Selling on Etsy is exciting, but managing your finances can be challenging. If you’re manually entering sales, fees, and refunds into QuickBooks, you’re not only wasting hours each month, you’re also at risk of costly errors that could affect your tax reporting.

The good news? There’s an easier way.

In this guide, we’ll walk you through the exact steps to record Etsy sales in QuickBooks, including:

- How to categorize Etsy transactions properly

- The fastest way to reconcile Etsy payments

- Why automation with Link My Books is the best solution for accurate bookkeeping

Key Takeaways from this Post

Manual bookkeeping leads to errors and wasted time: Incorrectly categorized transactions, missed fees, and reconciliation issues can create financial inaccuracies that impact tax reporting and business decisions.

Proper categorization of Etsy transactions is essential: To keep your books accurate, Etsy sales, refunds, fees, and VAT must be categorized correctly in QuickBooks.

Automation is the best way to record Etsy sales in QuickBooks: Using an integration like Link My Books eliminates manual data entry, ensuring all Etsy transactions sync directly into QuickBooks with the correct categories.

How to Record Etsy Sales in QuickBooks

- Download your Etsy sales report

- Categorize Etsy income and expenses properly

- Import transactions into QuickBooks

- Reconcile your Etsy payments with your bank account

- Automate everything with Link My Books

Let’s go through each step in detail.

Step 1: Download Your Etsy Sales Report

Before you start recording Etsy sales in QuickBooks, you’ll need to export your transaction data.

How to download your Etsy sales report

- Log into Etsy Seller Dashboard

- Go to Settings > Finances > Payment Account

- Click Download CSV

- Select the date range you need and export the file

This report includes sales, fees, refunds, and Etsy VAT, which we’ll categorize in QuickBooks next.

Step 2: Categorize Etsy Income & Expenses Properly

Manually recording Etsy sales in QuickBooks can lead to misclassified transactions. Here’s how to categorize them correctly:

Transaction Type

QuickBooks Category

👉 Tip: Using QuickBooks’ Etsy-specific categories will help you avoid tax issues later.

Step 3: Import Transactions into QuickBooks

Now, let’s get the data into QuickBooks. You can do this manually or automatically.

Manual Import (Time-Consuming & Risky)

- Open QuickBooks Online

- Go to Transactions > Banking

- Click Upload Transactions

- Select your Etsy CSV file and map the categories

🚨 Warning: Manual imports require careful review to avoid duplicate entries or incorrect categorization.

