If you’re selling on eBay and registered for VAT, there’s a good chance you’re overpaying. eBay fees include VAT - but if you don’t reclaim it, that money’s gone. Forever.

And the worst part? Many sellers don’t even realize they can claim it back.

Between vague invoices, confusing tax rules, and the maze of reports in your eBay account, it’s easy to overlook the refund you're legally entitled to. That’s money off your bottom line, month after month.

In this guide, we’ll show you exactly how to identify, calculate, and claim your VAT refund on eBay fees in 2025. You’ll also learn how to automate the process with Link My Books and avoid missing out again.

Key Takeaways from this Post

You can claim VAT back on eBay seller fees - but most sellers don’t: If you're VAT registered and eBay charges you fees with VAT included, you're entitled to reclaim it.

eBay’s reporting makes VAT recovery harder than it should be: Between missing data points, confusing invoices, and inconsistent tax breakdowns, manually tracking what’s reclaimable is tedious and error-prone.

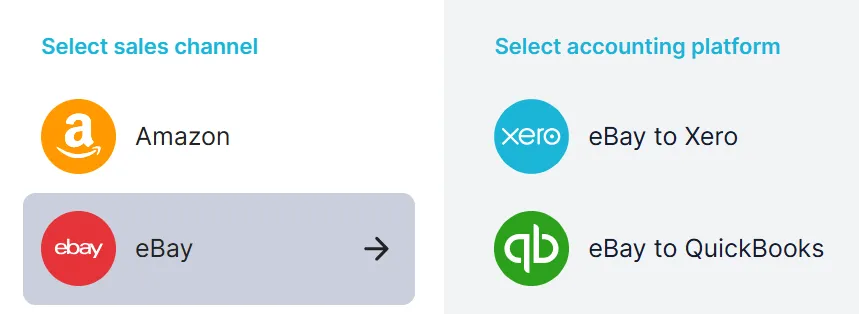

Link My Books automates VAT calculations and syncs them with your accounts: Link My Books pulls in fees, applies the correct VAT treatment, and posts it directly to Xero or QuickBooks - accurately and audit-ready.

What Most Sellers Get Wrong About eBay & VAT

A common pitfall for many eBay sellers is the misunderstanding that VAT on seller fees is a sunk cost, an inevitable part of online selling.

This misconception overlooks the crucial aspect of VAT recovery, potentially leaving substantial sums of money unclaimed.

The reality is that reclaiming VAT on eBay seller fees is not only permissible but encouraged for VAT-registered businesses.

This section shines a light on the intricacies of VAT within the eBay selling environment, backed by the streamlined accounting solutions from Link My Books, designed to simplify these processes for sellers.

Understanding the eligibility for VAT refund, the types of fees you can claim, and the correct process to follow can transform your approach to handling VAT, turning what is often seen as a financial burden into an opportunity for savings.

Who Can Claim Back VAT Paid on eBay Seller Fees?

Not every eBay seller is eligible to claim back VAT on seller fees. This privilege is reserved for VAT-registered businesses within the UK and the EU. Whether you're a sole trader, running a partnership, or operating a limited company.

If you're registered for VAT and use eBay as a platform for your sales, you may be eligible to reclaim the VAT paid on various eBay seller fees. This section details the criteria for eligibility, providing sellers with a clear understanding of who can benefit from VAT refunds.

Which eBay Fees Can I Claim a Refund of VAT On?

eBay charges sellers various fees, including listing fees, final value fees, shop subscription fees, and promotional fees.

Not all sellers realize that VAT paid on these fees can be reclaimed. This section outlines the specific eBay fees on which VAT can be refunded, guiding sellers on what to look for in their invoices and account statements to maximize their VAT recovery.

What Do I Need to Do to Reclaim the VAT Paid on eBay Fees?

If you're a VAT-registered business, this means you pay VAT on eBay fees, but you can (and should) reclaim that VAT on your VAT return.

The catch? eBay invoices aren’t always clear or easy to reconcile - especially across multiple countries and currencies.

📌 In the EU, eBay typically charges VAT based on your business location. If you're registered in Germany, for example, and eBay charges you 19% German VAT on seller fees, you can reclaim that input VAT in your return.

