Disclaimer: This article provides general information about common tax considerations for Amazon sellers. However, tax laws can be complex and frequently change. The content in this article does not constitute professional legal or tax advice. You should always consult a qualified tax advisor or attorney in your jurisdiction for guidance on your specific situation.

Running a small business of any sort can be incredibly rewarding. There's a reason why small business owners are among the most satisfied workers in the country, after all. That doesn't mean this kind of work comes without challenges, however.

As an Amazon FBA (Fulfilment by Amazon) seller, you are responsible for understanding and paying various fees and taxes associated with your business.

While Amazon provides a convenient platform for selling your products, it’s important to familiarise yourself with the costs involved to ensure you’re making a profit. You'll also need to stay compliant with regulations to stay in business!

What do you need to know about the fees and taxes for an Amazon FBA seller? How can you ensure you're running your business as you should? Read on and we'll walk you through the basics.

Key Takeaways from this Post

Amazon sellers are self-employed and must pay income tax on profits, with tax obligations varying based on business structure.

Amazon provides tax forms like 1099-K and various tax documents; accurate record-keeping simplifies tax filing.

Sellers must collect and remit sales tax in states where they have a nexus, with thresholds and rules varying by state. Compliance is crucial to avoid penalties.

How Do Amazon Seller Taxes Work?

If you sell products on Amazon, you are considered self-employed. You must pay income tax on your Amazon selling profits as a self-employed individual. You may also need to collect and remit sales tax in states where your business has a substantial connection.

Do Amazon Sellers Pay Taxes?

Yes, Amazon sellers must pay taxes on their income. The specific taxes you pay will depend on how your business is structured.

- Sole proprietorship or single-member LLC: You report your Amazon income and expenses on Schedule C and pay self-employment tax on your profits. Any remaining profit is taxed as individual income.

- Multi-member LLC: The business income passes through to the owners' personal tax returns. You pay self-employment tax on your share of the profits.

- Corporation: The business files a corporate tax return (Form 1120 or 1120S). Owners pay individual income tax on any money distributed to them.

So, while business structures affect how you calculate and file taxes, all Amazon sellers pay taxes on their profits.

Amazon Seller Tax Forms vs. Amazon Seller Tax Documents

What's the difference between Amazon tax forms and tax documents?

- Tax forms are specific IRS forms Amazon must send you, like Form 1099-K.

- Tax documents is a broader term referring to any tax-related files from Amazon, such as sales reports.

Key tax forms Amazon provides:

- 1099-K: Reports your gross sales and is sent to you and the IRS.

- W-9: Captures your taxpayer information so Amazon can accurately file 1099 forms.

- 1099-MISC: Reports any miscellaneous income earned on Amazon, like from sold services.

Tax documents that help with reporting:

- Settlement reports: Summarize your payouts and fees.

- Transaction reports: Details of every order and fee.

- Inventory reports: Lists data on your current inventory.

- Reimbursement reports: Provides info on refunds and reimbursements.

Having all your tax forms and documents in order makes filing your taxes much smoother. But keeping track of all these forms and reports sounds like a headache!

Link My Books automatically connects all your Amazon tax documents to your accounting software like Quickbooks or Xero. It organizes everything perfectly so you have one central place to access all the data you need.