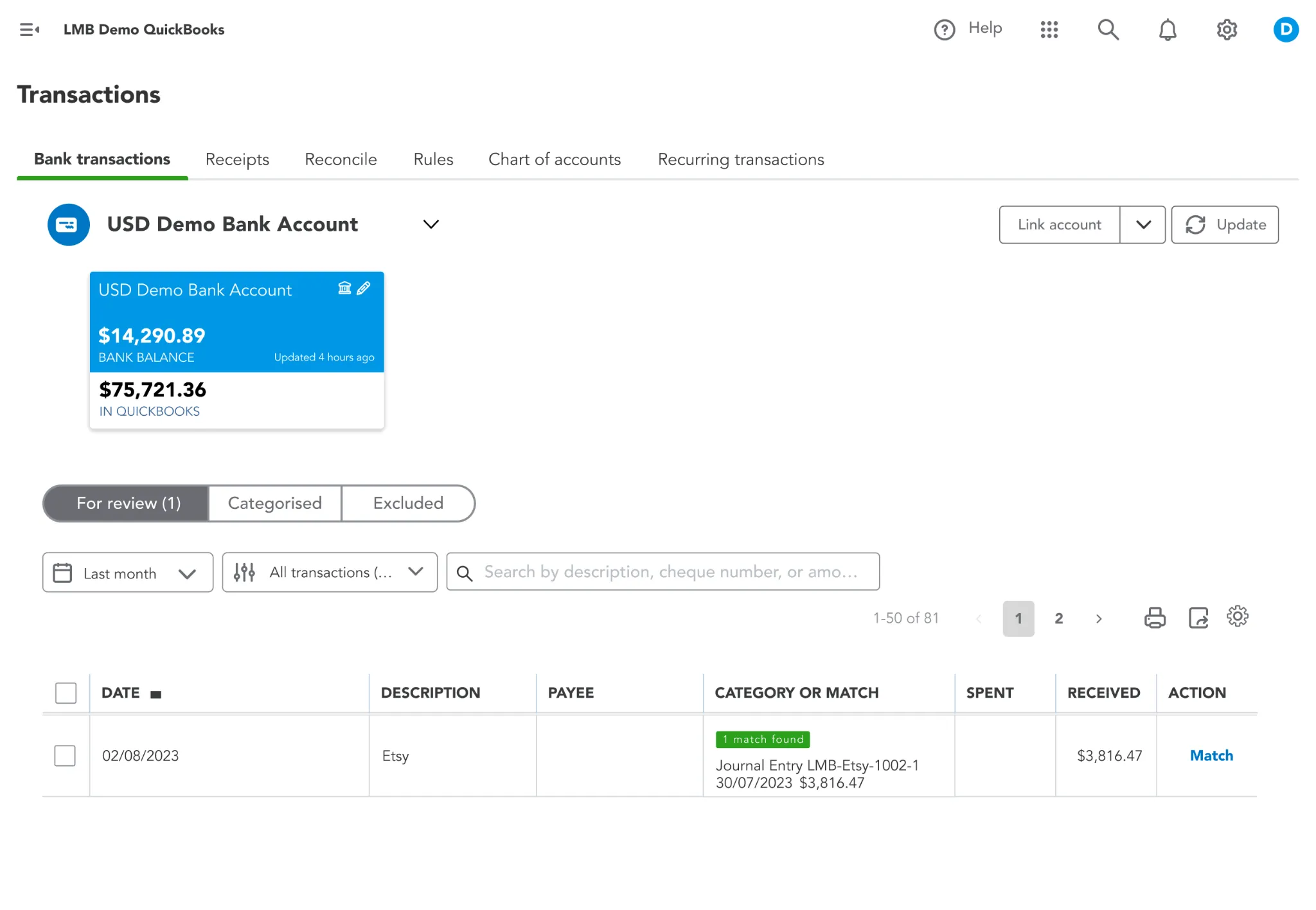

Step 4: Reconcile Your Etsy Payments with Your Bank Account

Once the sales are recorded, you need to match Etsy payouts with your bank deposits.

How to reconcile Etsy deposits in QuickBooks

- Go to Transactions > Banking

- Select your Etsy deposit

- Match it to recorded sales, minus fees

- Confirm the match and save

If the amounts don’t match, check for outstanding fees or refunds.

Step 5: Automate Everything with Link My Books

QuickBooks offers a direct integration with Etsy via the QuickBooks Connector for Etsy. The app can help you record your sales, but it has some limitations compared to Link My Books.

What the QuickBooks Connector for Etsy Does

- Syncs Etsy sales directly into QuickBooks

- Imports Etsy fees and expenses

- Matches Etsy deposits to bank transactions

Limitations of the QuickBooks Connector

- No proper VAT or sales tax breakdown – Can lead to tax compliance issues

- Limited automation for categorization – Some manual adjustments may still be required

- No multi-channel support – Only works with Etsy, while Link My Books supports Amazon, eBay, and Shopify

- Doesn’t summarize transactions – Unlike Link My Books, which creates clean, summarized invoices