How to Claim a VAT Refund on eBay Seller Fees

Claiming VAT back on your eBay seller fees takes a few key steps - but every one matters if you want to stay compliant and avoid missing money you're owed.

Step 1: Confirm Your VAT Registration

You must be VAT registered to claim any VAT refund. If you're over the £85,000 annual turnover threshold, registration is mandatory. But even below that, voluntary registration can make sense if you're paying VAT on fees and purchases.

Step 2: Download Your eBay Fee Invoices

Log into your eBay account and download your monthly fee invoices. These documents show the VAT you've been charged - without them, you can't make a valid claim.

Step 3: Add the Figures to Your VAT Return

Review your VAT return and include the VAT from eBay seller fees in the input tax section. Make sure everything lines up with your invoices to avoid errors or HMRC queries.

Step 4: File Your Return

Submit your return through HMRC’s portal or your accounting software. Double-check everything before submission to ensure your claim is accurate.

Step 5: Keep All Records

Store your eBay invoices and VAT return details. If HMRC audits you or asks for proof, you’ll need to show exactly what you claimed and why.

Manual vs. Automated VAT Refunds on eBay Fees

Manual Process

- Gather invoices manually from your eBay account.

- Calculate VAT and enter the amounts into your VAT return.

- File with HMRC using your accounting software or directly online.

Using Accounting Software

- Connect eBay to your software. Some tools auto-import fee invoices.

- Let the eBay bookkeeping software auto-fill your VAT return with the reclaimable amounts, streamlining the submission process.