How to Get Amazon Seller Sales Tax Report

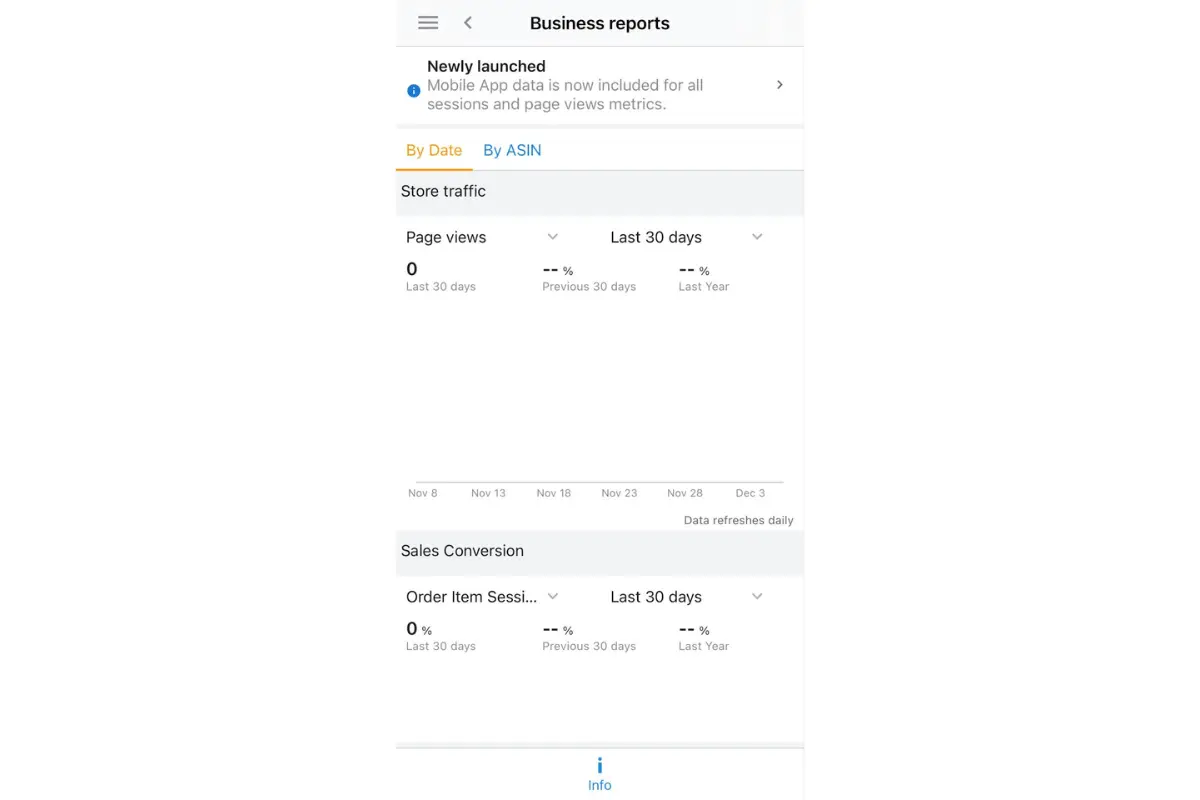

If you collect sales tax on Amazon orders, you can access detailed sales tax reports in Seller Central.

These reports contain the information you need to file and pay sales tax properly.

To generate Amazon seller sales tax reports:

