Managing your books can feel overwhelming. Between tracking transactions, reconciling accounts, and staying on top of taxes, it’s easy to feel like there aren’t enough hours in the day. Manual data entry, reconciliation errors, and hours spent on tax compliance are holding you back. But it doesn’t have to be this way.

The right accounting software can transform your workflow, automating tedious tasks and giving you back the time to focus on what matters most.

This guide highlights the best automated accounting software to help you take control, simplify your processes, and make your bookkeeping simple and accurate.

Key Takeaways from this Post

Automating your accounting saves hours of manual work and eliminates common errors, giving you more time to focus on growing your business.

The right software provides real-time insights, compliance-ready tax tracking, and scalability to match your business’s growth.

Xero + Link My Books is the ultimate solution for automating eCommerce bookkeeping, offering seamless integrations and error-free reconciliation.

Best automated accounting software

- Xero with Link My Books

- QuickBooks with Link My Books

- Zoho Books

- Sage 50Cloud

- FreshBooks

- Wave

- Expensify

- Kashoo

- Hubdoc

- ZarMoney

1. Xero with Link My Books - Advanced automated reporting and growing businesses

Xero is cloud-based accounting software that connects businesses to their banks, accountants, bookkeepers, and other business apps. It offers tools for small businesses, accountants, and bookkeepers.

Xero provides automatic data capture with Hubdoc, allowing bills and receipts to be pulled into Xero automatically. It offers access anytime, enabling users to track their business on the go and be confident in their numbers wherever they are.

It offers a free trial and is designed to keep practices a step ahead with its accounting software. It also provides free setup support for the first 90 days.

Features

- Easy Bank Matching: Xero simplifies your bookkeeping by automatically matching your e-commerce payouts to your bank transactions. Whether you're selling on Amazon, Shopify, or Etsy, this feature keeps your financial records accurate and up-to-date without the need for manual reconciliation.

- Tax Compliance Made Easy: Xero follows regional tax rules, such as VAT in the UK or GST in other regions, and lets you file tax returns directly from the platform. Paired with Link My Books, all your e-commerce sales are automatically assigned the correct tax rates, ensuring compliance while avoiding overpayment.

- Works with Over 1,000 Apps: Expand Xero’s functionality by connecting it to tools you already use, like inventory management systems or cash flow forecasting apps. This flexibility helps you manage every aspect of your e-commerce business more efficiently.

- Learning Resources at Your Fingertips: Xero provides extensive educational content, including lessons, videos, and online classes, to help you make the most of its features.

- Certifications and Payroll Management: You can take advantage of Xero's training programs to earn certifications in its platform and improve your skills, including managing payroll for employees.

While Xero offers excellent accounting features, it requires clean, organized data from your e-commerce sales channels to work effectively. Managing this manually can be time-consuming and error-prone. Pairing Xero with automated accounting software like Link My Books automates the process, ensuring accurate transaction data, tax compliance, and seamless reconciliation.

Link My Books + Xero = Error-free & e-commerce accounting

Xero paired with Link My Books is perfect for e-commerce clients. It automates complex workflows while delivering clean, tax-ready financials.

Link My Books is designed to streamline and enhance your financial management. It integrates with all the major e-commerce platforms to import sales data into Xero automatically.

If you want to see Link My Books in action you can try it out today, completely free.

2. QuickBooks with Link My Books - Best for eCommerce bookkeeping automation

QuickBooks Online helps businesses track income, and expenses, and stay ready for taxes. It also offers a mobile app that allows businesses to run their operations on the go.

It has features like income and expense tracking, invoicing and payments, tax deductions, receipt capture, mileage tracking, cash flow management, sales and sales tax management, estimates, contractor management, and the ability to connect to sales channels.

You can also opt for a free guided setup where a QuickBooks expert can walk you through connecting your banks and credit cards and automating the tasks you do most often.

While it does offer direct integration with some e-commerce platforms, those can sometimes be faulty.

