Reconciling your Etsy sales in Xero shouldn't require a finance degree or countless hours each month. Yet many sellers find themselves drowning in spreadsheets, manually entering hundreds of transactions, and still ending up with unbalanced books that don't match their bank deposits.

The reality?

Etsy's complex payment structure - mixing sales, fees, refunds, and taxes into single deposits - makes manual reconciliation in Xero nearly impossible to get right. One misclassified transaction or forgotten fee can throw off your entire financial picture and create serious tax compliance issues.

Link My Books automates the entire process by accurately syncing your Etsy data with Xero in minutes instead of hours. With no spreadsheets required.

Let's explore how this integration works and why it's transforming accounting for Etsy sellers.

Key Takeaways from this Post

Link My Books automatically breaks down Etsy payouts into sales, fees, refunds, and taxes in Xero, eliminating hours of manual reconciliation and preventing costly bookkeeping errors

Accurate tax management across borders applies correct VAT or sales tax rates to every transaction based on customer location and marketplace rules, ensuring compliance with UK VAT, EU OSS, and international requirements

Real-time financial visibility and benchmarking shows exactly how your Etsy store is performing compared to the market, helping you make data-driven decisions to improve profitability

If You're Manually Adding Etsy Sales to Xero, You're Doing It Wrong

Most Etsy sellers waste hours each month juggling exports, spreadsheets, and guesswork, trying to get their Etsy data into Xero correctly. But here’s what they don’t realize:

❌Etsy doesn’t provide sales, refunds, fees, and tax details in one clean format.

You end up stitching together reports, applying tax rates manually, and reconciling line by line, hoping it all balances out.

That’s not just inefficient. It’s risky.

Manual processes lead to:

- Overstated income or missing fees

- VAT errors that trigger audits

- Unbalanced payouts in Xero

You don’t need to be a professional bookkeeper to stay compliant and accurate. You just need the right integration to keep your Etsy accounting effortless.