Why Link My Books is a Better Alternative

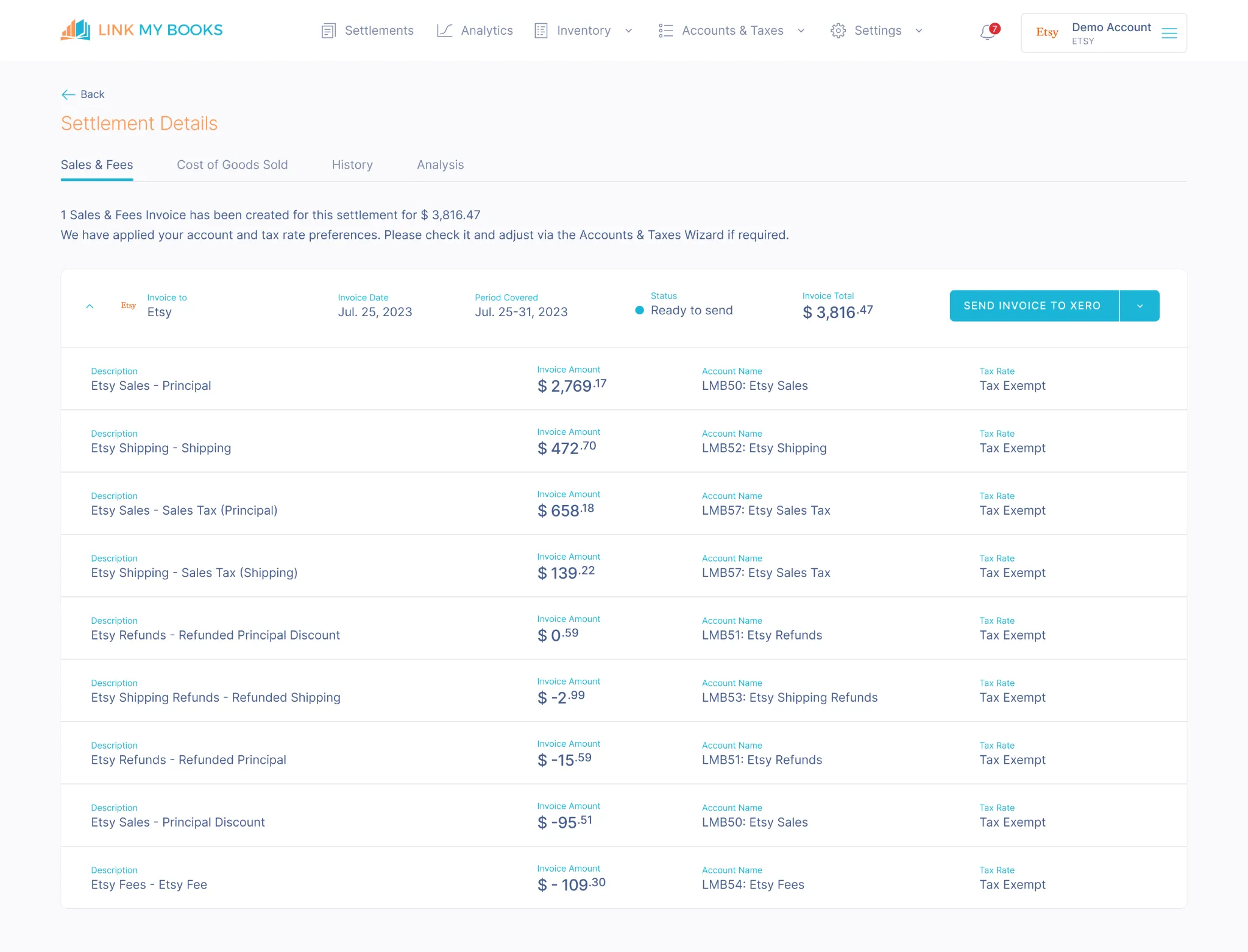

Link My Books goes beyond simple transaction imports by fully automating your Etsy bookkeeping, ensuring accurate tax and VAT handling. This means QuickBooks reflects the correct financial data without extra manual work.

- Automatically imports Etsy sales, fees, and VAT into QuickBooks

- Categorizes transactions correctly, eliminating manual errors

- Reconciles deposits with your bank account automatically

👉 Stop wasting time on manual bookkeeping – Start your free trial of Link My Books today!

Recording Etsy Sales in QuickBooks Desktop

If you’re using QuickBooks Desktop, follow these steps:

- Download Etsy sales report (CSV format)

- Open QuickBooks Desktop and go to File > Utilities > Import

- Select Excel or CSV file, then map your Etsy data fields

- Categorize sales, fees, and refunds correctly

- Reconcile deposits with your bank statement

Step 1: Download Your Etsy Sales Report

Before importing transactions, you need to download your Etsy sales data.

- Log into your Etsy Seller Dashboard.

- Go to Settings > Finances > Payment Account.

- Click Download CSV.

- Select the appropriate date range and download the file.

This file will contain details on sales, refunds, fees, and VAT, all of which need to be categorized correctly.

Step 2: Import the CSV File into QuickBooks Desktop

- Open QuickBooks Desktop.

- Go to File > Utilities > Import.

- Select Excel or CSV file.