Features

- Simplified Tax Preparation: QuickBooks takes the complexity out of preparing tax returns. It ensures accurate self-assessment reporting by organizing all your financial data in one place, making tax season less stressful for e-commerce sellers.

- HMRC Compliance with VAT Checker: Fully compliant with HMRC regulations, QuickBooks includes a built-in VAT error checker. This feature ensures your tax calculations are accurate and in line with the latest VAT rules, saving you from costly mistakes.

- Real-Time Cash Flow Monitoring: QuickBooks gives you a clear, real-time view of your business’s cash flow, helping you track revenue and expenses with ease. This feature is especially valuable for e-commerce businesses managing multiple income streams.

- Sales Forecasting for Smarter Planning: QuickBooks allows you to generate detailed sales forecasts, helping you anticipate trends, plan for seasonal fluctuations, and set realistic goals. These insights empower e-commerce sellers to make data-driven decisions.

- Customizable Class Tracking: QuickBooks enables you to categorize income and expenses by marketplace or sales channel, providing clear insights into your business's performance. When paired with Link My Books, transactions from platforms like Amazon, Shopify, or eBay are automatically assigned to the correct categories, ensuring your Profit & Loss (P&L) statements are always accurate and actionable.

While QuickBooks offers robust accounting features, it might still require some manual work. Integrating Link My Books automates the whole process, importing transactions, assigning tax rates, and categorizing sales and fees effortlessly.

The combination of QuickBooks and Link My Books delivers unmatched efficiency and accuracy, making it the ultimate solution for e-commerce accounting.

Link My Books & Quickbooks = Advanced Automated Reporting

QuickBooks and Link My Books create a powerful solution for bookkeepers managing clients with high transaction volumes or those needing customizable reports. Plus, it offers advanced reporting on key metrics like sales trends and profitability, making it a must-have for e-commerce sellers who want to streamline and optimize their financial management.

3. Zoho Books - Best for Small businesses and startups

Zoho Books is a versatile tool for startups and small businesses that need affordable automation with flexibility. Its affordability and range of features make it a solid choice for growing businesses on a budget.

While the software offers some useful features it comes with significant limitations.

Using Zoho Books means you'll need to manually download data from your e-commerce platform, separate revenue by country and tax rate, and categorize expenses by tax rate.

Features

- Invoicing & Payment Tracking: Automates invoicing, tracks payments, and integrates with payment gateways like Stripe and PayPal.

- Inventory Management: Tracks stock levels and automates inventory workflows.

- Multi-Currency Support: Handles cross-border transactions effortlessly.

4. Sage 50Cloud - Best for Advanced features in a desktop accounting solution

Sage 50Cloud combines desktop reliability with cloud functionality, offering robust features for inventory-heavy or multi-user businesses. It’s tailored for small businesses that require advanced bank reconciliation and in-depth financial management.

While it does integrate with third-party vendors, this setup tends to be pricier and trickier to get right compared to using Xero with Link My Books. Xero and Link My Books offer a more cost-effective and user-friendly solution.

Features

- Advanced Bank Reconciliation: Match transactions quickly, track changes, and reverse reconciliations if needed.

- Inventory Tracking: Tracks product levels, purchases, and reorders with precision.

- Customizable Reports: Allows detailed financial reporting for better decision-making.

- Remote Access: Cloud-enabled features let you manage finances on the go.

- Multi-Currency Support: Handle transactions and reconciliations in different currencies with ease.

5. FreshBooks - Best for Freelancers and service-based businesses

FreshBooks offers a user-friendly interface and focuses on simple bookkeeping for service-based businesses. Primarily designed for invoicing and expense tracking, it offers basic bank reconciliation features. However, its reconciliation capabilities are less robust than those found in more comprehensive accounting solutions.

Features

- Time Tracking: Tracks billable hours and integrates them into invoices.

- Expense Management: Captures expenses on the go with mobile apps.

