For Etsy sellers, especially those operating across borders, VAT can feel like a maze of rules, rates, and potential penalties. Whether you're a small handmade shop or scaling up with international sales, understanding and complying with VAT isn't just a task, it's essential to avoid expensive mistakes.

As Etsy evolves to handle more global transactions, tax rules for sellers continue to shift, and staying on top of your VAT obligations is more critical than ever. This guide covers everything you need to know to stay compliant in 2024.

Key Takeaways from this Post

Once your Etsy sales exceed the VAT registration threshold (e.g., £90,000 in the UK), you need to register and charge VAT on applicable products. Etsy automatically collects VAT for digital products and low-value goods under £135/€150.

Etsy handles VAT for sales under €150 to EU buyers, but for higher-value orders, buyers may face customs duties. Sellers should account for these costs and inform buyers about potential extra charges.

Link My Books simplifies VAT management by automatically applying the correct VAT rate, syncing transactions with accounting software, and making VAT returns easier to file. This tool saves time and ensures compliance for Etsy sellers.

What is Etsy VAT?

Etsy VAT is the Value Added Tax applied to goods and services sold through Etsy. VAT can be automatically collected by Etsy on applicable sales, such as digital products and orders shipped to certain countries. You may also need to charge VAT depending on your registration status and sales thresholds.

Etsy calculates and collects VAT based on the buyer’s location and remits it to the relevant tax authorities, simplifying cross-border compliance for sellers.

How does VAT work in the UK?

In the UK, Value Added Tax (VAT) is a tax applied to most goods and services sold by businesses. VAT-registered businesses are responsible for charging VAT on their products or services and reporting it to HMRC through VAT returns, typically submitted every three months.

VAT Registration Threshold

You must register for VAT if your taxable turnover exceeds £90,000 in 12 months. If your turnover is below this threshold, VAT registration is optional, though businesses may voluntarily register to reclaim VAT on purchases.

VAT Rates

There are three main VAT rates in the UK:

- Standard rate (20%): Applies to most goods and services.

- Reduced rate (5%): Covers items like children's car seats and home energy.

- Zero rate (0%): This applies to essentials like most food and children’s clothing.

Responsibilities of VAT-Registered Businesses

Once registered, businesses must:

- Include VAT in the price of goods/services sold to customers.

- Report VAT charged and VAT paid on business purchases in their VAT returns.

- Pay HMRC the difference between VAT charged and VAT paid, or claim a refund if they have paid more VAT than they charged.

How does Etsy VAT work for private sellers?

For private sellers on Etsy, VAT works in a slightly different way compared to business sellers. If you're not VAT-registered, Etsy automatically handles the VAT on certain sales and fees for you. Here's a breakdown of how VAT applies:

- VAT on Buyer Purchases: For certain countries, such as those in the EU or UK, Etsy automatically collects VAT on behalf of sellers for items sold to buyers in these regions, especially for digital goods and orders under €150 shipped to the EU. As a private seller, you don’t need to manage VAT collection yourself for these transactions.

- VAT on Seller Fees: If you're located in a country where VAT applies, Etsy will charge VAT on seller fees (like listing and transaction fees) and deduct this from your balance. If you provide Etsy with a VAT ID (if you eventually register for VAT), you won’t be charged VAT on these fees.

- VAT Compliance: While Etsy helps manage the VAT on certain transactions, private sellers should still monitor their sales turnover. If your taxable turnover exceeds the VAT registration threshold (e.g., £90,000 in the UK), you will need to register for VAT and handle additional VAT compliance tasks yourself.

How can Link My Books help with your Etsy VAT

Managing VAT as an Etsy seller can quickly become overwhelming, especially when selling a variety of products that may fall under different VAT rates (standard, reduced, or zero-rated). Link My Books automates VAT calculations and ensures you're applying the correct VAT rates for every product you sell, helping you avoid costly mistakes. Here’s how:

VAT Product Grouping: Link My Books' VAT Product Grouping feature automatically organizes your products into appropriate VAT categories—standard, reduced, or zero-rated. This ensures that the correct VAT rate is applied to each product based on its classification, reducing the risk of overpaying or underpaying VAT. By accurately grouping products, you can confidently submit VAT returns without fear of non-compliance or financial errors.