How to Connect Etsy to Xero with One Simple Integration

- Connect your Etsy account

- Link your Xero account

- Configure your tax settings

- Set your sync mode

- Reconcile payouts in Xero

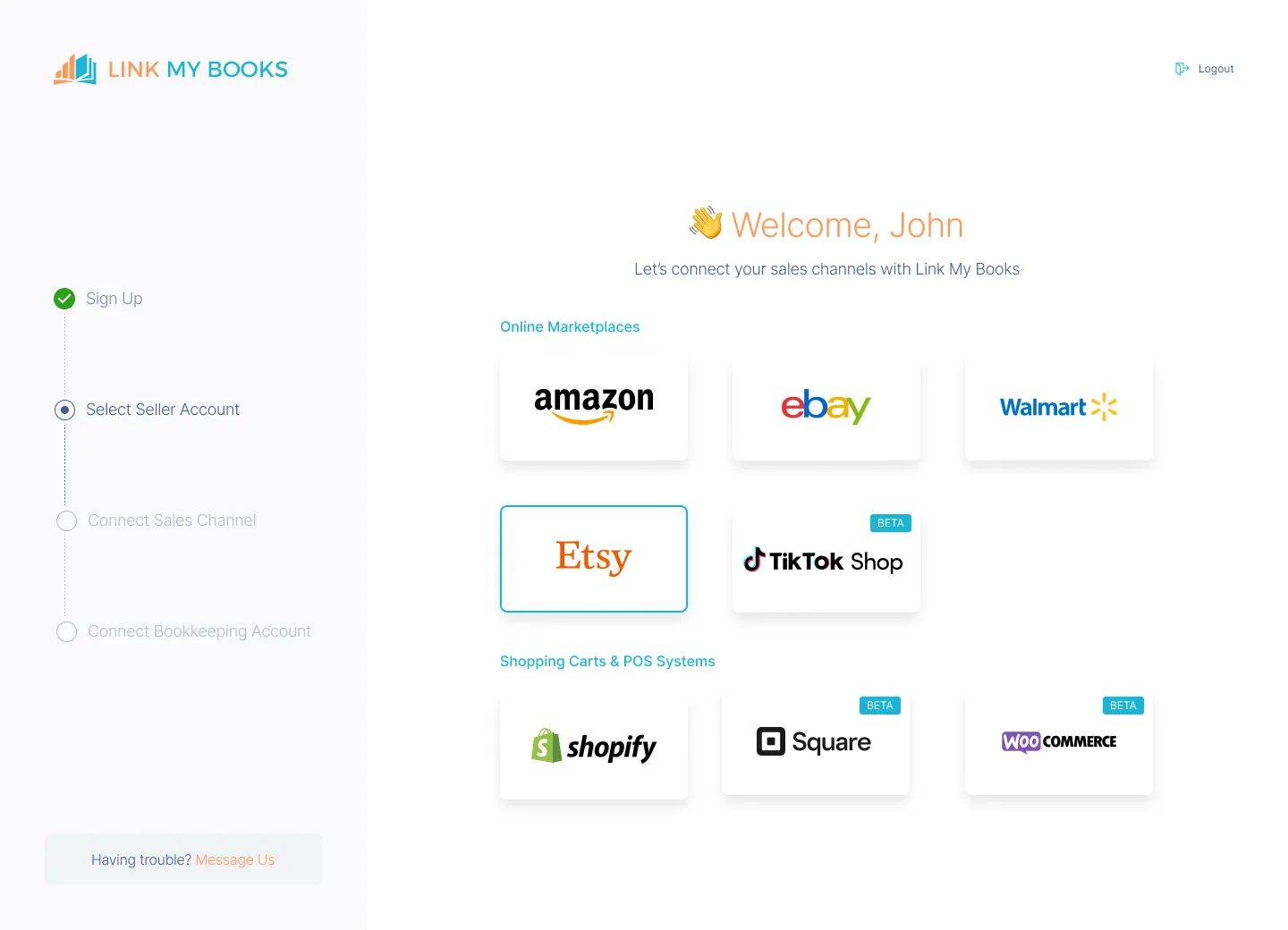

Step 1: Connect Your Etsy Account

- Sing up for Link My Books

- Go to the “Sales Channels” tab

- Click “Connect a Channel” and select Etsy

- Authorize the connection with your Etsy login

This will pull in your historical Etsy payout data for mapping.

Step 2: Link Your Xero Account

- Head to “Accounting Software” in Link My Books

- Click “Connect Xero”

- Sign in to your Xero account and grant access

Now LMB can post accurate summaries straight into Xero.

Step 3: Configure Your Tax Settings

Use the tax wizard in Link My Books:

- Set your VAT registration status

- Map Etsy sales by tax rate (standard, reduced, zero)

- Assign countries for OSS/EU VAT compliance

Link My Books will auto-apply the correct tax based on where each buyer is located.

Step 4: Set Your Sync Mode

Choose how LMB posts entries to Xero:

- Manual Mode: Review and send summaries one by one

- AutoPost Mode: Automatically sync Etsy payouts as they happen

Most sellers use AutoPost to stay hands-off.