- Recurring Invoices: Automates subscription-based billing and follow-ups.

6. Wave - Best for Free accounting solutions

Wave is an excellent choice for freelancers or micro-businesses needing basic accounting tools at no cost. Its intuitive design makes bank reconciliation simple for businesses with low transaction volumes.

However, it also has limitations, with Wave you’ll need to download data from your e-commerce platform manually, then separate revenue by country and tax rate, as well as expenses by tax rate, before accounting for those figures yourself.

Features

- Invoicing & Payments: Create professional invoices and accept online payments.

- Expense Tracking: Automatically categorizes expenses from bank feeds.

- Basic Reporting: Provides essential financial insights like profit and loss statements.

7. Expensify - Best for Expense tracking and approvals

Expensify automates expense tracking and simplifies approvals, making it a great tool for businesses with frequent travel or large teams. It’s a time-saving tool for businesses with complex expense workflows and it integrates with various software, including accounting and finance tools.

Features

- Receipt Scanning: Uses OCR technology to extract data from receipts.

- Automated Expense Reports: Generates and submits expense reports for approval with minimal input.

- Integration: Connects with accounting tools like Xero and QuickBooks.

- Credit Card Integration: Syncs with company cards to simplify expense matching.

8. Kashoo - Best for Simple bookkeeping for micro-businesses

Kashoo is an easy-to-use solution for freelancers and small businesses needing basic automation. It emphasizes easy invoicing, expense tracking, and financial reporting with an intuitive interface.

It’s designed to be simple and easy to use. It is praised for its ability to automate accounting workflows while using built-in safeguards to ensure numbers are always accurate and up-to-date.

Features

- Bank Feed Automation: Imports and categorizes transactions from connected accounts.

- Invoice Customization: Creates professional invoices tailored to your brand.

- Machine Learning Technology: Kashoo uses AI to automatically categorize expenses and transactions.

- Unlimited Users: Kashoo allows unlimited users at no extra cost.

- Multi-Currency Support: Handles transactions in various currencies.

9. Hubdoc - Best for Document management

Hubdoc automates the collection and management of financial documents, simplifying data entry for you or your bookkeeper. It syncs seamlessly with Xero and QuickBooks, ensuring receipts, bills, and statements are stored and reconciled correctly. Hubdoc eliminates paperwork, allowing you to focus on analysis instead of admin.

Features

- Document Capture: Automatically pulls bills, receipts, and invoices from email or uploads.

- Receipt Scanning: Upload receipts using your phone or email for automatic extraction.

- Data Extraction: Extracts key data and syncs it with accounting software like Xero or QuickBooks.

- Cloud Storage: Safely stores all documents for easy access.

10. ZarMoney - Best for Mid-sized businesses needing inventory and billing automation

ZarMoney provides a flexible solution for businesses requiring strong billing and inventory management features. ZarMoney is designed to be simple to use, offering a comprehensive set of tools for managing various aspects of business finance. Its combination of accounting and inventory tools makes it great for mid-sized businesses with complex operations.

It provides a free 2-week trial, allowing businesses to test out its capabilities before committing to a subscription.

Features

- Inventory Tracking: Tracks stock levels, sales, and reorders in real-time.

- Custom Billing: Automates invoicing and integrates with payment processors.

- Multi-User Collaboration: Allows multiple team members to work on the same platform securely.

How to choose the best automated bookkeeping software for you

E-commerce Accounting can be complex but finding the perfect automated accounting software for your business doesn’t have to feel overwhelming. The key is to focus on what really matters like accuracy, time-saving features, ease of use, and overall value. While free tools might be tempting, they often come with limitations that could cost you more in the long run.

Here’s what to consider when making your decision:

1. Accuracy: Get It Right Every Time

Mistakes in fees, taxes, or reconciliations can lead to costly errors and wasted time. The right software ensures all your numbers are precise, making your accounting easier to manage.

What to Look For: Tools that automate transaction imports, tax calculations, and reconciliation tasks to eliminate manual errors.