For sellers managing multiple types of products, this is invaluable. Whether you’re selling zero-rated children's items or standard-rated crafts, the automated system applies the correct rate every time, protecting your profit margins and ensuring compliance with tax authorities.

Accurate VAT Reporting: When it comes time to file your VAT returns, Link My Books automatically compiles all the necessary VAT data, including product-specific tax rates. This makes submitting VAT returns to HMRC or other tax authorities straightforward and error-free. You can also track the VAT applied to each transaction, ensuring transparency and compliance.

Why Choose Our VAT Management Tool?

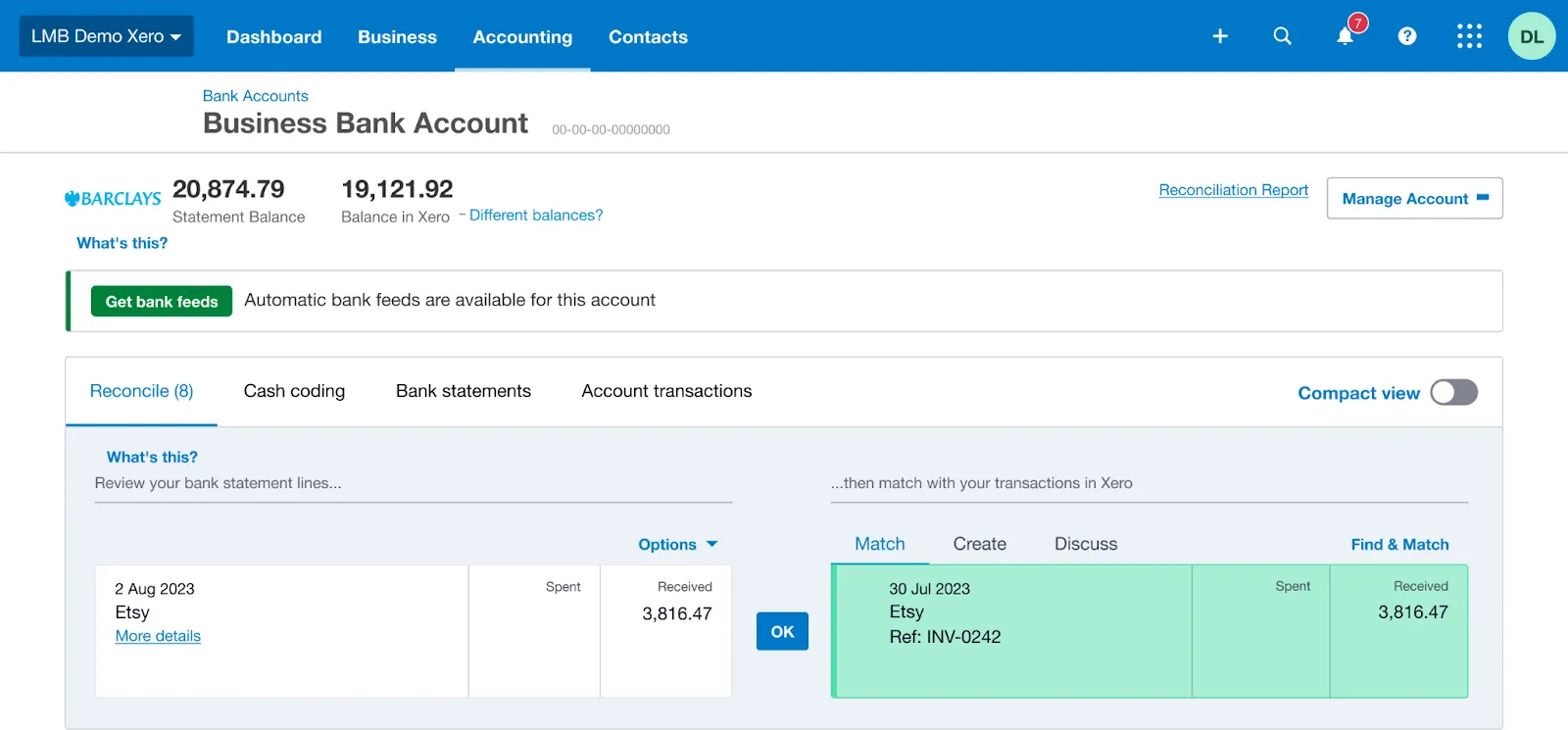

Link My Books integrates directly with popular accounting platforms like Xero and QuickBooks, syncing your Etsy sales, refunds, and fees. This eliminates the manual entry of transactions, saving you time while ensuring your VAT records are accurate and up to date.