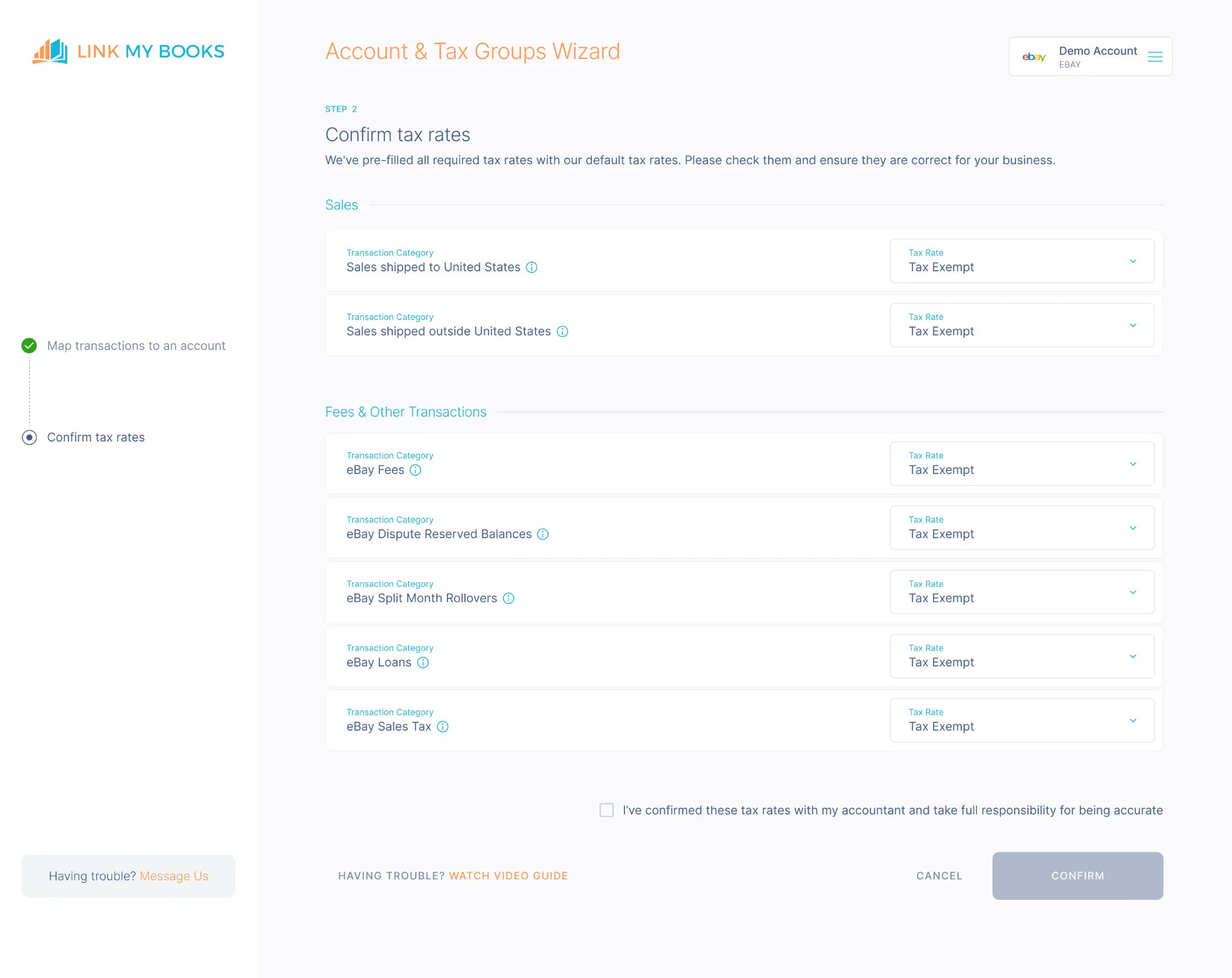

With Link My Books

- Connect your eBay account. Link My Books pulls in all fee data automatically.

- VAT is auto-calculated and posted to Xero or QuickBooks using the correct tax codes.

- Your return is ready to file with accurate, audit-proof records - no manual effort required.

How Long Does a VAT Refund Take?

VAT refunds are typically issued within 4 to 8 weeks of submitting your return. Staying organized - especially with clean records and correct invoice data - can speed things up.

Claim every penny of VAT you're owed - with a free 14-day trial.

How to automate your VAT calculations with Link My Books

Link My Books simplifies eBay accounting by automating VAT tracking on seller fees. It pulls in your sales, fees, and refunds, applies the right VAT treatment, and posts everything straight to Xero or QuickBooks. You save hours each month - and stay fully compliant without lifting a finger.