Why It Matters: Clean, accurate records keep you compliant with regulations, simplify audits, and save time during tax season.

2. Save Time with Automation

Accounting software should streamline your workload, not complicate it. Look for tools that handle repetitive tasks like reconciliation, invoicing, and tax preparation automatically.

What to Look For: Integration with platforms like Xero or QuickBooks, auto-import of data, and features like one-click reconciliation.

Why It Matters: More time saved on bookkeeping means more time to focus on growing your business.

3. Insights Tailored to Your Business

Good accounting software goes beyond numbers by helping you analyze and understand your business performance.

What to Look For: Built-in reporting tools, profitability analytics, and insights customized for eCommerce sellers.

Why It Matters: Knowing your margins, cash flow, and top-performing products empowers smarter business decisions.

4. Ease of Use: Simple Yet Powerful

Even the best features won’t help if the software is too hard to use. Aim for tools that are intuitive and efficient without unnecessary complexity.

What to Look For: User-friendly interfaces, easy navigation, and features tailored to your business needs.

Why It Matters: If you’re new to accounting software, ease of setup and minimal learning curves are invaluable.

5. Reliable Customer Support

Technical hiccups are inevitable. Software with dependable support ensures you’re never left in the lurch.

What to Look For: Responsive support via chat, email, or phone, along with onboarding and training resources.

Why It Matters: Timely help minimizes disruptions and keeps your operations running smoothly.

6. Value for Money

Cost matters, but it’s not just about finding the cheapest option. Consider the value of features like automation, integration, and reporting when evaluating software.

What to Look For: Tools that offer automated reconciliation, tax compliance, and eCommerce-specific features. Be cautious of free tools that may lack critical functionality.

Why It Matters: Paying for reliable software upfront saves time, money, and frustration in the long run.

7. eCommerce-Specific Features

Not all accounting software is built for eCommerce. Sellers need tools tailored to the complexities of online businesses.

What to Look For:

- eCommerce Integration: Direct sync with platforms like Amazon, Shopify, or Etsy.

- Inventory Tracking: Monitor stock levels and calculate Cost of Goods Sold (COGS).

- Tax Automation: Automatically handle VAT, GST, and sales tax.

Why It Matters: As your business grows, having eCommerce-specific tools ensures scalability and reduces manual work.

Additional Tips for Choosing the Right Software

- Prioritize Features: Decide what’s essential (e.g., reconciliation, tax compliance, integration), nice-to-have (e.g., inventory management), and not necessary.

- Test Before You Commit: Use free trials to explore the software’s features, ease of setup, and user experience.

- Plan for Growth: Choose software that scales with your business and adapts to evolving needs.

Also, consider this if you want to outsource your accounting and are looking for an ecommerce accountant.

How do they Compare

Here’s a simple table that can help you compare the software we mentioned.

Why manual bookkeeping is no longer the best way?

Manual bookkeeping used to be the go-to method for managing finances, but in today’s fast-paced, data-driven world, it’s no longer the most effective option.

Here’s why:

1. Time-Consuming and Inefficient

Manually recording transactions, reconciling accounts, and calculating taxes can take hours, time that could be better spent growing your business or focusing on strategic tasks.

The Alternative: Automated accounting software saves hours each week by syncing directly with sales channels, bank feeds, and tax systems, reducing repetitive tasks.

2. Prone to Human Error

Even the most diligent bookkeepers can make mistakes when manually entering data. Errors in tax calculations, miscategorized expenses, or missing transactions can lead to costly consequences.

The Alternative: Automated tools like Link My Books ensure accuracy by pulling transaction data directly from platforms like Amazon, Shopify, and Etsy and categorizing it without error.

3. Limited Scalability

As businesses grow, managing higher transaction volumes becomes overwhelming with manual methods. Multi-channel eCommerce sellers, in particular, struggle to track data across platforms efficiently.