- Choose the Etsy sales report you downloaded and click Open.

- Follow the prompts to map the Etsy data fields to QuickBooks categories.

Not all data will match up automatically, so some manual adjustments may be necessary.

Step 3: Categorize Etsy Sales, Fees, and Refunds

To maintain accurate records, categorize your transactions properly:

Step 4: Reconcile Etsy Payouts with Your Bank Statement

Etsy deposits funds into your bank account after deducting fees and refunds, so the deposit amount will not match total sales.To reconcile Etsy deposits:

- Open QuickBooks Desktop and go to Banking > Reconcile.

- Select the bank account where you receive Etsy payouts.

- Match the Etsy deposit with the recorded sales minus fees and refunds.

- If the amount does not match, verify any missing transactions or processing delays.

Key Consideration: No Link My Books Support for QuickBooks Desktop

If you're using QuickBooks Desktop, Link My Books is not compatible with automation. You will need to manually import and categorize transactions.For QuickBooks Online users, Link My Books provides full automation, eliminating manual data entry and ensuring accurate bookkeeping.

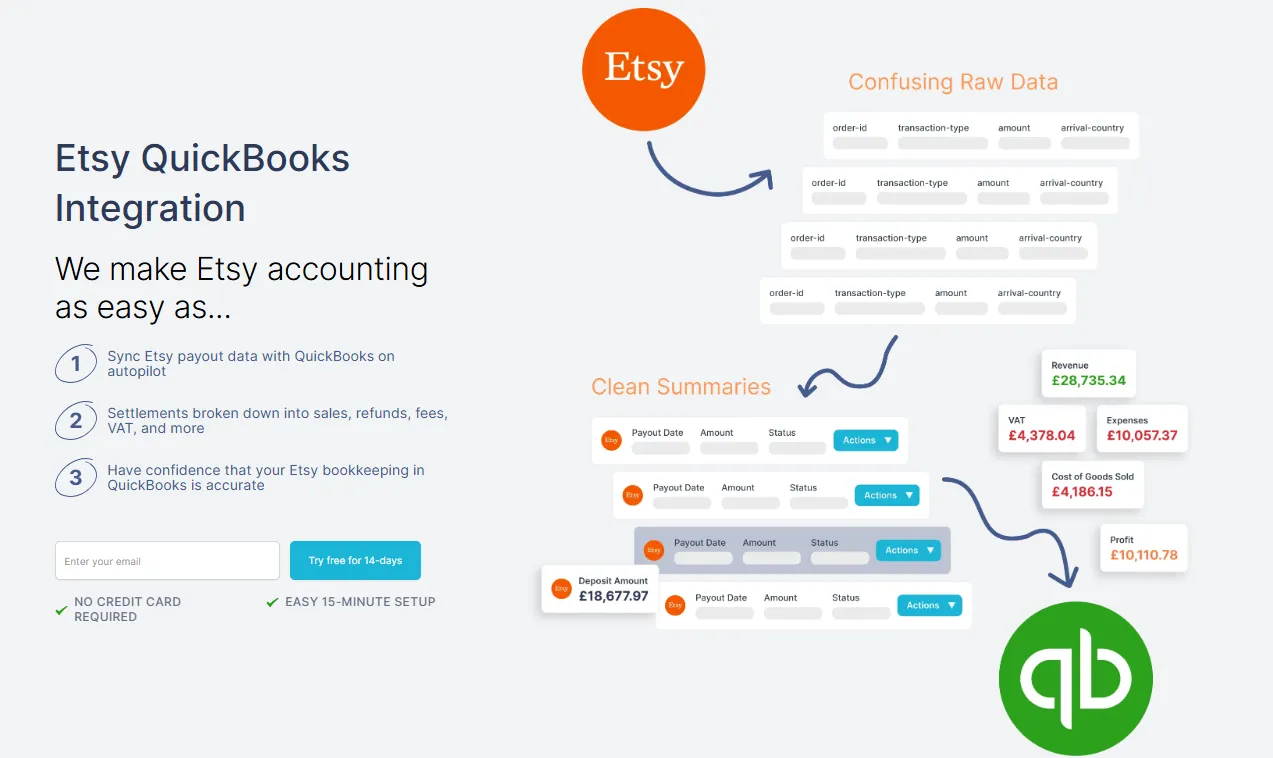

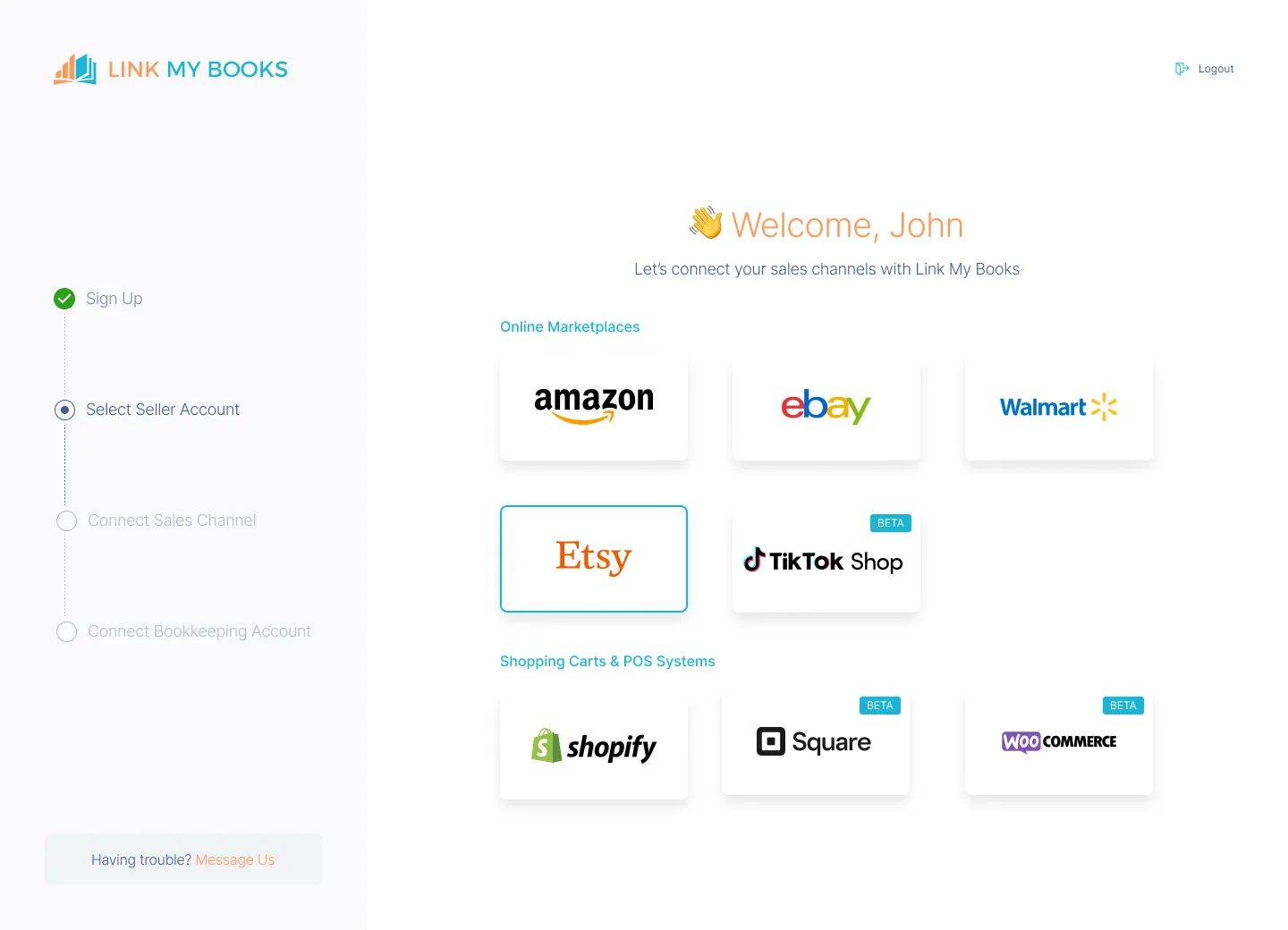

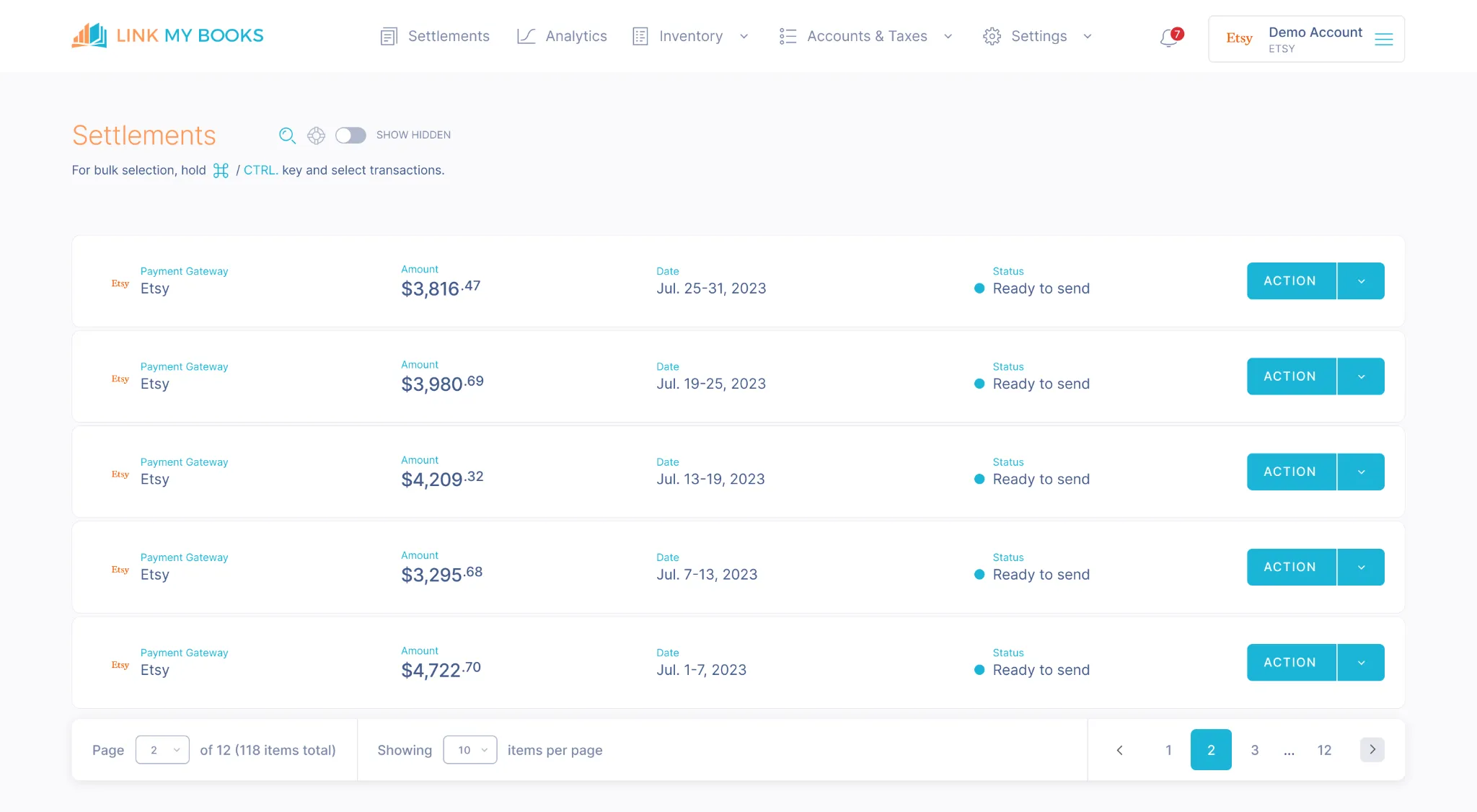

How Link My Books Makes Recording Etsy Sales in QuickBooks Automatic & Easy

Link My Books integrates directly with QuickBooks, syncing your Etsy sales, refunds, and fees. This eliminates the manual entry of transactions, saving you time while ensuring your records are accurate and up to date.

This allows you to focus on growing your Etsy business, while Link My Books takes care of the bookkeeping details.

You can try out Link My Books for free, and simplify your accounting, spend more time doing what you love, like running your shop.

Here’s how it works:

- Connect Etsy to QuickBooks via Link My Books: This integration ensures seamless data flow between the platforms.