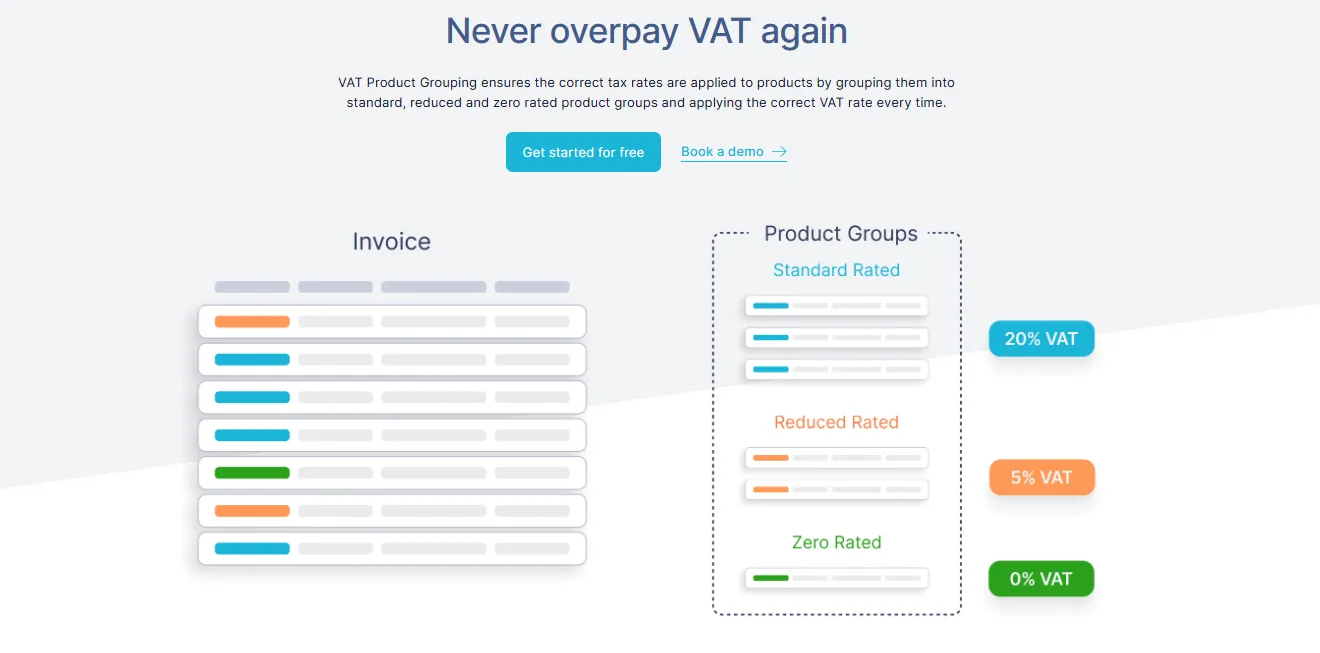

Automated VAT recognition & grouping

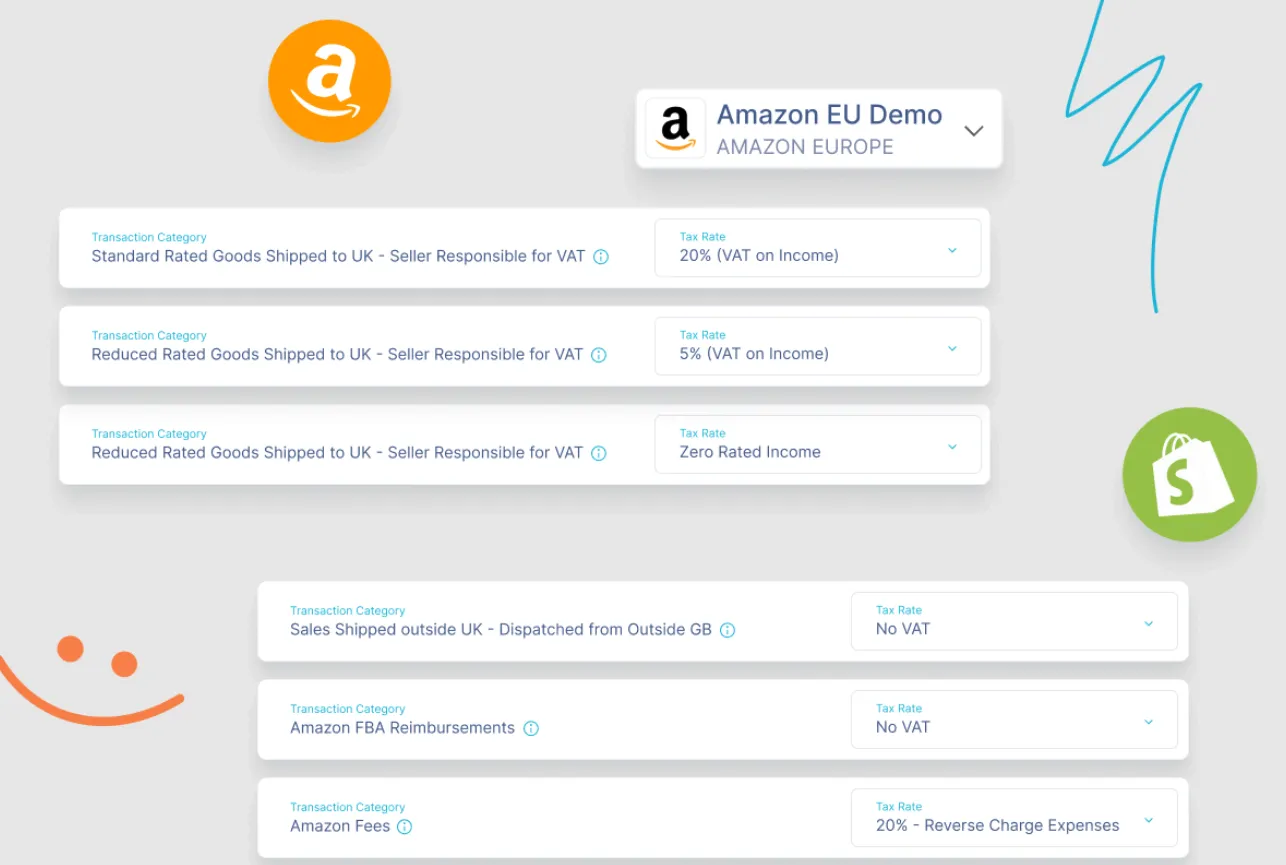

Link My Books connects directly with your eBay Managed Payments account, imports fee data, and automatically applies the correct VAT rate for each transaction - whether it's the standard UK rate, zero-rated exports, or varied EU rates.