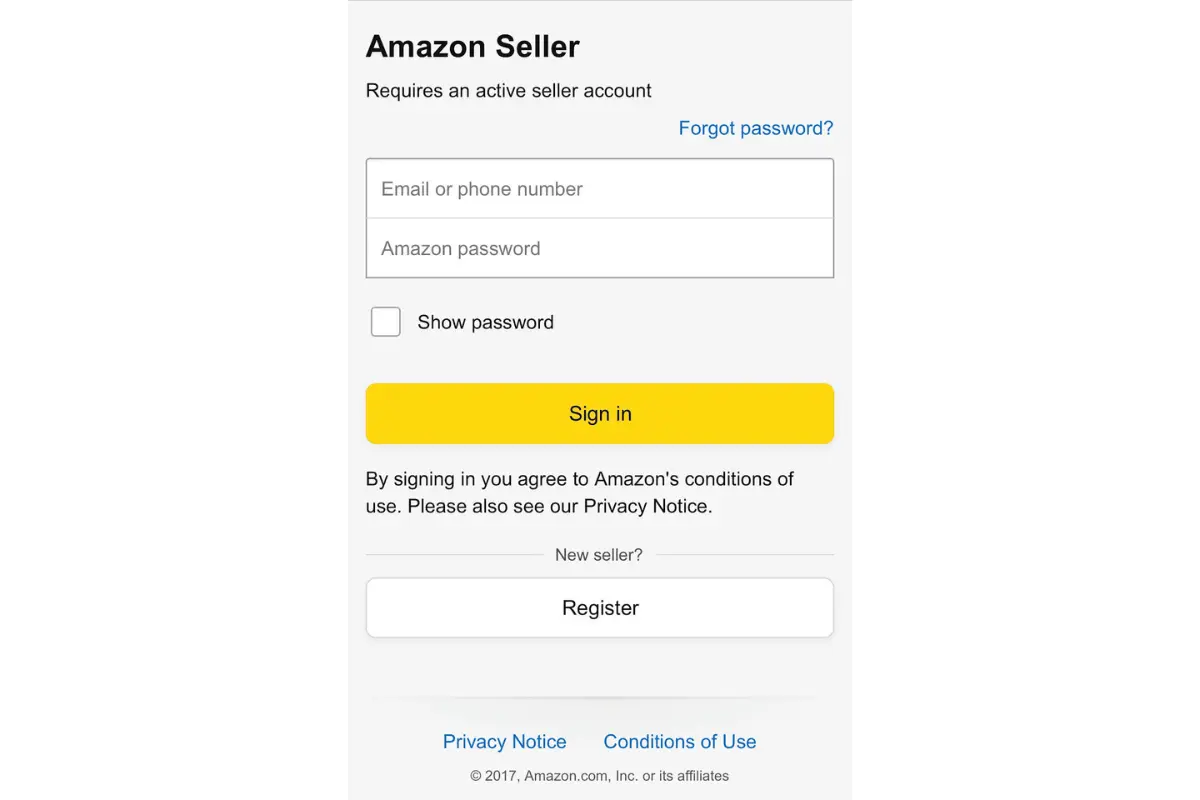

1. Login to your Seller Central account and navigate to the Reports section.

2. Select the "Tax Document Library" link.

3. Scroll down to the "Sales Tax Reports" area.

4. Click "Generate Tax Report" to create a new report.

5. Choose the report type and reporting period. Examples:

- Sales Tax Calculation Report: This shows the sales tax you collected.

- Marketplace Tax Collection Report: Details tax collected by Amazon.

6. Run the report. It may take up to an hour to generate.

7. Refresh the page and download your tax report file.

Review the reports and use them to accurately file your sales taxes by the deadlines.

Having detailed sales data makes tax filing much smoother.

What is the Amazon Tax Form 1099?

The 1099-K form is a tax document Amazon sends sellers to report gross sales and transaction totals.

The Amazon 1099-K forms help sellers calculate income taxes owed.

How to Get 1099-K from Amazon

If you meet the requirements, Amazon automatically emails your 1099-K tax form by January 31st. To get the form:

- Check your email for a message from Amazon with your 1099-K attached.

- If you can't find the email, log into Seller Central and go to Reports > Tax Documents to access your 1099-K.

When Does Amazon Send 1099-K?

For the 2023 tax year, Amazon sends 1099-K forms to sellers who:

- Had over $20,000 in sales.

- Had over 200 transactions.

Starting in 2024, the 1099-K threshold drops to $5,000 in sales with no transaction minimum.

The initial plan was to drop the threshold to $600, which was delayed in the recent IRS Nov. 21, 2023 announcement. More sellers will receive a 1099-K from Amazon moving forward.

Here’s Where to Find Your 1099-K on Amazon

If you can't find the 1099-K email from Amazon, follow these steps:

- Login to Seller Central and click "Reports."

- Select "Tax Document Library".

- Scroll down to the 1099-K section.

- Click "Download" next to the appropriate 1099-K form.

- Open or save your 1099-K file.

Having your 1099-K form makes filing your taxes much simpler.

How to Collect Amazon FBA Sales Tax

If your Amazon business has a sales tax nexus in a state, you must register, collect, and remit sales tax on eligible orders.

Sales tax nexus refers to the physical locations where your business has a presence substantial enough to trigger tax obligations.

For example, if your business is based in Oklahoma but you store inventory in a California fulfillment center, you likely have a nexus in both states.

Here’s how the sales tax collection process works:

Determine Your Sales Tax Nexus

The first step is identifying every state where you have exceeded nexus thresholds and have a sales tax collection obligation.

If you have over $100,000 in sales or 200 transactions in a state, you likely meet economic nexus rules even if you don't have a physical presence there.

Common nexus triggers include:

- Economic nexus based on sales and transactions in the state.

- Physical presence such as offices, warehouses, and inventory.

- Affiliates or drop shipping partnerships located in the state.

Review nexus rules and thresholds carefully for each state.

Register for a Sales Tax Permit

Once you determine your nexus states, apply for a sales tax permit with each state’s tax authority. This permit allows you to collect and remit sales tax in that state legally.

When approved, you'll receive a filing schedule and due dates for remitting the sales tax you collect. Depending on your sales volume, states may require monthly, quarterly, or annual tax payments.

Identify When to Collect Tax

Once registered, identify situations where you must collect sales tax:

- The buyer's location (their delivery address).

- The type of product sold. Some goods are tax-exempt.

- Whether Amazon collects tax on your behalf in that state.

Set Up Product Tax Code

Classify products appropriately in your Seller Central tax settings so the correct rates apply:

- Taxable goods: "A_GEN_TAX"

- Non-taxable goods: "A_GEN_NOTAX"

- Reduced rates: "A_FOOD_GROC" for groceries, for example.