This allows you to focus on growing your Etsy business, while Link My Books takes care of the bookkeeping details.

You can try out Link My Books for free, and simplify VAT compliance, spend more time doing what you love, running your shop.

Here’s how it works:

- Connect Etsy to Xero or QuickBooks via Link My Books: This integration ensures seamless data flow between the platforms.

- Automatic Transaction Validation: Each time you receive a payout from Etsy, Link My Books validates every transaction within that payout. It checks the details of each sale, refund, and fee to ensure the correct tax treatment is applied.

- Generate a Clean Summary: Link My Books then creates a clean summary, breaking down the payout into sales, refunds, and fees, and allocates them to the correct accounts. Importantly, it applies the correct tax rates to each transaction.

- Effortless Reconciliation: The entry in Xero matches the Etsy payout deposit exactly, allowing you to reconcile the transactions with your bank account in just one click.

VAT charges in different countries

For companies that do business within EU countries, governments have put distance selling thresholds in place. When a business sells more than the threshold in any EU country, they are required to register for VAT locally and file VAT returns accordingly.

UK Etsy sellers who sell their goods in Germany should pay VAT in the UK only, but when they hit the German threshold of €100,000 in a tax year, they must register for VAT in Germany and pay and collect VAT at the local VAT rate (19%).

EU countries (and the UK) are required to set minimum VAT rates and up to a maximum of two reduced rates. Member EU countries also offer a 0% VAT rate on some amenities, including intra-community and international transport.

How to register for VAT

It’s a straightforward process, all you need to do is:

- Determine When to Register

- Gather Necessary Information

- Register Online (Usually)

Determine When to Register

You should register for VAT when your business’s taxable turnover (the total value of your sales) exceeds the VAT threshold set by your country. The threshold varies from country to country, so check the specific rules for your location.

For the UK it’s £90,000.

Some countries also allow voluntary registration even if your turnover is below the threshold. This can be an advantage if you want to reclaim VAT for your business expenses.

Gather Necessary Information

- Business Details: Your business name, address, and contact information.

- Bank Account Details: You’ll need a bank account for VAT-related transactions.

- Unique Taxpayer Reference (UTR): If applicable, provide your UTR.

- Annual Turnover: Details about your annual sales.

Register Online (Usually)

Most countries allow online VAT registration. You’ll need a Government Gateway ID (a 12-digit series) to access the relevant tax authority’s portal.

During online registration, you may need to fill in additional forms based on your business type.

In some cases, you might not be able to register online. These include situations like:

- Applying for a temporary registration exception due to a sudden increase in turnover.

- Joining specific schemes (e.g., the Agricultural Flat Rate Scheme).

- Registering as part of a VAT group or for separate divisions/business units.

- Registering an overseas partnership.

If you fall into any of these categories, you’ll need to register by post using the appropriate form (e.g., VAT1).

Once registered, you’ll receive:

- A VAT registration number (include this on your invoices).

- Information on setting up your business tax account (if you don’t have one already).

- Guidance on when to submit your first VAT return and payment.

- Confirmation of your registration date (known as your ‘effective date of registration’).

Different VAT scenarios for Etsy sellers

By understanding these VAT scenarios, you can manage your VAT obligations efficiently and remain compliant across different tax regions.

You can also learn more about the 10 best Etsy tools for sellers that can help you with building your store.

1. Purchases that Cross the UK-EU Border

If you sell items that cross borders between the UK and the EU, you may need to deal with import VAT and customs duties. After Brexit, Etsy sellers based in the UK shipping to EU customers (and vice versa) may be subject to these additional taxes:

- UK to EU Sales: Buyers in the EU may face import VAT on goods over €150, and this could affect your pricing strategy or delivery time.

- EU to UK Sales: Similar rules apply, with import VAT potentially charged to UK buyers.