It even supports zero, reduced, and standard-rate VAT goods through its smart product grouping feature.

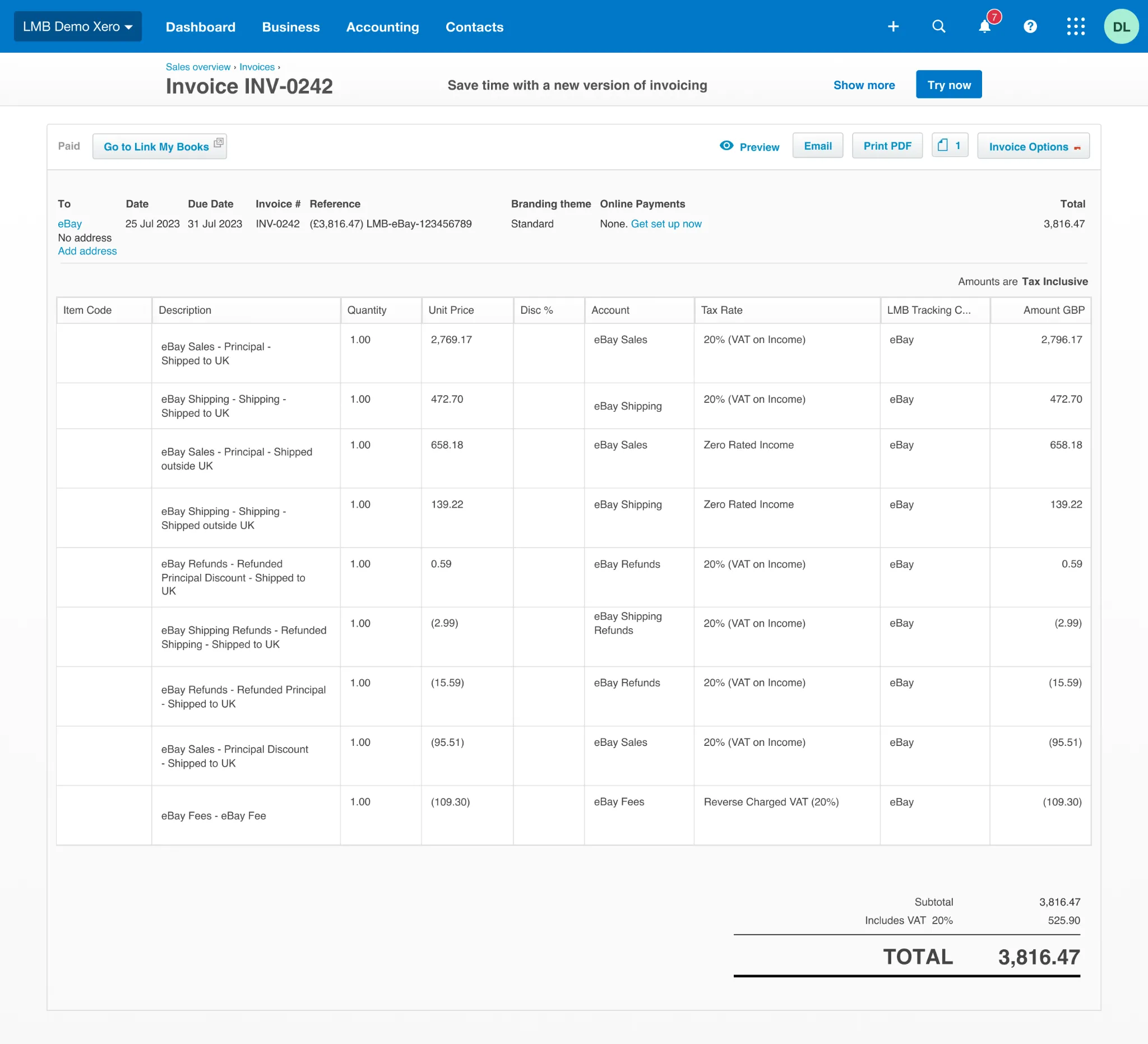

VAT-inclusive invoice breakdowns

For every eBay payout, the platform generates a clean, summary invoice that mirrors your bank deposit. It separates sales, fees, refunds, and crucially, splits out VAT-paid on seller fees for easy refund claims.