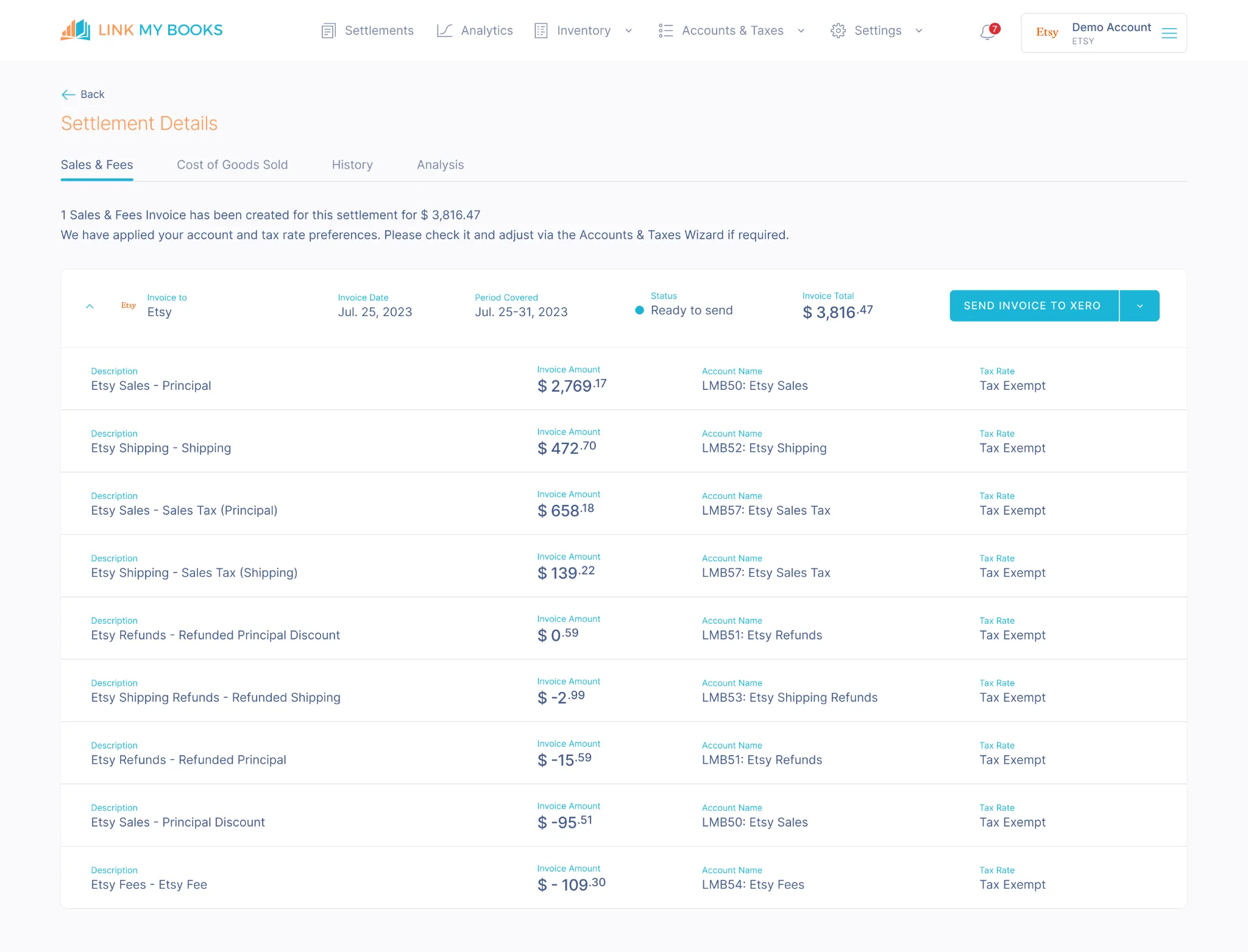

Step 5: Reconcile Payouts in Xero

Each Etsy payout appears in Xero as a single, summarised invoice.

It includes:

- Sales totals

- Refunds

- Etsy fees

- Shipping income

- Collected taxes

Just match it to your bank deposit in one click. Done. ✅

How Link My Books Makes Etsy Accounting in Xero Automatic & Easy

Link My Books is built to simplify Etsy bookkeeping. It integrates directly with popular accounting platforms like Xero and QuickBooks, syncing your Etsy sales, refunds, and fees. This eliminates the manual entry of transactions, saving you time while ensuring your records are accurate and up to date.

You can try out Link My Books for free, and simplify VAT compliance, spend more time doing what you love, running your shop.

Here’s what to expect:

Automated payout reconciliation

Link My Books automatically breaks down each Etsy payout into individual sales, refunds, fees, and taxes, and syncs them to your Xero account with perfect accuracy. It does the heavy lifting so your books stay clean, clear, and audit-ready, in just one click.

Accurate tax calculation

Selling across borders? Link My Books applies the correct VAT or sales tax rate to every transaction based on customer location and marketplace rules. That includes UK VAT, EU OSS, and international tax compliance, with no manual mapping required.

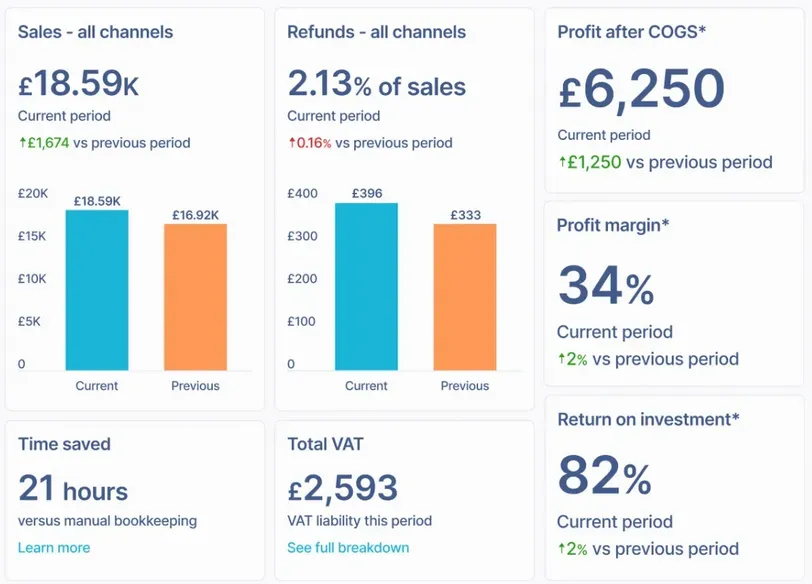

Real-time reporting and analytics

Get up-to-date, easy-to-read summaries of your Etsy financials. With Link My Books, you see what’s really happening in your business, from profit margins and sales growth to tax liabilities, all in real-time.