Look Out for Tax Amnesty in your State

Some states offer tax amnesty to new Amazon sellers. This allows you to register and start collecting sales tax without paying prior unpaid taxes.

Check if your state currently offers vendor amnesty. It can provide penalty relief.

How to File Taxes as An Amazon Seller in 5 Steps

Follow these steps when filing your Amazon seller taxes:

1. Register for Sales Tax Permits in Relevant States

Obtain a sales tax permit for every state where you have a sales tax nexus. This allows you to collect and remit sales taxes legally.

2. Calculate and Report Amazon Sales Income

Use your 1099-K, sales reports, and other documents from Seller Central to calculate your total sales income. Report this income on your tax return.

3. Utilize Amazon's Tax Collection Services

Amazon can collect and pay sales tax on your behalf in many states. Enable this in Seller Central to simplify tax compliance.

4. Maintain Accurate Sales and Expense Records

Keep detailed records of all Amazon sales and expenses. This supports income tax deductions and sales tax calculations.

Automating your bookkeeping with Link My Books can help you easily track Amazon sales, fees, and other expenses without manually entering data.

Our free trial lets you connect your Amazon account in minutes to see your key metrics.

5. Adhere to Tax Filing Deadlines and Procedures

File all required tax forms on time. This includes income taxes, sales taxes, and quarterly estimated payments.

Missing deadlines can lead to penalties.

Staying on top of your tax obligations is crucial for Amazon sellers. Following best practices can help you stay compliant.

What Are The Best Amazon FBA Tax Deductions?

You can reduce your taxable income as a seller using every available tax deduction. Here are some of the top deductions for Amazon businesses:

- Inventory costs: Your cost of goods sold, including manufacturing and shipping expenses.

- Amazon fees: Selling fees, FBA fees, subscription costs, and more.

- Advertising: Any Amazon PPC, social media ads, or other marketing.

- Mileage: Miles driven for business purposes, such as sourcing inventory.

- Home office: A portion of rent, utilities, office supplies, and other home office costs.

- Supplies: Packaging materials, labels, tape, and other order fulfillment supplies.

- Professional fees: Accounting, legal, consulting, and outsourcing services.

- Business travel: Flights, hotels, transportation.

- Inventory management: Software, scanners, and other inventory tools.

- Shipping: Postage, shipping supplies, and delivery costs.

- Returns: Costs associated with customer returns and refunds.

- Education: Classes and training to improve your selling skills.

- Subscriptions: Memberships, tools, and resources for your business.

- Insurance: Policies to cover business liability, inventory, and other risks.

- Phone/internet: A portion of phone and internet costs used for your business.

- Business bank fees: Merchant account fees, wire transfers, currency conversions.

Keeping detailed records of your Amazon expenses makes claiming deductions easy when tax time comes. Consult a tax professional to utilize every available deduction and reduce your tax bill.

Frequently Asked Questions (FAQs)

Below are a few frequently asked questions surrounding the topic of Amazon seller taxes:

Does Amazon Report to the IRS?

Yes. Amazon is required to provide Form 1099-K to both sellers who meet requirements and the IRS. This reports gross sales and transactions.

Does Amazon Remit Sales Tax For Sellers?

In many states, yes. Amazon can calculate, collect, and remit sales tax on your behalf through their automated systems, often at no cost to sellers. Check Seller Central for details.

How Does Amazon Help with Sales Tax Compliance?

Amazon provides detailed sales tax reports to simplify filing. They also collect taxes in many states. This removes the manual work of tracking tax rates across jurisdictions.

What Is the Difference Between Amazon FBA Taxes and Regular Seller Taxes?

Taxes for Amazon FBA (Fulfillment by Amazon) sellers vs. regular Amazon sellers are generally the same. The only difference is that FBA sellers may have sales tax nexus in more states since Amazon stores inventory nationwide.

Conclusion

As an Amazon seller, you have important tax filing and payment obligations. While Amazon provides helpful reports and automation, you are still responsible for accurately calculating, reporting, and paying your income and sales taxes.

We know from experience how tricky e-commerce accounting can be. Even with Amazon's tools, it's easy to make mistakes that could lead to penalties. That's why we'd highly recommend checking out Link My Books.

Our platform directly integrates all your sales channels, like Amazon, with platforms like Xero or QuickBooks. It handles VAT calculations, creates reports, and gives real-time profit analytics.

Why don't you set up a quick demo, and we can show you exactly how it works?

.webp)

.png)