Manage complex VAT setups

Whether you hold multiple EU VAT registrations, use the UK VAT Margin Scheme, or sell internationally, Link My Books' guided VAT Tax Wizard configures your account in minutes. It handles import VAT and cross-border rules too.

Seamless integration with Xero & QuickBooks

It doesn't just calculate VAT - it posts everything into Xero or QuickBooks with the correct tax codes and fully audit-ready entries. Payout invoices reconcile perfectly with your bank feeds - no manual entry, no reconciliation headaches.

Built-in VAT compliance & support

Multi-currency VAT, Marketplace Facilitator scenarios, OSS reporting - you’re covered. Link My Books maintains compliance, prevents over- or under-paying, and its support team is qualified accountants who help onboard and configure your eBay VAT correctly.

Why this matters: Link My Books transforms VAT from a liability into a streamlined, automated process - reducing your monthly admin from hours to minutes and ensuring you never leave VAT refunds unclaimed again.

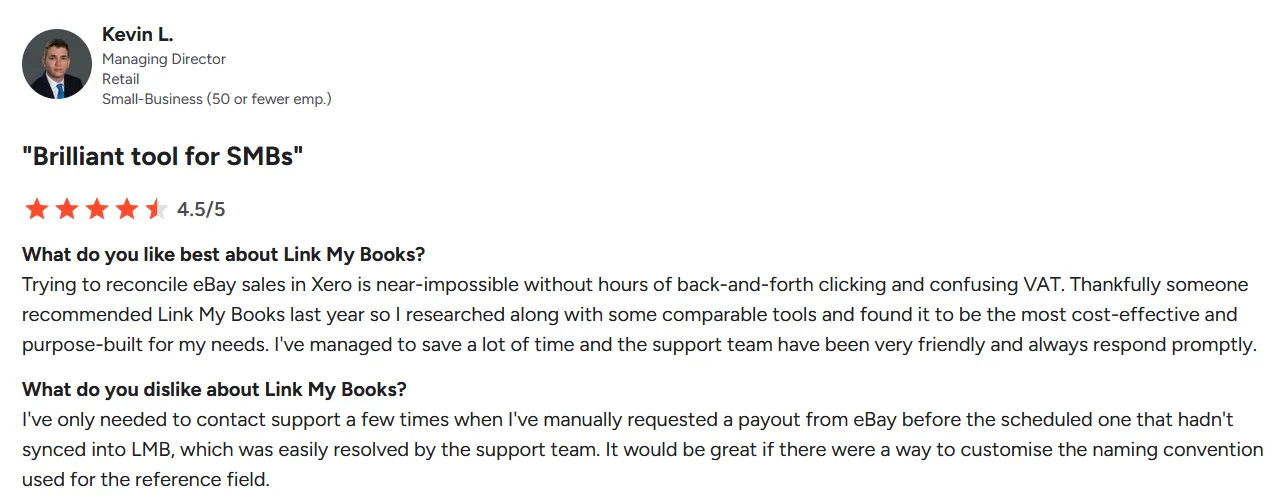

Why Sellers Choose Link My Books Over Other Tools

Built-in eCommerce expertise: Link My Books isn’t generic accounting software - it’s purpose-built for online sellers. Every feature is designed to solve real problems like VAT on seller fees, multi-channel reporting, and payout reconciliation.

Support that actually knows VAT: No bots. No scripted agents. Link My Books’ support team is made up of qualified accountants who understand the ins and outs of eBay, VAT, and e-commerce bookkeeping. They speak your language - and they’ve got your back.

Better value than competitors: Link My Books delivers the same automation, faster setup, and deeper VAT handling - for around 30% less than the competition. No compromise on features. Just more profit in your pocket.

