for easy VAT returns

✅ Result: You're fully VAT-compliant, accurate to the penny, and ready to submit returns, without spending hours decoding CSVs.

Common Challenges with Square Transaction Reports

Square is designed to help you sell, not do your books. And while it offers basic reporting features, sellers quickly hit roadblocks when it’s time to reconcile data, track taxes, or prepare for compliance. Here’s why relying solely on native Square reports creates more problems than solutions:

Limitations of Native Square Reporting

At first glance, Square’s reports seem helpful, but once you dig into tax reporting or try to reconcile payouts, the cracks start to show.

- No breakdown of tax by region or product type: Square lumps all taxes into one total. If you're selling into multiple countries or need to separate standard, reduced, or zero-rated VAT, you’re on your own.

- No support for One-Stop-Shop (OSS) VAT schemes: For UK and EU sellers, managing OSS reporting is critical post-Brexit. Square doesn’t segment EU sales by country or apply local VAT rates.

- Tips and promotions get buried: Square reports include tips and discounts in totals, but don’t clearly flag them for accounting purposes. That’s a problem if you’re trying to calculate accurate taxable revenue.

- Hard to trace discrepancies: If a payout doesn’t match your transaction total, you’re left comparing lines in a CSV file. There’s no audit trail, and no visibility into what went wrong.

Manual Data Entry and Reconciliation Issues

Even if you export the right Square report, that’s only step one. Next comes the hours of manual work.

- Sales, fees, refunds, and taxes are all in different reports

You have to cross-reference multiple files to get the full picture. This opens the door to miscategorization, missed entries, and incorrect reporting. - One mistake can snowball into a tax mess

A single missed refund or misapplied tax rate can throw off your entire return. And if HMRC or your accountant flags it, you’ll be stuck explaining spreadsheet formulas. - Bank deposits rarely match up

Square sends payouts net of fees and refunds, which rarely match your raw sales totals. Reconciling these manually each month is tedious and error-prone.

Even if you consider manually downloading your reports, you still need accounting software to make sense of your business.

Time Constraints for Busy Business Owners

Most sellers aren’t accountants, and they shouldn’t have to be. Yet manual Square reporting turns your back office into a second full-time job.

- Bookkeeping takes hours, every month

Manually downloading, sorting, and reconciling reports can take 5–10 hours per month, more if you’re multi-channel or VAT registered. - Takes you away from revenue-generating work

Every minute spent wrangling Square data is time not spent on inventory, marketing, or customers. That’s opportunity cost. - You’re constantly second-guessing your numbers

Even after doing the work, there’s still that lingering doubt: “Did I miss something?” That stress compounds during tax season.

Why Do You Need a Square Transaction Report?

Even if you’re using accounting software, your Square transaction report plays a critical role in maintaining accurate records, staying compliant, and running a financially sound business.

Here’s why it matters:

Tax Filing – Stay Compliant and Audit-Ready

Tax authorities don’t care what your Square dashboard says—they want evidence. Accurate sales, refund, and tax data are essential for:

- Filing VAT or sales tax returns

You need to break down taxable vs. non-taxable sales, apply the correct rates, and prove what was collected versus what was remitted. - Supporting Marketplace Facilitator rules

In many jurisdictions, Square is required to collect and remit taxes on your behalf. But you’re still responsible for recording it properly and knowing what to report. - Audit defense

If you’re ever audited, messy or incomplete records from manually processed reports can lead to penalties or overpaid taxes.

Learn more about how to get your Square sales tax report.

Reconciliation – Ensure Every Penny is Accounted For

Reconciling what Square says you earned with what actually hit your bank account is critical for accurate bookkeeping.

- Square payouts include adjustments for fees, tips, refunds, chargebacks, and taxes.

Your sales summary might say £10,000, but your bank deposit could be £9,237. Matching those figures manually? Painful. - Discrepancies go unnoticed without proper reconciliation

If a fee was misapplied or a refund wasn’t processed, you could be leaving money on the table, or misreporting revenue. - Accountants require detailed, categorized summaries

They need clear data broken into sales, fees, taxes, and refunds. If you’re just handing over raw CSVs, you’re adding hours to their workload (and increasing your bill).

With a properly structured transaction report, or better yet, automated syncing via Link My Books, this process is instant, accurate, and painless.

Business Insights – Make Smarter, More Profitable Decisions

Your Square report isn’t just a compliance tool, it’s also your financial dashboard. When used correctly, it can help you:

- Understand profit margins across products or services

By reviewing item-level sales, discounts, and fees, you can see what’s actually making money, not just what’s selling the most. - Spot high-fee payment methods or costly transactions

Credit card processing fees add up fast. Identifying the payment types that eat into your profits lets you adjust pricing or offer incentives for lower-cost options. - Track performance trends

See how your sales fluctuate by day, week, or month. Compare seasonal performance or identify your peak hours for staffing and marketing. - Plan smarter with real data

Whether it’s inventory restocking, staff planning, or promotional strategy—your Square report provides the data to make every decision more strategic.

FAQ on Square Seller Sales Tax Reporting

Will Square send me a 1099?

- Yes, if you're in the US and meet IRS thresholds, Square will issue Form 1099-K.

How can I find sales by country on Square?

- Use itemized reports and filter by customer location. Link My Books automates this by region.

How far back can I see Square sales?

- You can typically view up to 24 months of data, but export reports regularly to preserve access.

How much do I have to make on Square to file taxes?

- This depends on your country’s thresholds. For VAT in the UK, it’s £85,000/year. For the US, it's based on state laws.

Does Square automatically take out sales tax?

- Yes, but only for jurisdictions where it’s required to act as a facilitator. You’re still responsible for accurate filings.

Simplify Accounting for Square with Link My Books

Square reporting is built for snapshots, not compliance. Without automation, the margin for error is high, and the time cost is even higher.

Link My Books fixes all of this.

It pulls your Square transactions in automatically, applies the right VAT rules, splits out tips and taxes, and posts accurate summaries into Xero or QuickBooks, ready for reconciliation in a click.

Start your free trial with Link My Books today and experience the difference it can make in your bookkeeping process.

No spreadsheets. No guesswork. No wasted weekends.

.webp)

.png)