For sellers, Etsy automates VAT collection for EU orders under €150, but it’s important to understand that orders exceeding this amount will require the buyer to handle import VAT and customs

2. You Are Not VAT-Registered

If you're not VAT-registered, Etsy handles most VAT on your behalf:

- Buyer Purchases: Etsy collects VAT on sales to customers in countries where VAT is required, such as the UK and EU for both physical and digital goods.

- Seller Fees: Etsy may charge VAT on your seller fees depending on your location, but you cannot reclaim VAT on your business expenses since you're not VAT-registered.

However, keep track of your turnover—if you surpass the VAT registration threshold in your country (e.g., £90,000 in the UK), you'll need to register for VAT.

3. Flat Rate Scheme

The Flat Rate Scheme simplifies VAT reporting for small businesses by allowing you to pay a fixed percentage of your gross sales as VAT, rather than calculating VAT on each transaction. For Etsy sellers, this scheme could reduce the administrative burden if:

- You sell a wide variety of products with different VAT rates.

- You want a simplified VAT process without having to reclaim VAT on most purchases.

However, this scheme limits your ability to reclaim VAT on expenses, so it may not be suitable for sellers with significant business costs.

4. Zero, Reduced, and Standard-Rated Products

Etsy sellers may offer a mix of zero-rated, reduced-rated, and standard-rated products, each subject to different VAT rules:

- Standard-rated (20%): Most goods and services fall under this category in the UK and EU.

- Reduced-rated (5%): Items such as children's car seats and home energy.

- Zero-rated (0%): Certain essential goods like most foods and children’s clothing.

Etsy sellers must ensure that the correct VAT rate is applied to each item. For example, Link My Books can help automate VAT grouping for different product categories, ensuring that the correct rates are applied.

Does Etsy charge VAT on seller fees?

Yes, Etsy does charge VAT on seller fees in certain situations. VAT is added to fees like listing fees, transaction fees, and payment processing fees for sellers based in countries where VAT applies.

Different Regions: VAT policies differ across regions. In countries like the UK, EU, Norway, and others, VAT is charged on eligible seller fees. However, in countries like the US, VAT (or sales tax) does not apply to Etsy fees.

Etsy bills its fees to UK and EU sellers through their Irish legal entity, Etsy Ireland UC.

Ireland: Since Etsy invoices directly from Ireland, sellers in Ireland are charged a 23% Irish VAT on all fees, even if they provide their VAT number.

UK and EU (Excluding Ireland): The rules differ depending on whether or not you have submitted your VAT number to Etsy:

If you don’t provide a VAT number, Etsy treats you as a consumer under VAT laws and must apply VAT to the fees.

If you provide a VAT number, Etsy recognizes you as a business and applies the reverse charge mechanism, meaning no VAT is charged, but you still need to account for VAT on your end.

When VAT is applied using the reverse charge mechanism, Etsy does not charge VAT, and you don’t pay VAT upfront. Instead, you need to record both the input and output VAT.

Does Etsy charge VAT on advertising?

Yes, Etsy charges VAT on advertising fees in countries where VAT applies. This includes fees related to Etsy Ads, which are used to promote your listings. Just like other fees (e.g., listing and transaction fees), if you're located in a VAT-applicable country such as the UK or within the EU, Etsy will collect VAT on these advertising costs and reflect it in your account.

- If you're based in the UK or EU (excluding Ireland) and have provided Etsy with your VAT number, Etsy does not charge VAT on advertising.

- If you are in the UK or EU (excluding Ireland) and have not given your VAT number to Etsy, then Etsy will charge VAT on advertising.

- For sellers located in Ireland, Etsy always charges 23% VAT on fees, regardless of whether a VAT number has been provided.

For VAT-registered sellers in the UK and EU, who have provided their VAT ID, Etsy does not charge VAT on these fees, as the reverse charge mechanism is applied. In this case, you are responsible for declaring both the input and output VAT on your tax return, resulting in no net VAT cost but ensuring that the transaction is properly reported.

For non-registered sellers, VAT on advertising and other fees is an additional business cost that should be accounted for in your financial records

How VAT works on digital items sold on Etsy

When selling digital products on Etsy (such as printables or downloadable art), VAT is automatically calculated and collected based on the buyer’s location, not the seller's. This applies regardless of where the seller is based.