- Automatic Transaction Validation: Each time you receive a payout from Etsy, Link My Books validates every transaction within that payout. It checks the details of each sale, refund, and fee to ensure the correct tax treatment is applied.

- Generate a Clean Summary: Link My Books then creates a clean summary, breaking down the payout into sales, refunds, and fees, and allocates them to the correct accounts.

- Effortless Reconciliation: The entry in Xero matches the Etsy payout deposit exactly, allowing you to reconcile the transactions with your bank account in just one click.

👉 Try Link My Books for Free 👈

How to Categorize Etsy in QuickBooks

Accurate categorization of Etsy transactions in QuickBooks is essential for proper bookkeeping, tax compliance, and financial reporting. Every sale, fee, and refund must be assigned to the correct account to ensure that your records match reality.

Best Practices for Categorizing Etsy Transactions

- Separate income from expenses – Sales, fees, and refunds should each have distinct categories.

- Use consistent naming conventions – This makes tax reporting easier.

- Match QuickBooks categories with Etsy transaction types – This prevents errors when reconciling deposits.

Recommended QuickBooks Categories for Etsy Sellers

How to Categorize Etsy Transactions in QuickBooks Online

- Go to Transactions > Banking in QuickBooks Online

- Click on the Etsy transaction you want to categorize

- Select the correct category from the table above

- Add a memo if needed for additional details

- Click Save

If you're manually importing Etsy transactions, you can also set up Rules in QuickBooks to automatically categorize similar transactions in the future.

Why Manually Recording Etsy Sales in QuickBooks is Problematic

Many Etsy sellers start by manually entering their sales into QuickBooks, thinking it will be a simple process. However, as sales volume grows, manual bookkeeping becomes time-consuming, error-prone, and difficult to manage. Here’s why manually recording Etsy sales in QuickBooks is not the best approach.

1. High Risk of Errors

Manually entering sales, fees, and refunds increases the risk of:

- Incorrect data entry: Typing mistakes can lead to financial discrepancies.

- Misclassified transactions: Fees and refunds might be recorded incorrectly.

- Duplicate entries: Transactions could be counted twice, inflating revenue or expenses.

These errors can cause inaccurate financial reports, making it difficult to track profitability and prepare for tax filings.

2. Time-Consuming and Inefficient

Each Etsy transaction includes multiple components, sales, refunds, processing fees, and VAT, which must be recorded separately in QuickBooks. If you’re entering transactions manually, you’ll need to:

- Download Etsy reports regularly

- Manually input sales, refunds, and fees

- Match Etsy payouts to bank deposits

For high-volume sellers, this process can take hours each month, reducing the time available for growing the business.

3. Sales Tax and VAT Complexity

Etsy automatically collects and remits sales tax in many locations. However, if tax transactions are not properly categorized in QuickBooks, you could:

- Overpay or underpay taxes

- Have missing or inaccurate VAT records

- Struggle with tax reporting and audits

Without automation, it’s easy to misclassify tax-related transactions, leading to compliance issues.

4. Bank Reconciliation Challenges

Etsy does not deposit the full sales amount into your bank account. Instead, it deducts fees and refunds before making a payout. This creates issues when reconciling in QuickBooks:

- The Etsy sales total does not match the deposit amount

- Fees and refunds need to be manually matched to payouts

- Any discrepancies require extra time to track down and adjust

5. No Scalability for Growing Sellers

As your Etsy store grows, so does the volume of transactions. Manually recording every sale becomes impractical, leading to:

- Delays in bookkeeping: Transactions pile up and become overwhelming.

- Inaccurate financial tracking: It’s harder to see a clear picture of your business performance.

- Increased bookkeeping costs: If you hire an accountant to handle this manually, costs can rise significantly.

This is why opting for Etsy accounting software makes more sense for sellers who are looking to streamline tier accounting.

Automate Etsy Bookkeeping with Link My Books

Manually entering Etsy sales into QuickBooks is time-consuming, error-prone, and inefficient, especially as your store grows. Link My Books automates the entire process, eliminating the need for manual data entry while ensuring accuracy.

If you’re ready to save time and simplify your bookkeeping, Link My Books is the best solution for Etsy sellers.

👉 Try Link My Books for Free 👈

.webp)

.png)