The Alternative: Software like Xero or QuickBooks, paired with automation tools, scales effortlessly with your business, handling thousands of transactions seamlessly.

4. Lack of Real-Time Insights

Manual bookkeeping doesn’t provide instant access to financial insights, leaving you reactive instead of proactive in decision-making.

The Alternative: Automated accounting software offers real-time reports on profitability, cash flow, and taxes, empowering you to make smarter, data-driven decisions.

5. Compliance Challenges

Tax laws and regulations are complex and constantly changing. Manually keeping up with them increases the risk of errors, missed deadlines, and penalties.

The Alternative: Automated systems apply the latest tax rules and ensure compliance, whether it’s VAT, GST, or sales tax, making audits and filings stress-free.

Read more about the best sales tax software for e-commerce.

Why do e-commerce sellers choose Link My Books?

Link My Books automates bookkeeping for e-commerce businesses, it’s designed for businesses selling on platforms like Amazon, eBay, Shopify, Etsy and other platforms.

It helps you save time on bookkeeping, allowing you to focus on other aspects of your business. For accountants, it can increase the number of clients they can work with without increasing their workload.

Features

Seamless Integration with Multiple Sales Channels

Managing sales data from platforms like Amazon, Shopify, eBay, and Etsy can quickly become a nightmare. Each platform generates its own mix of sales, refunds, fees, and taxes, often leaving bookkeepers to manually piece together fragmented data.

Link My Books automatically imports all transaction data directly from sales platforms. It organizes sales, refunds, and fees into clean, categorized summaries and syncs this data seamlessly into your accounting software.

Automated Reconciliation

Link My Books automatically matches your e-commerce sales, refunds, fees, and taxes with your accounting software, giving you clear and accurate financial data.

It supports multiple marketplaces and integrates with platforms like eBay, Etsy, and Shopify, so you can manage your entire e-commerce business from one place.

Accurate Tax Calculation

Managing taxes across different regions with varying tax laws is a major challenge for e-commerce sellers. Link My Books calculates the correct VAT or sales tax on every sale, ensuring accuracy based on each jurisdiction.

Cost of Goods Sold (COGS) Tracking

Tracking your Cost of Goods Sold is vital for understanding your profit margins. Link My Books ensures that COGS is accurately recorded, helping you get a clear picture of your true costs and how they impact your bottom line. By keeping a close eye on COGS, you can make smarter pricing decisions and improve your overall profitability.

Real-Time Reporting and Analytics

Link My Books gives you access to real-time financial reports and analytics, tailored for e-commerce businesses. You'll get insights into your profitability, sales performance, level reserve, and cash flow, helping you make informed decisions.

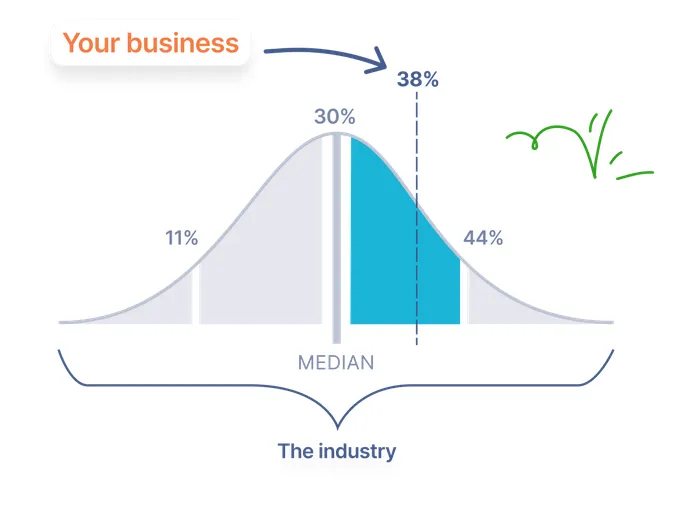

Benchmarking

Gain industry insights from anonymous data on key metrics like sales growth, refund ratios, and fee ratios. Link My Books focuses on percentage changes and trends rather than exact numbers, helping you see if your business is following broader market trends or experiencing unique changes.