- VAT Collection: Etsy adds VAT to the buyer's total during checkout. The VAT rate applied is based on the buyer's country. For example, if a customer from the UK purchases a digital product, 20% VAT is added to the sale price.

- Who Pays VAT: The buyer sees the price with VAT included. Etsy collects this VAT during the transaction and remits it directly to the relevant tax authorities, meaning sellers do not handle the VAT themselves for digital products.

- Etsy-Generated VAT Invoices: If a buyer requests a VAT invoice, it will be issued by Etsy, not the seller, as Etsy collects and remits the VAT. Sellers do not need to include this in their bookkeeping as Etsy handles the reporting.

- Impact on Sellers: Sellers need to consider the final price displayed to customers, as it will vary depending on the buyer’s location and local VAT rates. This could affect pricing strategy and profit margins when selling internationally.

What to do with a mixture of VAT-rated products

What to Do with a Mixture of VAT-Rated Products on Etsy

When selling products with different VAT rates (e.g., standard-rated, reduced-rated, or zero-rated goods), Etsy sellers must ensure each product is taxed appropriately. Here's how to manage a mix of VAT-rated products:

Categorize Products by VAT Rate: Identify which VAT rate applies to each product:

- Standard-rated (20%): Most goods.

- Reduced-rated (5%): Some items, such as energy-saving materials.

- Zero-rated (0%): Certain essentials like most foods and children’s clothing.

Accurate VAT Application: If you are VAT-registered, ensure your listings reflect the correct VAT rate for each product. Tools like Link My Books can automate this process, applying the right VAT rate based on the product type and syncing it with your Etsy accounting software.

Over and Under-Paying VAT for Etsy Sellers

Overpaying VAT occurs when you charge more VAT than required, often due to incorrect categorization of products. This can hurt your profit margins.

Underpaying VAT can lead to penalties from tax authorities if you fail to charge the correct amount of VAT. To avoid this:

- Regularly review VAT rules for your product categories.

- Use automation tools to prevent errors in VAT calculations.

Other Considerations for Etsy VAT

Customs Duty

Customs duty applies to goods imported from outside the UK or EU. For Etsy sellers shipping across borders, customs duties might affect the final price. It’s important to factor in customs when pricing your products for international sales, especially if selling physical goods

Import VAT

Since Brexit, VAT rules have become more complicated for sellers shipping between the UK and EU. For UK sellers sending products to the EU import VAT may be charged upon delivery, depending on the value of the goods.

If you're selling from the EU to the UK, similar rules apply, and import VAT may be owed by your UK customers.

If you are VAT-registered, you can reclaim import VAT through your VAT return.

Invoicing for VAT

If you are VAT-registered, you are required to issue VAT-compliant invoices for B2B sales. The invoice should include:

- Your VAT registration number

- The VAT rate and total VAT amount

- The net and gross prices

How to Remit VAT

As a VAT-registered seller, you must file VAT returns regularly (typically quarterly). The return will include:

- Total VAT you charged to customers

- VAT you paid on business-related purchases (such as import VAT)

- Any adjustments from over or underpayments

Etsy automatically collects and remits VAT on orders under €150 for EU customers, but you need to account for the correct VAT rates in each country if you're shipping from within the EU or exceeding that value.

Using tools like Link My Books can streamline this process by automatically syncing your sales and fees from Etsy with your accounting software, making your Etsy accounting stress-free.

What about VAT for non-EU-based selling partners?

Import VAT is also payable when goods enter the UK or EU from non-EU countries. Etsy sellers importing products from abroad must ensure that import VAT is correctly recorded and reported.

For non-EU-based Etsy sellers, VAT obligations vary depending on the region they are selling to, especially if shipping products to EU or UK customers. Here’s how VAT typically works for non-EU-based selling partners:

VAT on EU Sales

As of July 2021, for non-EU sellers shipping goods to the EU, Etsy collects VAT on orders under €150 at checkout. This applies to both digital and physical products. Sellers do not need to handle VAT directly for these sales, as Etsy collects and remits the tax to the appropriate EU tax authorities.