Benchmarking

See how your store stacks up. With anonymised industry benchmarks, you can track refund ratios, sales performance, and fee impact, and know whether you're outperforming the market or need to pivot, all using benchmarking.

How to Categorise Etsy Sales in Xero (Automatically)

Accurate bookkeeping starts with accurate categorisation. If you’re selling on Etsy, your sales report will include more than just product sales, there are fees, refunds, shipping income, and taxes all mixed in. Manually sorting those line by line in Xero? That’s not scalable.

Link My Books simplifies this by automatically mapping every element of your Etsy payout to the correct account in Xero.

Here’s what gets categorized and where it goes:

- Product sales: Broken down by country or tax rate so you stay compliant with UK VAT, EU OSS, or other regional tax rules.

- Refunds: Automatically recognized and applied to the correct accounts, ensuring your net revenue is always accurate.

- Etsy fees: Including transaction fees, listing fees, and payment processing fees — all categorized as expenses.

- Shipping income: Tracked separately from product sales so you can monitor profitability on shipping vs. costs.

- Gift wrap & personalization fees: Mapped to a separate income category so you can see how much these extras are adding to your bottom line.

- Sales tax or VAT collected by Etsy: Identified and correctly excluded from income to avoid overreporting revenue.

All of this is fully customizable.

You can edit account mappings inside Link My Books to match your chart of accounts in Xero. Whether you're working with a bookkeeper or doing it yourself, the system ensures your accounting records reflect the real structure of your business, without manual edits or late-night spreadsheet sessions.

No more mismatched accounts. No more last-minute reclassifications. Just clean, categorised data, synced daily.

Why Manually Recording Etsy Sales in Xero Is a Problem

Manual Etsy bookkeeping might seem manageable at first, until the volume picks up. Then it becomes a drain on your time, accuracy, and sanity.

Here’s what sellers get wrong:

- Etsy reports are fragmented: Sales, fees, shipping income, and taxes are spread across multiple files that don’t talk to each other.

- Fees and taxes are buried: You’ll have to dig through exports to figure out what's actually yours to keep and what went to Etsy or the tax office.

- Reconciliations become a monthly nightmare: Etsy payouts rarely match your gross sales totals because they include fees, refunds, and tax deductions, meaning every line has to be manually matched.

That’s not just annoying, it’s risky.

Spreadsheets = Mistakes. And mistakes lead to:

- Overstated revenue

- Incorrect VAT filings

- Unbalanced bank statement

- Potential audit red flags

Manual bookkeeping doesn’t scale. The more you sell, the more mistakes you risk, and the more time you waste fixing them.

What to Know About Settlement and Accrual Accounting for Etsy

Not all Etsy sellers handle accounting the same way, and that’s fine. Link My Books supports both major accounting methods so your books reflect your true financial position.

Cash Basis Accounting

You recognize income when Etsy sends the money to your bank. This is simple and often used by smaller businesses or cash-based operations.

Accrual Basis Accounting

You record income when the sale happens, not when the cash lands. This gives a clearer picture of financial performance, especially if you're managing stock, paying for ads up front, or scaling.

During setup, Link My Books automatically adjusts to your method, so whether you're running cash or accrual, you don’t need to rework a single entry. Just plug in your settings and go.

Do You Need an Accountant for Your Etsy Store if Using Xero?

Yes - but not for manual data entry. Your accountant should be focused on:

- Forecasting cash flow

- Ensuring VAT and tax compliance

- Helping you plan for growth

What they shouldn’t be doing is logging into Etsy, downloading CSV files, and manually coding transactions into Xero.

That’s where Link My Books comes in.

It handles the day-to-day Etsy bookkeeping, automatically categorizing transactions, applying tax codes, and reconciling payouts, so your accountant can spend more time giving you advice, not chasing receipts.

Think of Link My Books as your bookkeeping assistant, and your accountant as your strategic partner. Both are essential, but only one should be doing the manual labor.

Simplify Your Etsy Accounting with Link My Books

Link My Books handles the heavy lifting, from mapping every payout to the right account to applying the correct tax rates, so your books are always up to date. Whether you're reconciling hundreds or thousands of transactions, automation ensures every detail lands exactly where it should.

✅ Syncs Etsy sales, fees, and tax into Xero in real-time

✅ Handles UK VAT and OSS rules automatically

✅ Categorizes income and expenses correctly

✅ Supports multiple Etsy shops and currencies

✅ Clean, simple setup with UK-based accountant support

Stop wrestling with data exports and get your time back. 👉 Try Link My Books for free!

.webp)

.png)