User-Friendly Setup and Interface

Link My Books is designed to be easy to use, even if you're new to bookkeeping. Setup is quick, with most users up and running in just 15 minutes. If you need help, we offer a free onboarding call with our team of experts, or you can explore our blog posts, webinars, guides, and videos for additional support.

FAQ

1. What are the most common accounting tasks to automate?

The most common accounting tasks to automate include:

- Reconciliation: Matching transactions to bank deposits.

- Tax Compliance: Calculating VAT, GST, or sales tax accurately.

- Expense Categorization: Assigning fees, refunds, and other costs to the correct accounts.

- Financial Reporting: Generating profit and loss statements or cash flow reports.

- Data Entry: Importing transactions from sales platforms like Amazon or Shopify.

Link My Books automates reconciliation, tax compliance, and expense categorization by pulling data directly from your e-commerce platforms and syncing it with accounting software like Xero or QuickBooks.

2. Is QuickBooks or Xero best for automated accounting?

Both QuickBooks and Xero are excellent choices for automated accounting, but the best option depends on your needs:

- Xero + Link My Books: Ideal for e-commerce sellers, offering seamless integrations with Amazon, Shopify, and other platforms. It excels at tax compliance and COGS tracking.

- QuickBooks + Link My Books: Great for businesses needing advanced reporting and customized financial insights.

Pairing either software with Link My Books takes automation to the next level by handling sales reconciliation, tax compliance, and transaction categorization effortlessly.

4. Can automated accounting software integrate with my ecommerce platform?

Yes, many automated accounting tools integrate with eCommerce platforms, but Link My Books specializes in this area. It connects directly with platforms like Amazon, Shopify, eBay, and Etsy, pulling transaction data, categorizing fees and refunds, and ensuring accurate reporting in Xero or QuickBooks.

Without this integration, you’d need to manually organize and input data, increasing the risk of errors and wasted time.

5. What is the best automation software for bookkeepers?

The best accounting software for bookkeepers managing e-commerce clients is Link My Books. When combined with Xero or QuickBooks, it automates the most time-consuming tasks, including:

- Multi-platform sales reconciliation.

- Tax compliance for VAT, GST, and sales tax.

- Accurate COGS tracking and profitability reporting.

Why It’s Best: Link My Books is tailored for eCommerce, simplifying workflows, reducing errors, and saving hours of manual work. It’s a game-changer for bookkeepers looking to streamline operations and scale their services.

Which automated accounting software is best for You?

Ultimately, when we look at how to automate your ecommerce business, you'll need to pay keen attention to what your business needs.

If you’re in e-commerce, go with Xero or QuickBooks paired with Link My Books, they automate everything, from reconciliation to tax compliance, perfectly.

For small businesses or startups, Zoho Books is affordable and scalable, while FreshBooks is great for freelancers who need something simple. If you want free accounting, try Wave, but it’s limited for growing businesses.

Need help with expenses? Go with Expensify. For managing documents, Hubdoc is excellent.

For mid-sized businesses handling inventory, ZarMoney is a strong choice, and Sage 50Cloud offers desktop features with cloud flexibility.

Automate your e-commerce accounting with Link My Books

Managing e-commerce accounting can be overwhelming, juggling sales channels, tracking fees, reconciling bank deposits, and ensuring tax compliance takes time and leaves room for errors. Manual methods or tools that aren’t built for e-commerce often create more frustration than solutions.

That’s where Link My Books changes the game. By automating reconciliation, tax compliance, and transaction categorization, it eliminates hours of manual work and ensures your books are always accurate.

Because your time is valuable, stop wasting it on manual bookkeeping or tools that don’t fit your needs. Let Link My Books handle the heavy lifting while you focus on growing your business.

Start your free trial today and experience accounting automation done right!

Try Link My Books Now!

.webp)

.png)