For orders over €150, customs duties and VAT are typically paid by the buyer upon receipt of the goods. Non-EU sellers should make buyers aware of these potential extra costs, as it may impact the customer's purchasing decision.

VAT on UK Sales

Post-Brexit, similar rules apply to the UK. For orders under £135, Etsy collects and remits VAT directly to HMRC. For orders above this threshold, VAT and potential customs duties are handled by the buyer when the goods arrive in the UK. Non-EU sellers do not need to register for VAT in the UK if Etsy handles the VAT on their behalf

Digital Products

For digital goods sold to EU or UK customers, Etsy automatically calculates, collects, and remits VAT based on the customer’s location. Non-EU sellers don’t need to worry about managing VAT on these sales, but they should be aware that the final price shown to the customer will include VAT.

Key Considerations:

- VAT Thresholds: Non-EU sellers shipping to the EU or UK need to be mindful of the VAT thresholds (€150 for the EU, £135 for the UK) and inform buyers of any potential additional costs if the order exceeds these limits.

- Reclaiming VAT: Non-EU sellers generally cannot reclaim VAT on their purchases unless they have a registered business in the EU or UK.

FAQ on Etsy VAT

Does Etsy notify HMRC?

Yes, Etsy reports VAT directly to HMRC on behalf of sellers when necessary. For orders under £135 shipped to the UK, Etsy collects VAT at checkout and remits it to HMRC without sellers needing to manage this aspect. This is part of Etsy's VAT compliance process, especially post-Brexit.

Where do I get a VAT invoice from Etsy?

Sellers can access their VAT invoices through Etsy's Payment Account:

- Log in to Etsy

- Navigate to Shop Manager > Finances > Payment Account

- Download VAT invoices for the relevant period

Etsy provides a breakdown of VAT charged on seller fees such as listing and transaction fees

3. Why is Etsy adding VAT to my listing?

Etsy adds VAT to listings based on the buyer's location. VAT is automatically applied at checkout for customers in VAT-applicable regions like the EU or UK, to ensure compliance with local tax laws. This applies particularly to digital products and physical goods under regional VAT thresholds (e.g., £135 in the UK, €150 in the EU)

4. Do I need a VAT number before selling on etsy?

You do not need a VAT number to start selling on Etsy unless you meet your country’s VAT registration threshold (e.g., £90,000 annual turnover in the UK). However, once you exceed the VAT threshold or if you want to reclaim VAT on business expenses, you’ll need to register for VAT and provide your VAT ID to Etsy.

5. How does Etsy handle VAT collection and remittance?

Etsy automatically handles VAT collection and remittance for applicable sales:

- For orders shipped to the EU or UK under their VAT thresholds, Etsy collects VAT at checkout and remits it to the respective tax authorities.

- For digital products, VAT is also collected and remitted based on the buyer's country.

Sellers do not need to manually collect VAT or handle the remittance in these cases, but VAT may still need to be reported in some instances.

6. Is there a VAT requirement in the US for Etsy buyers and sellers?

The US does not have VAT, but it has sales tax. Etsy collects and remits sales tax in states where it is required under marketplace facilitator laws. US-based Etsy sellers are generally not subject to VAT unless they sell to EU or UK customers.

7. Who is responsible for VAT on cross-border sales on Etsy?

For cross-border sales, Etsy takes responsibility for collecting and remitting VAT on orders under the EU threshold of €150 or the UK threshold of £135. Sellers are responsible for ensuring compliance for larger orders, where VAT and customs duties may be paid by the buyer upon delivery.

Make your Etsy VAT calculations simple with Link My Books

Managing VAT as an Etsy seller can be complicated, especially when you’re dealing with different VAT rates, cross-border sales, and the complexities of compliance. Link My Books simplifies this entire process, automating VAT calculations so you can focus on growing your Etsy shop.

Ready to simplify your Etsy VAT calculations and save time on manual bookkeeping? Let Link My Books automate your VAT reports.

Start your free trial today and make VAT easy!

DISCLAIMER

We are not Tax Advisors and so our guidance and suggestions on the application of tax rules cannot be construed as tax advice. We highly recommend that you seek advice from qualified accountants for tax compliance.

.webp)

.png)