When you connect Link My Books to your eBay account, VAT refunds are just the start. You’ll unlock clean books, accurate tax records, and hours of your time back - month after month.

Stop overpaying VAT - set up Link My Books in under 15 minutes with a free 14-day trial.

What do I need to know about eBay VAT refunds in Europe?

When it comes to eBay VAT refunds in Europe, here are the key things you need to know - especially if you’re VAT-registered and selling cross-border:

You Must Have a Valid VAT Invoice

To legally reclaim VAT, you need a proper VAT invoice from eBay that includes:

- eBay’s VAT number

- Your VAT number

- A clear breakdown of net fees, VAT charged, and total amount

Many sellers miss refunds simply because they don’t download or file these invoices consistently. Link My Books automatically pulls this info into your books and categorizes it for reclaim.

Marketplace VAT Rules (OSS & MOSS) Don’t Cover Seller Fees

The One-Stop Shop (OSS) scheme introduced in the EU applies to sales, not fees. That means the VAT on seller fees still falls under your normal domestic VAT rules. You claim this VAT just like any other business expense.

Location Matters: UK vs. EU Sellers

- UK Sellers: Post-Brexit, eBay fees are usually billed from eBay’s Luxembourg or German entity with 20% VAT. You can still reclaim this if you're UK VAT-registered.

- EU Sellers: You'll usually be charged VAT according to your local VAT rate. Again, reclaimable if you’re VAT-registered.

✅ If you're charged VAT from another EU country, you may need to use the EU VAT Refund Scheme (or Reverse Charge mechanism if the invoice is valid and you're B2B).

Automate or Risk Losing Refunds

The risk with eBay VAT in Europe isn’t non-compliance; it’s leaving money unclaimed. Manual tracking means you're likely missing eligible refunds buried in disorganized invoices or miscategorized fee data.

That’s why many sellers use automation tools like Link My Books to:

- Import eBay fee invoices automatically

- Extract and assign correct VAT amounts

- Sync everything to Xero or QuickBooks with audit-ready data

TL;DR

Frequently Asked Questions (FAQ)

Can I reclaim VAT on eBay seller fees?

Yes - VAT-registered businesses can reclaim VAT paid on eBay seller fees. Ensure you have valid VAT invoices showing net amounts, VAT charged, and eBay’s VAT number. Then include these amounts in the input tax section of your VAT return.

Which eBay fees include VAT?

Most managed payments fees incur VAT. This includes listing fees, final value fees, and upgrades like subtitles or promotional options.

Why did eBay collect VAT on some sales but not others?

eBay applies VAT based on delivery location and seller/buyer VAT status. For instance:

- It collects VAT on shipments under €150 from non-EU sellers to EU consumers.

- It doesn't collect VAT if the buyer is VAT-registered, using the reverse-charge mechanism.

What do I need to keep track of for my tax and VAT reporting?

You should track:

- All sales (by country/jurisdiction)

- VAT collected or paid (including marketplace-facilitated VAT)

- Seller fees and VAT on those fees

- Refunds and adjustments

- Reconciliation between payouts and bank deposits

How to keep track of eBay sales for tax purposes?

Manual tracking, your eBay sales for taxes, requires exporting your eBay sales tax reports, reconciling sales, fees, VAT, refunds, and categorizing every transaction - a complex and time-consuming process.

Using an automation tool like Link My Books streamlines the entire process: it connects to eBay, imports all necessary data, applies the right VAT codes, and categorizes everything correctly - then syncs this to Xero or QuickBooks.

What records do I need to keep for compliance?

Save:

- Monthly eBay invoices

- VAT return submissions

- Sales summaries, receipts, and bank records

- Export records if applicable (e.g., OSS for intra‑EU sales)

Save Hours on Your eBay Bookkeeping

Stop wasting hours on eBay bookkeeping and missing VAT you could reclaim. Automating your accounting with Link My Books means your seller fees, VAT, and payouts are all handled accurately, automatically, and audit-ready.

Follow the steps above, plug in Link My Books, and take VAT refunds off your to-do list for good.

Start your FREE 14-day trial now and see how fast you can clean up your eBay VAT.

Less stress. More time. No more missed refunds.

.webp)

.png)